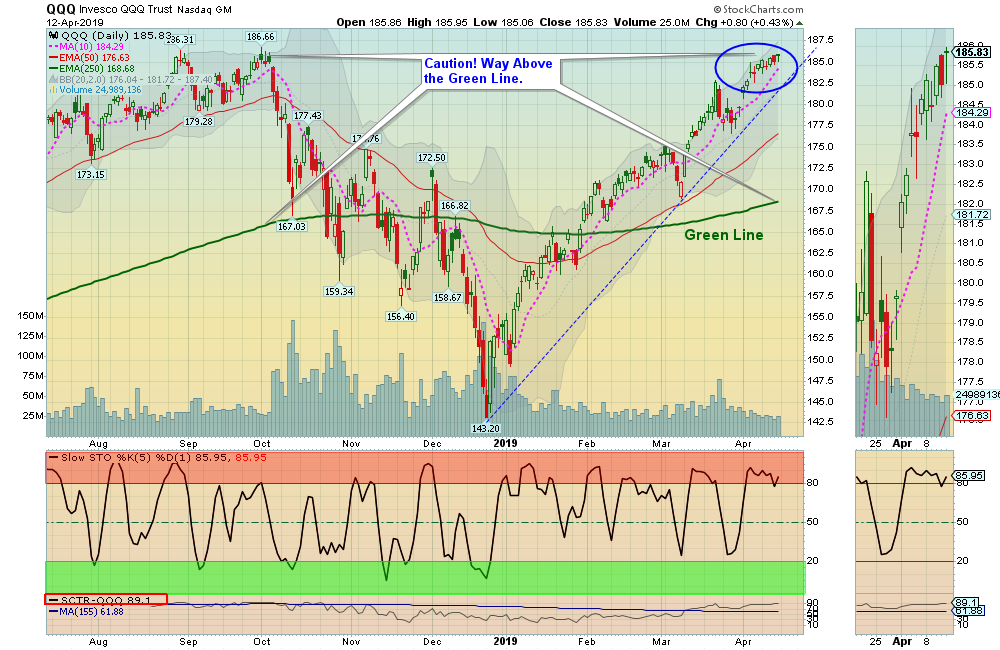

04/14/2019: Markets were up slightly for the week, after bouncing up from the Pink Lines (10-day avgs.) earlier. The major Indices are getting back up near the Sept. Highs. Normally Indices will struggle at earlier Highs (Resistance), as the last time the Markets were up here they dropped 20%, so many Short Term Traders will EXIT on next Sell Signal.

For the week the Dow was down 0.05%, the S&P 500 was up 0.55%, and the Nasdaq 100 was up 0.65%. The very Long Term Trend on the Stock Markets is UP.

The Inflation Index (CRB) was up 0.36% and is slightly Above the Green Line, indicating Economic Strength.

Bonds were down 1.10% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.38.

Crude Oil was up 1.28% for the week at $63.89, and GOLD was down 0.03% at $1295.50.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 10 logged Open Positions, for the Short & Medium Term. There are 3 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM TRADES

Buy the Leading Investments that are down near the weekly Green Zones.

AVP AVON PRODUCTS Buy if is Closes above $3.41 on High Volume.

BSX BOSTON SCIENTIFIC Wait for a Close above the Red Line of $38.36.

CIEN CIENA CORP. Wait for a Close above the Red Line of $38.20.

DXCM DEXCOM INC. Wait for a Close above the Red Line of $129.79.

KTOS KRATOS DEFENSE Wait for a Close above the Red Line of $15.62.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is HIGH (Red Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

QUESTION: Alberto writes “AGL: Little question: what does the green dot on the portfolios holdings mean? Thank you.”

ANSWER: Hi Roberto, please click on the Symbol Link for a Daily Chart, and on the Green Dot to see the 60-min Chart of the Investment.

Good trading, and tell your friends!

AGL