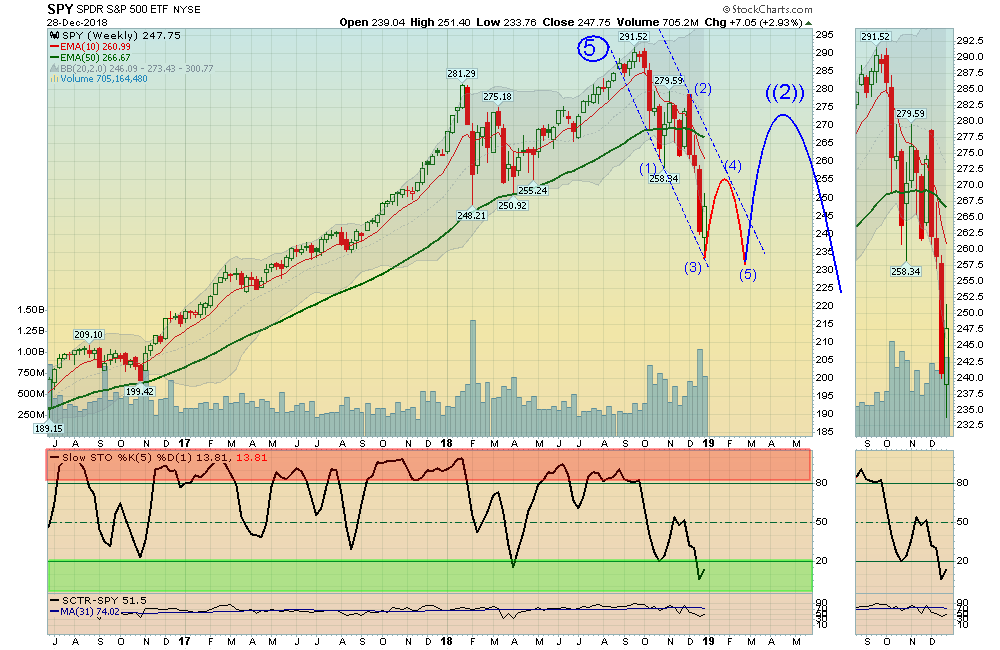

12/30/2018: Markets bounced up this week after being extremely Over-Sold. Normally when the FEAR is so high and Tammy has sold out after Buying High, the media will begin to print positive stories (maybe like gasoline prices below $2, mortgage rates have dropped 3/4 -1%, maybe Earnings better than expected, the FED becoming less Hawkish, a necessary China Trade deal, etc.)

And then in a few months the sentiment and confidence could flip, and eventually the Herd and Tammy would pile back in. Eventually the Markets should bounce back up to at least the Green Line, once they bottom.

For the week the Dow was up 2.75%, the S&P 500 was up 2.93%, and the Nasdaq 100 was up 3.95%. The very Long Term Trend on the Stock Markets is UP, but many Indices made 52-week Lows last week which could signal a Top has been made.

The Inflation Index (CRB) was down 0.68% and is Below the Green Line, indicating Economic Weakness.

Bonds were up 0.27% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.64%, and could be topping as the FED is probably finished Raising Rates for a while (unless they purposely want to create a Slow Down). A falling Dollar could be good for Tech Stocks and Commodities.

Crude Oil was down 0.57% for the week at $45.33, and GOLD was up 2% at $1283.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 13 logged Open Positions, for the Short & Medium Term. There are 3 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM TRADES

Investments below that can Bounce up off the Green Line with Above 80 Relative Strength, could re-test their recent Highs.

ARWR ARROWHEAD PHARMA. Wait for weekly Close Above the Red Line of $13.29 (50-day avg.)

BSX BOSTON SCIENTIFIC Wait for weekly Close Above the Red Line of $35.53 (50-day avg.)

CGC CANOPY GROWTH Wait for weekly Close Above the Red Line of $32.96 (50-day avg.)

FIVE FIVE BELOW Wait for weekly Close Above the Red Line of $103.93 (50-day avg.)

FTNT FORTINET INC. Wait for weekly Close Above the Red Line of $72.48 (50-day avg.)

I INTELSAT GLOBAL Wait for weekly Close Above the Red Line of $23.60 (50-day avg.)

LULU LULULEMON ATHLETICA Wait for weekly Close Above the Red Line of $125.84 (50-day avg.)

MSFT MICROSOFT CORP. Wait for weekly Close Above the Red Line of $104.66 (50-day avg.)

UAL UNITED CON’T. AIR Wait for weekly Close Above the Red Line of $87.23 (50-day avg.)

WWE WORLD WRESTLING Place Buy Stop above $77.95 on the Close.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is LOW (Green Zone). The probability of successful Short Term Trades is better, when the S&P 500 is down near the Green Line.

Tell your Friends about the Green Line, and Help Animals.

QUESTION: Steve writes ” What is the deciding factor for you to say “Caution! Way above the Green Line? Thank you.”

ANSWER: Hi Steve, Way Above the Green Line means that if you Buy up there, you will probably have a “Sick Feeling” when the Investment eventually returns to the Green Line.

Good trading, and tell your friends!