By ATGL

Updated December 23, 2024

A bull flag is a continuation pattern that forms in the middle of an established bullish trend. It signals a temporary pause or consolidation period before the price resumes its upward trajectory. The pattern gets its name from its resemblance to a flag on a pole, where the “flagpole” is the sharp initial rally, and the “flag portion” represents the consolidation phase.

Traders highly favor this pattern because it provides clear entry points and signals that the prevailing trend is likely to continue. Recognizing the bull flag pattern early lets you ride the momentum of a trend while minimizing downside risks.

Why Traders Rely on the Bull Flag

- Trend Continuation: It provides confidence that the upward trend will persist after the consolidation period.

- Risk Management: The clearly defined structure of the pattern helps you set precise entry points, stop-loss levels, and profit targets.

- High Probability: The bull flag often emerges in liquid and trending markets, making it a reliable signal for many traders.

The bull flag is especially relevant in volatile markets where upward price movement is pronounced, offering opportunities to capture strong breakouts while avoiding false signals.

Formation of a Bull Flag Pattern

The bull flag chart pattern consists of three key phases: the flagpole, the flag formation, and the breakout. This rapid upward movement is one of the clearest indicators of a strong trend.

Knowing how the bull flag forms allows you to identify it in real time. Each phase of its formation tells a story about market dynamics and trader behavior.

1. The Flagpole

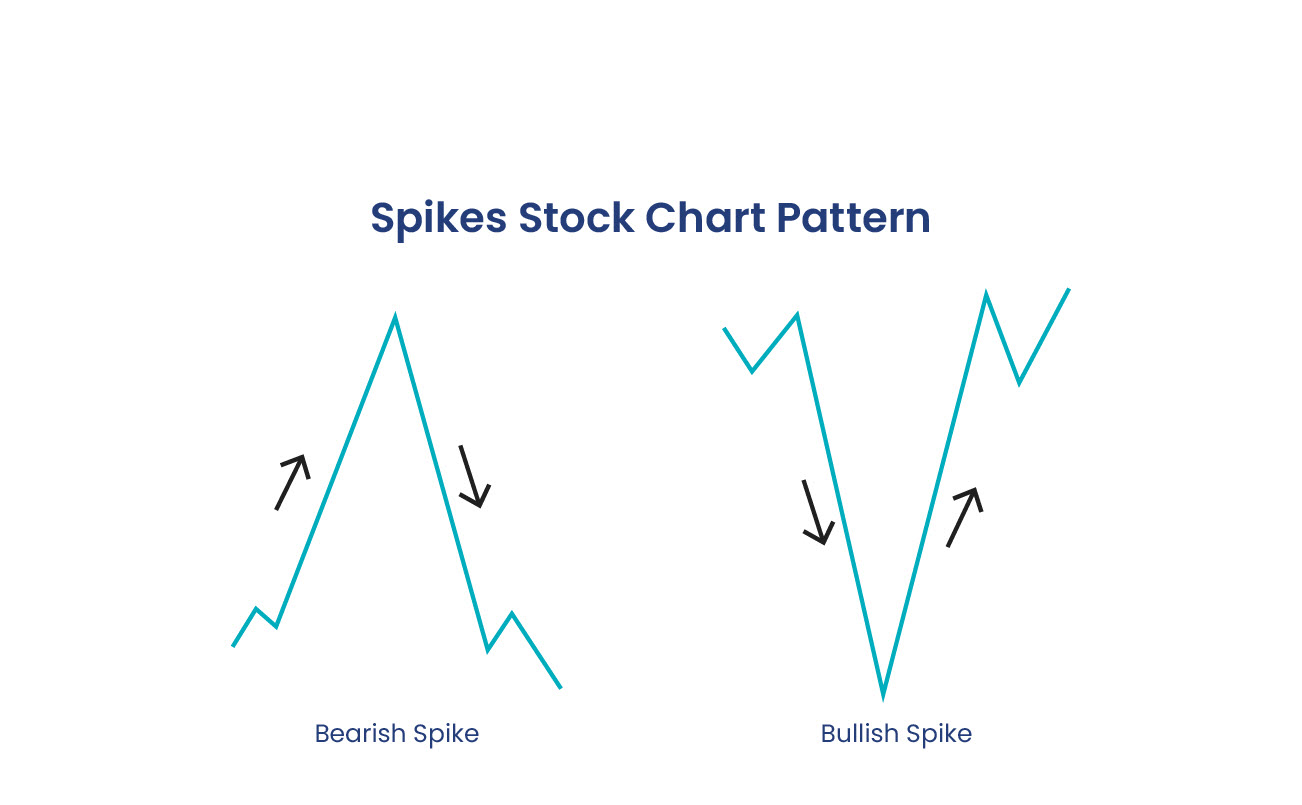

The pattern begins with a steep and rapid upward price movement, often driven by a surge in buying activity. This upward move forms the “flagpole,” representing the initial momentum behind the strong uptrend.

Characteristics of the Flagpole:

- Sharp Uptrend: The price often breaks through resistance levels with strong momentum.

- High Volume: The rally is usually accompanied by increased trading volume, signaling strong interest from buyers.

2. The Flag (Consolidation Phase)

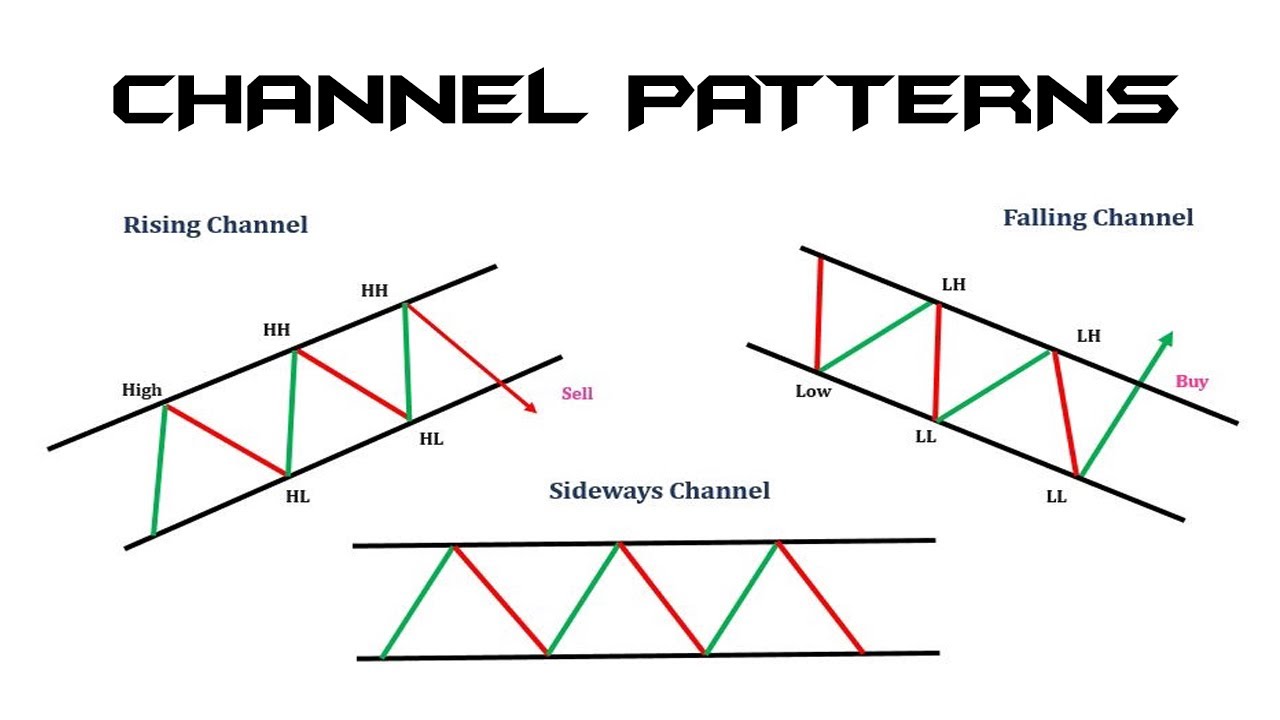

After the initial surge, the price enters a consolidation period, forming the “flag portion” of the trading pattern. The flag formation follows the initial rally, showing a temporary consolidation phase. This phase is characterized by minor price movements within a tight range, often sloping slightly downward. On a daily chart, this phase may appear as a series of small, parallel price movements, often sloping downward or sideways. Use trendlines to delineate the boundaries of the flag and watch for a potential breakout above the upper boundary.

Key Features of the Flag:

- Lower Volume: Trading volume tends to decline during consolidation, reflecting reduced activity.

- Retracement Limits: The price typically retraces no more than 38 to 50% of the flagpole’s length. A deeper retracement or excessive downward price movement may invalidate the pattern.

3. The Breakout

The final phase is the potential breakout, where the price decisively exits the flag portion, resuming the uptrend. This breakout is a confirmation signal to enter a long position.

Breakout Characteristics:

- Increased Volume: A volume spike during the breakout indicates strong buying interest.

- Directional Movement: The breakout should move above the upper trendline of the flag, confirming the continuation of the bullish trend.

How To Identify a Bull Flag Pattern

Spotting a bull flag in real time requires a keen eye and a methodical approach. Look for the following visual and technical cues.

Spotting Potential Bull Flags

- Look for a Strong Rally: The pattern starts with a sharp upward move, forming the flagpole.

- Identify Consolidation: The flag portion should exhibit tight price action within a small range, often sloping slightly downward.

- Observe Breakout Potential: Use trendlines to mark the boundaries of the flag, and monitor for an upward breakout above the upper trendline.

High volume during the flagpole, lower volume during the consolidation period, and a spike during the breakout confirm the pattern’s strength. When trading flag patterns, always confirm the breakout with volume and verify the consolidation phase doesn’t invalidate the underlying trend.

Key Characteristics To Look For

- Steep Flagpole: A robust upward rally is essential for the pattern’s validity.

- Compact Flag Shape: The flag portion should have a well-defined structure with minor price retracement.

- Volume Dynamics: High volume during the flagpole, lower volume during the consolidation period, and a spike during the breakout confirm the pattern’s strength.

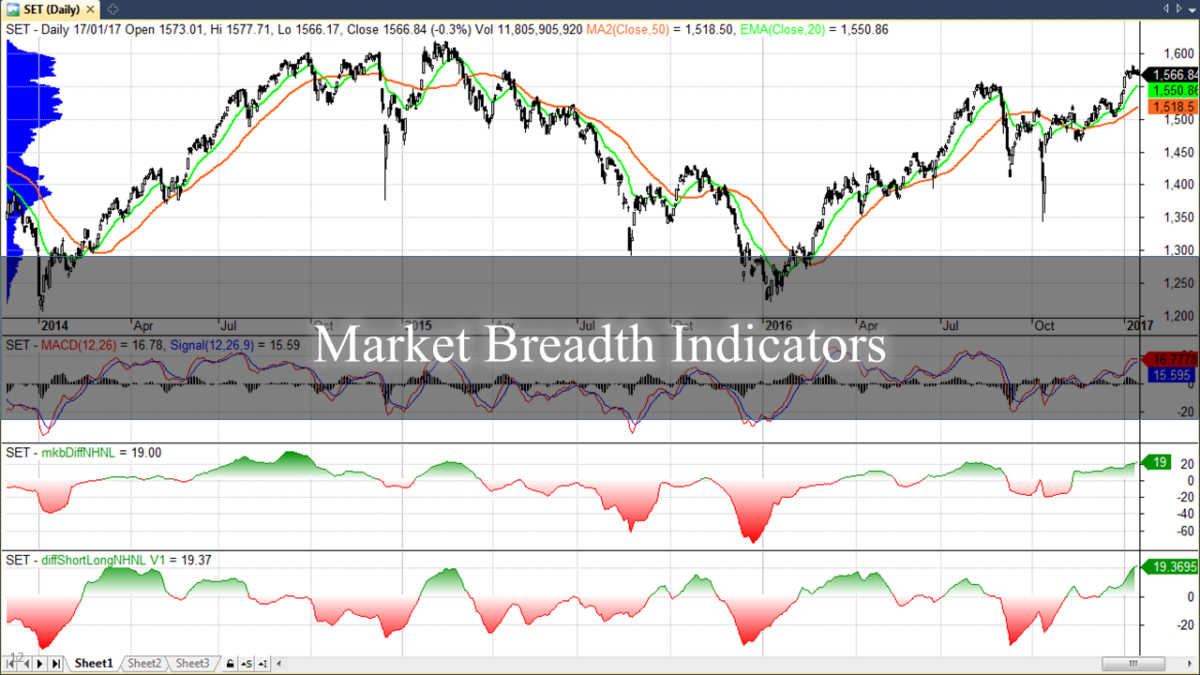

In addition to visual analysis, technical indicators like moving averages, Relative Strength Index (RSI), and stochastic oscillators can validate the trend and reduce the risk of false signals.

Trading Strategies for Bull Flags

Once you’ve identified a valid bull flag pattern, the next step is to develop a clear trading strategy. Focus on identifying a compact and orderly flag formation, which signals a healthy continuation pattern. This structure shows that the consolidation phase does not invalidate the underlying trend or momentum.

Whether you focus on short-term moves or prefer holding positions longer, understanding the nuances of trading vs. swing trading can help you align your strategy with patterns like the bull flag.

1. Entering at the Breakout

The optimal entry point is when the price breaks above the upper trendline of the flag portion. Waiting for confirmation, such as a strong close above the resistance line, can help reduce the risk of false signals. Use candlestick patterns like bullish engulfing or strong green candles to confirm the breakout. Properly timing the breakout in a pattern like this can capture maximum gains during the subsequent bullish momentum.

2. Using Volume for Confirmation

Volume plays an important role in validating the breakout. A breakout with low volume may indicate a lack of conviction, increasing the likelihood of a failed move. Look for a significant volume increase to confirm the potential breakout.

3. Setting Stop-Loss Orders

Risk management is essential in trading. Place a stop-loss order just below the lower boundary of the flag portion or slightly below the recent swing low. This can help minimize losses if the breakout fails.

4. Targeting Profit Levels

To calculate your profit target, measure the height of the flagpole and project it upward from the breakout point. This technique provides a realistic price target based on the pattern’s structure.

Bear Flag vs. Bull Flag

Key Differences

- Bull Flag: Forms during an upward price movement and signals continued upward momentum.

- Bear Flag: Appears during a downward price movement and indicates further declines.

Trading Implications

Bull flags are used for initiating long positions, while bear flags are typically associated with short selling. By recognizing the correct pattern, you can align your trades with the broader market trend, helping you avoid costly mistakes.

Master Stock Trading With Above the Green Line

At Above the Green Line, we empower you with actionable insights and cutting-edge tools to enhance your decision-making. Our proprietary technical analysis models are designed to help you identify high-probability patterns like the bull flag with precision. For additional insights into market trends and opportunities, explore our weekly commentary for expert analysis and updates.

By joining our memberships, you’ll gain access to exclusive resources, expert commentary, and advanced charting tools. Whether you’re exploring the nuances of the bull flag or diving deeper into technical analysis basics, our platform offers the guidance and resources you need to thrive.