The Decision That Shapes Long-Term Outcomes Every investor eventually reaches a recurring decision point: what should be done with incoming cash flow? Dividends arrive, profits are realized, and surplus capital accumulates. The choice to spend or … [Read more...]

How the Elder Impulse System Helps Traders Time Their Entries

The Elder Impulse System provides traders with a visual framework for timing entries by combining trend direction with momentum strength. Developed by Dr. Alexander Elder, this color-coded method distinguishes between strong directional movement and … [Read more...]

Kelly Criterion Trading: How to Size Positions with Confidence

Successful trading requires more than selecting profitable securities. It demands disciplined risk management and precise position sizing. The Kelly Criterion provides a mathematical framework that removes emotion from position sizing decisions by … [Read more...]

SMA vs EMA: Which Moving Average Works Best for Your Trading Strategy?

Moving averages help traders identify trends, time entries and exits, and filter market noise. The debate between simple versus exponential moving average centers on responsiveness versus stability. The simple moving average treats all data points … [Read more...]

Stop-Loss Strategies: How to Build a System That Protects Your Portfolio

Managing risk is essential for active traders and investors. Markets can change quickly, and without safeguards, one bad move can wipe out weeks of gains. Stop-loss strategies help limit losses automatically and reduce emotional decisions. This … [Read more...]

What Is Beta Weighting and How It Improves Portfolio Risk Control

Institutional traders and advanced retail investors often rely on consistent methods for evaluating portfolio exposure to the market. Beta weighting enables this by translating a portfolio’s directional risk into benchmark-relative terms—typically … [Read more...]

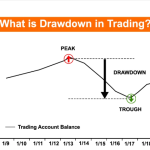

What Is Drawdown in Trading? A Guide for Risk-Conscious Traders

Drawdown is one of the most critical metrics in trading for assessing performance and managing risk exposure. It quantifies the decline of an investment portfolio from a peak to a trough before a new peak is reached. For investors and traders seeking … [Read more...]

7 Tips to Master Mean Reversion Trading Strategies for Consistent Results

Mean reversion trading appeals to investors and traders who prefer systematic, rule-based approaches. Instead of chasing fast-moving breakouts, you focus on situations where price has moved too far away from its typical range and is statistically … [Read more...]

Trading Psychology Explained: How Your Mind Shapes Market Decisions

Successful trading depends on more than technical indicators, chart patterns, or market timing. Your mindset plays a central role in shaping decisions, influencing risk tolerance, and determining how you respond to gains and losses. Even the most … [Read more...]

Master Scalp Trading Methods for Fast and Effective Market Entries

Scalp trading is a demanding, precise strategy that involves executing multiple trades in a single session to capture small price movements. Traders who use scalp trading methods operate in a fast-paced environment — every millisecond can impact … [Read more...]

- 1

- 2

- 3

- …

- 9

- Next Page »