By investing in a diversified set of ETFs, an investor is positioned to take advantage of an uptrend in certain sectors while reducing the risk of losses due to exposure to high-risk stocks. In addition, by selling a portion of your holdings in sectors that are at the peak of their cycle and reinvesting in those sectors that are expected to perform well in the next few months, you are following a disciplined investment strategy.

The Green Line Strategy:

- Own the 5 Strongest ETFs based on Volume and 1 year Relative Strength.

- ETF must be Above the Green Line (250-day ema average), or move to Money Market (CASH).

- Every three months rotate to the Strongest ETFs.

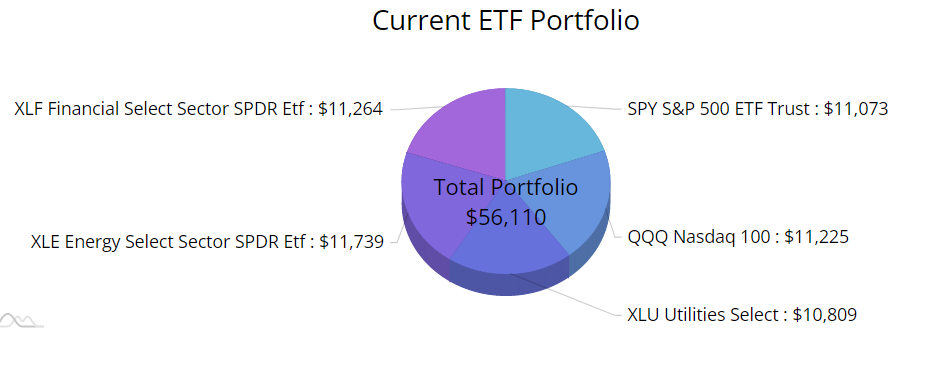

The percent allocation is automatically updated based on the market and performance of the underlying securities. The allocation is adjusted quarterly and assumes an initial equal percentage (20%) in each ETF sector.

The new 5 Strongest ETFs with High Volume are:

SPY S&P 500 Fund

QQQ NASDAQ 100 Fund

XLU Utilities Fund

XLE Energy Stock Fund

SLV Silver Fund

The only change on Monday is to replace XLF with SLV and try to allocate 20% evenly among the 5 Funds.

Good trading and tell your friends!