Welcome to the March 2021 edition of ATGL Dividend Growth Portfolio. This month, I screened for stocks with dividend yields greater than 7% along with a StockChart Relative Strength SCTR score of at lease 80, and most importantly a dividend increase streak of at least 10 years which qualifies as a “Contender” as defined by George L Smith, founder of Dividend Resource Center. I was looking for a strong potential growth stock with high quality dividend. The initial list of dividend stocks before factoring the SCTR strength resulted in 9 stocks NOT surprisingly consisting of primarily Energy and Financial stocks.

OKE, with a current dividend yield of 8.44 and an SCTR score of 83.40, was selected for the ATGL Dividend Growth Portfolio based on its high current dividend yield and long sequence of consecutively dividend increases. OKE, along with its subsidiaries, engages in gathering, processing, fractionating, storage, and transportation of natural gas in the United States. The company operates through the following segments: Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines primarily in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region. OKE was founded in 1906 and headquartered in Tulsa, Oklahoma.

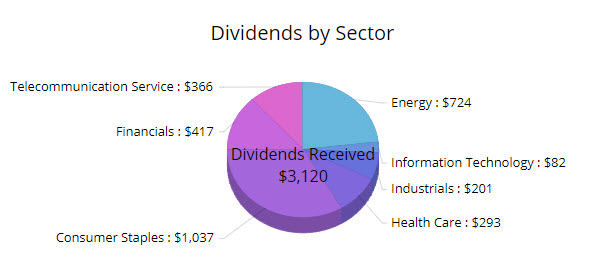

Presented below is the Dividend Distribution by Sector with the addition of OKE to the ATGL Dividend Growth Portfolio.

To see the current DivGro Portfolio, please visit the ATGL Dividend Growth Portfolio.