We started the ETF Sector Rotation fund as an alternative to Swing Trading but also primarily for individuals with Retirement Plans (e.g. 401K). In the past, retirement plans had restrictions on what securities you could invest in but also how often one could switch. Thus, the concept of quarterly rotation was born.

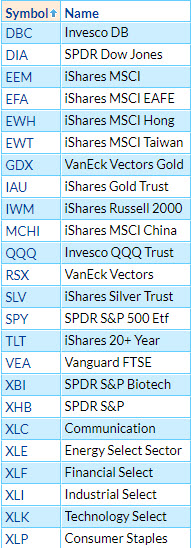

With respect to what securities one invest their retirement funds, in the past individuals could only select from a “Family” of funds. Individuals had limited options and performance was not great by all standards. Over the past 10 years, Exchange Traded Funds (ETF) has grown in popularity and are becoming options with company sponsored plans. Individuals with Self Directed IRA’s are also finding them available as well. ETF exist for many key markets and make them a great alternative to regular mutual funds. Below is the list of ETF’s that ATGL currently uses for its selection process.

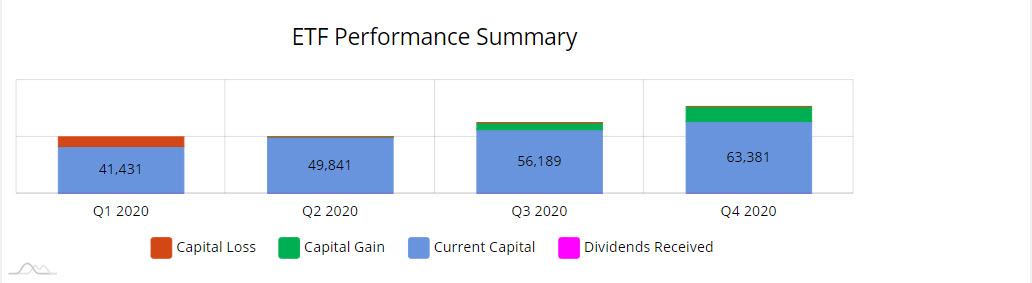

In starting the ETF Sector Portfolio, we started with an initial investment of $50,000 and purchased the Top 5 ETF’s based on Above the Green Line rules with the intent to close ALL positions at the end of each quarter and rebalance for the new period.

On Dec 31, 2020, we closed our ETF Sector Portfolio for its inaugural year. Shown below are results of the ETF Sector Portfolio for 2020. The 5 Funds were Sold on the Close December 31, 2020. On Jan 4, 2021, 20 % of the account value will be allocated into the new funds. The preliminary list of ETF’s for the 2021 First Quarter are: SPY, EEM, SLV, IWM, and QQQ. The final selection will be based on the closing numbers on Jan 4, 2021.

To see the current ETF Sector Portfolio, please visit our ETF Sector.