Mar 30, 2025.

For busy investors that don’t have time to Swing Trade, we now have a simple Strategy:

Top Pick of the Week. You Buy the “Pick” on Monday morning, and then Sell on Friday’s Close. It’s a time-efficient approach designed to capture short-term gains without requiring constant market monitoring.

This “Pick” is emailed to you with this Weekly Commentary (more details here).

The Top Pick of the Week is again: HIMS & HERS HEALTH HIMS We kept HIMS and did not Sell on Friday. HIMS got trashed last week, as the Buyers at $70 are getting Flushed out down near the Green Line. If you have not bought HIMS yet, maybe Buy soon on the next Daily Buy Signal. New Members: Buy on the Open on Monday, and Sell on the Close Friday.

Since the Oct 7th TPOW inception, the S&P 500 Fund (SPY) was at 571.30, and is now down -1.20 %.

The 22 Top Picks of the Week Trades are up 39.6 %.

You can view the current Weekly Stock Performance.

______________________________________________________________________________

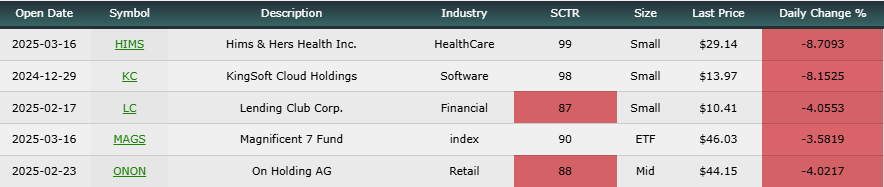

DAILY SWING TRADING (SHORT TERM)Watchlist and Charts to Buy Soon.

| Daily Swing Watch List | Daily Swing Charts to Buy |

| Current Swing Positions | Current Swing Charts |

| Closed Results | Trading Dashboard |

3/30/2025 Markets were lower for the week, as many of the Momentum stocks got crushed on this FEAR Flush. The Media has many investors concerned that a slowdown is coming. But the Weekly indicators and high FEAR levels say that there there is a high probability of another bounce up soon.

Many are very frustrated now as it has been harder to make money lately. Remember that investing requires Discipline to wait out these emotional FEAR Flushes, and that the Strongest Leaders will normally go back up to retest their recent high. FEAR levels have dropped from the previous March low (maybe Sellers are drying up). This should be a normal correction to take the FOMO out of the Markets.

The S&P 500 Chart looks like a Wave 4 Correction down, and then back up again, after this FEAR Flush is over (Emotions are temporary)

We Buy the strongest Leaders that make new highs, on pull-backs. So follow the Green Line System and you should continue to win more than you lose. SEE WATCH LIST

With the Green Line System, your Money should flow into the Strongest areas and your Account value should be able to grow in both Bull and Bear Markets. Follow the MONEY, not the MEDIA.

______________________________________________________________________________

For the week the Dow was down 0.95%, the S&P 500 was down 2.01% and the NASDAQ 100 was down 2.33%. The major Indices still have a Relative Strength below 80, so you should currently own the stronger Funds here.

The Inflation Index (CRB) was up 0.36% the week and is Above the Green Line, indicating Economic Expansion.

Bonds were down 0.62% for the week, and are Above the Green Line, indicating Economic Contraction.

The US DOLLAR was down 0.12% for the week.

Crude Oil was up 1.58% for the week at $69.36 and GOLD was up 2.04% at $3082.46, a new high.

_______________________________________________________________________

DAY TRADERS: We are doing many profitable Day Trades on our Discord Trading Hub (free). Please join Discord or X (Twitter) with your cell phone app for the fastest Trade Alerts and Daily email notifications during the day. Other methods of notification have been too slow. Also, please check our our Live Trading Room on YouTube during Market hours.

_______________________________________________________________________

SWING TRADE COMPLETED TRADES:

BBAI HOOD NFLX OOPI & TPR were Stopped Out even.

APP APLOVIN CORP. was Stopped Out with a 4 % Loss.

PLTR PALANTIR CORP. was Stopped out with 2.7 % Gain,

We are now in 4 Three Star logged Swing Trading Positions for the Short Term. There are 54 investments on the Short Term Watch List.

Completed Swing Trades thru Feb 2025: 53 Trades, + 160.94% Total. Avg. Trade = 3.04 % Gain (before taxes and commissions).

______________________________________________________________________________

LONG TERM WATCH LIST

ATGL Long Term Weekly Watchlist- Click here for scrolling charts.

CVNA CARVANA CO. Was bought on Friday at $204.41. Target $250.

HOOD RIBINHOOD MKTS. Was bought on Friday at $41.92. Target $58.

Completed Long Term Trades in 2024: 51 Trades, +333.46% Total, or 9.6 % / Trade (before taxes & commissions).

______________________________________________________________________________

Important Links| Top 100 | Stage Chart Investing | CNN Fear & Greed Index |

| Dividend Growth Portfolio | ETF Sector Portfolio | Dogs of the Dow |

| Long Term Strategy | Stage Chart Investing | Articles |

Alert! Market Risk is Medium (YELLOW). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

______________________________________________________________________________

QUESTION: PGP writes” What are your recommendations for your 401k clients?”

ANSWER: The easy answer is to only OWN Investments that are Above the Green Line. Historically, there should always be many choices available.

But if your 401k Plan only has basic Stock and Bond Funds and does not have all the Sector Funds or Stocks, then you might not have many Options, except Cash.

One Solution could be to use Market Timing (see Chart Link below) with the S&P 500 Fund. Buy Green Zone, Sell Red Zone.

Longer Term Market Timing Chart