03/03/2019: Markets were up slightly for the week, but the buying Volume has slowed down. Stocks are saying that the Economy is good, and Bonds and Commodities are saying the Economy is weak. Somebody is WRONG.

We like to Buy during FEAR, and the FEAR Indicator shows that Tammy feels great again. When Tammy feels good, she has usually fully invested her Cash so the Markets have more risk.

Now is a good time to identify the very Strongest Leaders that have made recent new Highs. These will usually hold up the best when the Markets correct, and can have nice bounces out of their Green Zones. Some Leaders: ABT ARRY BA CIEN COUP ETSY GRMN HZNP KEYS KL LLY LSCC NVTA OKTA SE TEAM TNDM TWLO VMW W & XLNX to Buy on pull-backs.

For the week the Dow was down 0.02%, the S&P 500 was up 0.46%, and the Nasdaq 100 was up 0.86%. The very Long Term Trend on the Stock Markets is UP. All of the major US Indices are back Above the Green Lines.

The Inflation Index (CRB) was down 1.39% and is Below the Green Line, indicating Economic Weakness.

Bonds were down 2.19% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was up 0.08%.

Crude Oil was down 2.55% for the week at $55.80, and GOLD was down 2.52% at $1299.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 4 logged Open Positions, for the Short & Medium Term. There are 4 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM TRADES

Many of the Strongest Investments that bounced up off the Green Line with Above 80 Relative Strength, are now getting back into their Red Zones on the weekly charts (Danger Zone).

ACAD ARCADIA PHARMA Broke Out above $23.55 this week for 16% Gain. Wait for the next Daily Money Wave Buy Signal.

AVP AVON PRODUCTS Wait for the next Daily Money Wave Buy Signal.

CYH COMMUNITY HEALTH Buy if it Closes above $5.06.

FIT FITBIT, INC. Buy if it Closes above $7.79.

LW LAMB WESTON HOLDINGS Buy if it Closes above $71.46.

ODP OFFICE DEPOT Buy if it Closes above $3.60.

PFE PFIZER, INC. Wait for the next Daily Money Wave Buy Signal.

UAL UNITED CON’T. AIR Wait for the next Daily Money Wave Buy Signal.

VER VEREIT, INC. Relative Strength is Below 90. (7% Dividend)

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is HIGH (Red Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

QUESTION: Jerry S. writes “How do I know when to Sell?”

ANSWER: Hi Jerry. Please follow the Rules for Selling below based on the Time Frame that you want to be in the Investment:

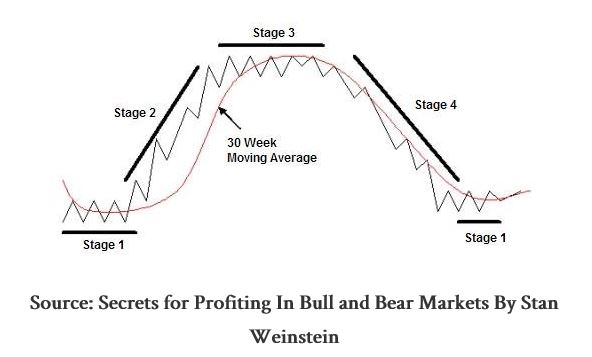

- Short Term: Sell when it Closes below the 10-day avg.

- Medium Term: Sell when it Closes below the 50-day avg.

- Long Term: Sell when it Closes below the Green Line (250-day avg).

Or Follow the PORTFOLIO (please click) on your daily emails.

Good trading, and tell your friends!