05/24/2020 Markets were up for the week as the S&P 500 Index was able to Close Above the Green Line, along with the Nasdaq 100 Index. The weaker Indices (DOW 30 Index, Small Caps, Transports, & NYSE) are still Below the Green Lines and would normally go back down to re-test the March Lows. But we currently have two reasons why the Markets are holding up: 1.) Massive FED Printing and 2.) No Alternative Investment (NAI).

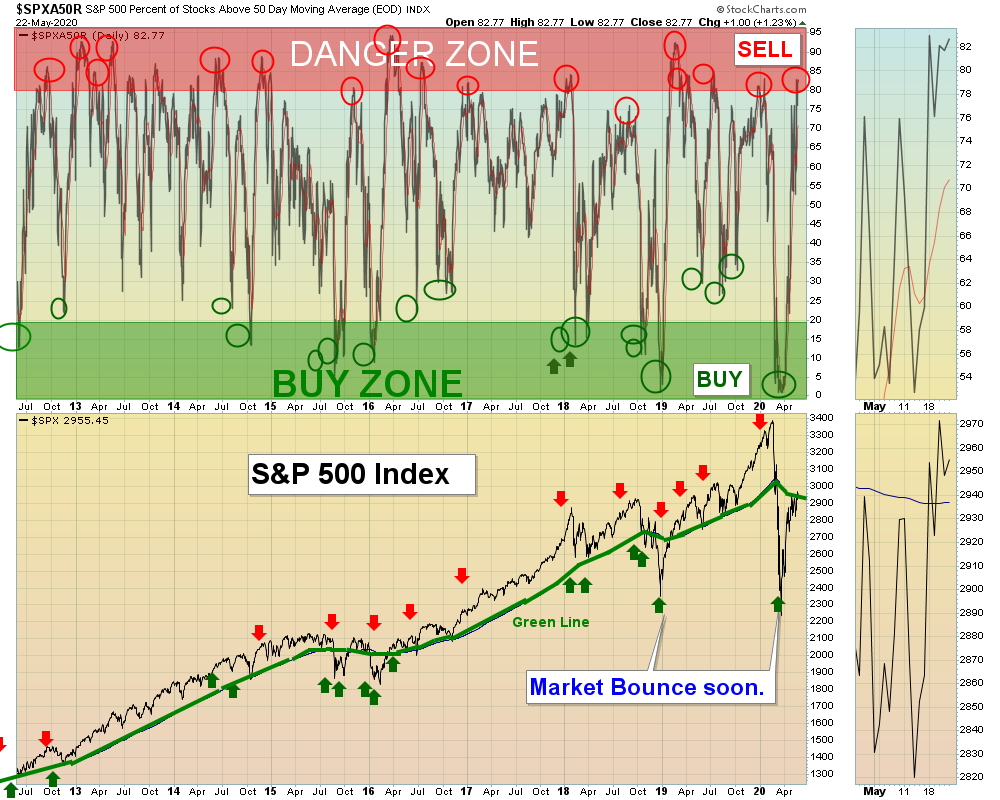

Most of the Strongest Leaders are now Way Above the Green Lines again, like they were at the January Highs. So the Markets will probably struggle for a while to relieve the Over-Bought condition (see Chart above). If you don’t stay in sync with Red Zone / Green Zone of the Chart above (Buy Green Zone / Sell Red Zone), then you might not make much more Money this year in the Indices.

When the Economy improves, then historically Bonds would sell off from Inflation Fears and the lower prices on Bonds would make them more competitive with Stocks. Also with all of the FED Printing, Inflation could finally return and confirm why Gold and Gold Mining Funds (GDX) are making New Highs (and Silver up 15 % this week).

For the week the Dow was up 3.36%, the S&P 500 was up 3.20%, and the Nasdaq 100 was up 2.86%. The Long Term Trend for the Indices is mixed.

The Inflation Index (CRB) was up 3.84% and is Below the Green Line, indicating Economic Weakness.

Bonds were down 0.70% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.70 % for the week.

Crude Oil was up 12.64% for the week at $33.25 and GOLD was down 1.18% at $1735.50.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 3 logged Open Positions, for the Short & Medium Term. There are 7 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Most of the Leaders are back up in the Weekly Red Zones.)

Buy the Leading Investments that are down near the Weekly Green Zones.

AUY YAMAHA GOLD Wait for next Daily Green Zone Buy Signal. All time High is $18.50.

GDX GOLD MINING FUND Wait for next Daily Green Zone Buy Signal. All time High is $62.

KALA KALA PHARM. Wait for next Daily Green Zone Buy Signal.

LLNW LIMELIGHT NETWORKS Buy if it Closes above $5.38 on High Volume.

______________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

NEW DAY TRADE LIST MAY 15, 2020

Dividend Growth Portfolio (we are now posting a Dividend Calendar for the entire portfolio to assist with planning purposes).

ETF Sector Rotation System – Quarterly Rotation was on Apr 1, 2020.

Long Term Strategy for IRAs & 401k Plans:

Alert! Market Risk is HIGH (Red Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

QUESTION: Juanita writes “Does the ATGL website list previously posted (or all) “recent comments,” not just the two to three most current ones? I find reading those comments and replies very helpful, but I frequently miss them because I am not on the computer trading every day. Is there somewhere on the website I can find older postings to review?”

ANSWER: Yes Juanita, all emails are available on the Main Menu of the web site under Commentary for weekly, and Buy / Sell Signals for Daily.

Good trading and tell your friends!