04/26/2020 Since the Markets bottomed in early 2009 from the Mortgage Bubble bust, the Stock Indices and Bonds have gone up fairly steadily for two reasons: 1.) Excess Money Flow (mostly from FED Printing), and 2.) No alternative Investment for the Money to flow into. This has not changed, so the Markets could go back up to the Highs again.

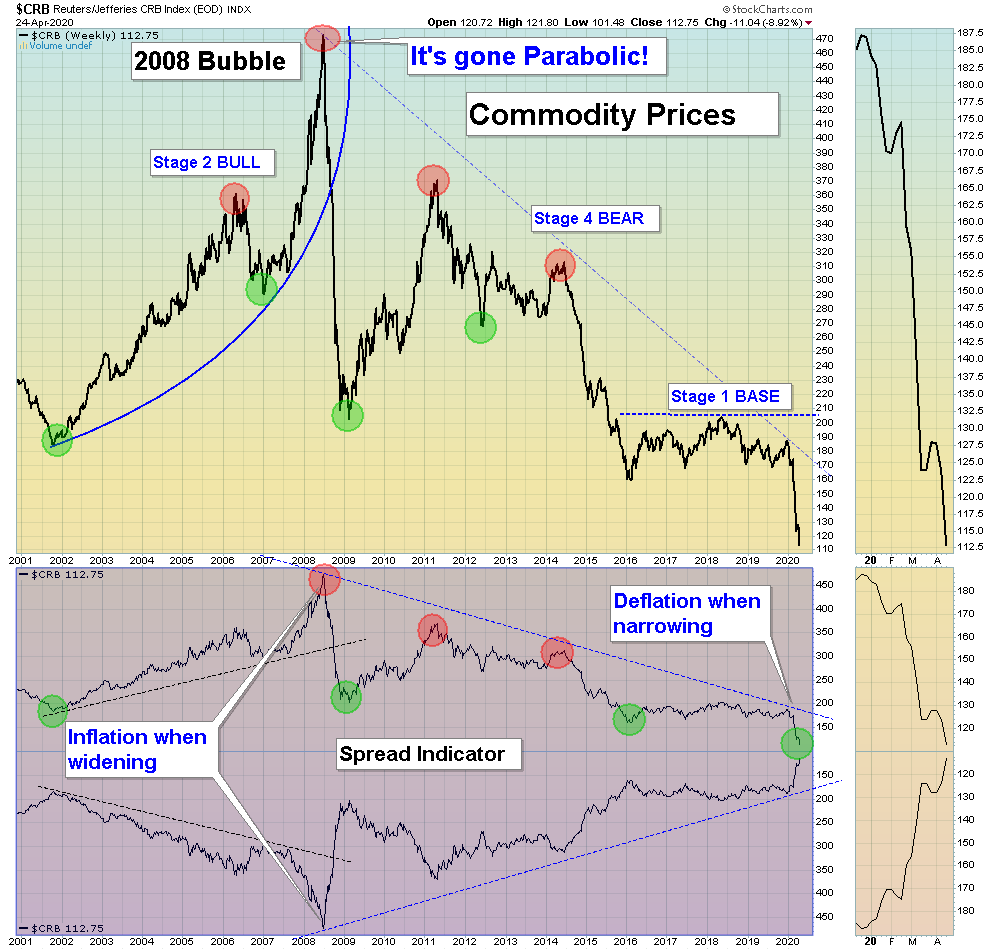

However with the Covid 19 problem, Congress has borrowed about $2.7 Trillion and the FED promises another $4.5 Trillion if necessary. Too much Money will eventually cause Inflation, something we have not seen since 2008 (see Chart above). Historically if Inflation is coming, Bonds will drop and Gold will rise. Currently both Bonds and Gold are both Strong, but one will eventually weaken. Gold made New Highs last week and that could be a temporary Fear trade. We will pay very close attention if other Commodities start moving up (Uranium Fund URA just closed Above the Green Line on Friday),

Why? Because Commodities are currently down 78 % from the 2008 Highs, and won’t go to zero. Stocks and Bonds are High because Interest Rates are Low. The Herd is loaded in Stocks and Bonds, so Smart Money will eventually rotate into Investments that are Low and wait for the next up cycle.

This could be uncomfortable to many Investors that have only participated in the last 11 year Bull up. Currently the Green Line Sector Rotation System has 40% in Gold and Gold Mining Funds because they are the strongest. Are you prepared for possible Inflation?

Markets were down slightly for the week but the Indices are trying to get back up near their Green Lines. The FEAR levels have dropped some, but the Buying Volume has dried up some.

The Markets should either have a “V” shaped recovery back up towards the Highs from massive FED Printing, or a “W” pattern where the recent rally up from the Lows is the middle of the W. We will have to wait and see, but currently the strongest Leaders are now over-bought and in the Red Zones (probably too late to Buy for the Short Term).

It looks like the weaker Indices (DOW 30 Index, Small Caps, Transports, & NYSE) could be doing an A-B-C Correcting rally back up from very over sold levels. If you are worried about a Bear Market, the Green Line System is in 2 Inverse Funds (RWM Inverse Small Cap Fund and VXX Volatility Index).

The Green Line System has been closing out most positions that were bought before Covid 19, and 69 % of the trades have been profitable with sizable gains. The goal is to EXIT the rest as the Markets return up near their Green Lines (250-day avgs.) Or when the CNN Fear & Greed Index returns back up near 70. (Now at 39).

For the week the Dow was down 1.93%, the S&P 500 was down 1.28%, and the Nasdaq 100 was down 0.67%. The Long Term Trend for the Indices is mixed.

The Inflation Index (CRB) was down 8.92 % and is Below the Green Line, indicating Economic Weakness.

Bonds were up 1.81% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was up 0.59% for the week.

Crude Oil was down 32.32 % for the week at $16.94 and GOLD was up 2.17% at $1735.60.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 6 logged Open Positions, for the Short & Medium Term. There are 6 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (concentrating more on the Short Term now)

Buy the Leading Investments that are down near the weekly Green Zones.

GDX GOLD MINING FUND Closed $31.84 but the Volume was not High. Wait for next Daily Green Zone Buy. All time High is $62.

KALA KALA PHARM. Wait for next Daily Green Zone Buy Signal. (Volume was not High last week on break out.)

______________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

NEW DIVIDEND GROWTH PORTFOLIO (we are now posting a Dividend Calendar for our entire portfolio to assist with planning purposes).

ETF Sector Rotation System – New Quarterly Rotation was on Apr 1, 2020.

Long Term Strategy for IRAs & 401k Plans:

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________