Dogs of the Dow is a stock picking strategy that tries to beat the Dow Jones Industrial Average (DJIA) each year by selecting the highest dividend DOW stocks. The strategy first became a popular fixture in 1991 with the publication of Michael B. O’Higgins’s book, “Beating the Dow,” in which he also coined the name “Dogs of the Dow.” The strategy is based on creating a portfolio by investing an equal amount of money in the 10 highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. At the beginning of each year the portfolio is re-balanced. A variation of the Dogs of the Dow is the Dow 5 or Small Dogs. The Dow 5 is the lowest priced stocks of the Dogs of the Dow.

In 2020, we at Above the Green Line started our ATGL Dogs of the Dow as an alternative to Swing Trading. Performance of Dogs of the Dow and Small Dogs for 2021 was approximately 14.5% and 15.1% respectively. It was a good year for the Dow 10 and Dow 5 considering the pandemic and the strategy basics. Unlike the ETF sector rotation where we rebalance on a quarterly basis, the Dow 10 and Dow 5 are only rebalanced once a year.

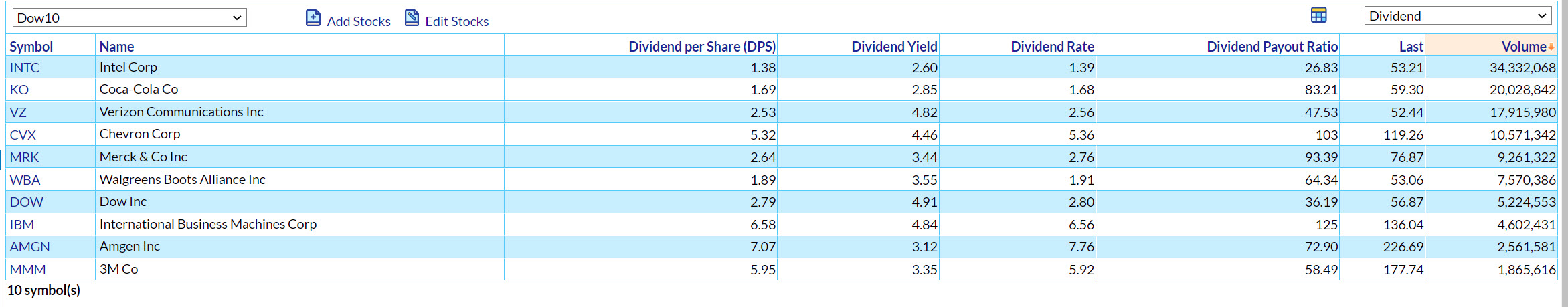

With the start of 2022, we have determined the new Dow components for 2022 which are shown below.

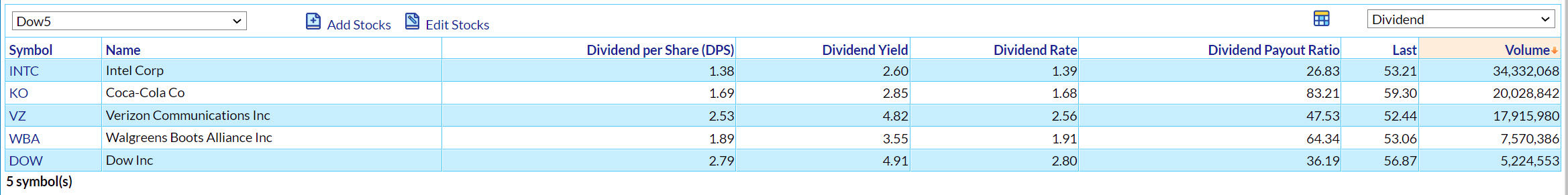

The Small Dogs of Dow (Dow5) for 2022 are shown below.

To see the current Dogs of the Dow Portfolio, please visit our Dogs of the Dow.