Jul 20, 2025.

The Top Pick of the Week System is up +46.76 % vs the S&P 500 up +10.3% (since the Oct. 7, 2024 inception).

For busy investors that don’t have time to Swing Trade, we now have a simple Strategy:

Top Pick of the Week. You Buy the “Pick” on Monday morning, and then Sell on Friday’s Close. It’s a time-efficient approach designed to capture short-term gains without requiring constant market monitoring.

This “Pick” is emailed to you with this Weekly Commentary (see below & more details here).

The Top Pick of the Week is: Uber Tech. $UBER to be bought on the Open on Monday, and will be sold on the Close 0n Friday.

You can view the current Weekly Stock Performance.

______________________________________________________________________________

DAILY SWING TRADING (SHORT TERM)Watchlist and Charts to Buy Soon.

| Daily Swing Watch List | Daily Swing Charts to Buy |

| Current Swing Positions | Current Swing Charts |

| Closed Results | Trading Dashboard |

7/20/2025 Markets were mixed for the week, but the S&P 500 and NASDAQ 100 Funds were able to make slightly higher highs again. Buying Volume has not been great, and the strongest Stocks are very over-bought from MAX Greed & FOMO (Fear of Missing Out). Now the other Indices must make highs also (DOW 30, Transport, Small Caps) to confirm that this Stock rally is strong.

The S&P 500 will eventually correct back down near the Red Line (50-day avg.) for another Swing Buy, which is normal after a big run up like last week on Good News. Bit-Coin made a higher high, but could be in Wave 5 up.

We Buy the strongest Leaders that make new highs, on pull-backs. So follow the Green Line System and you should continue to win more than you lose. SEE WATCH LIST

With the Green Line System, your Money should flow into the Strongest areas and your Account value should be able to grow in both Bull and Bear Markets. Follow the MONEY, not the MEDIA.

______________________________________________________________________________

For the week the Dow was down 0.03%, the S&P 500 was up 0.64% and the NASDAQ 100 was up 1.27%. The major Indices still have a Relative Strength below 80, so you should currently own the stronger Funds here.

The Inflation Index (CRB) was up 0.86% this week and is Above the Green Line, indicating Economic Expansion.

Bonds were down 0.55% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.62% for the week.

Crude Oil was down 1.68% for the week at $67.30 and GOLD was down 0.22% at $3349.44.

_______________________________________________________________________

DAY TRADERS: We are doing many profitable Day Trades on our Discord Trading Hub (free). Please join Discord or X (Twitter) with your cell phone app for the fastest Trade Alerts and Daily email notifications during the day. Other methods of notification have been too slow. Also, please check our our Live Trading Room on YouTube during Market hours.

_______________________________________________________________________

SWING TRADE COMPLETED TRADES:

AVAV AeroVironment Stopped out at $260 for a 9.4 % Gain.

BBAI BigBear AI Target was Hit at $7.75 with a 9.2% Gain.

IONQ IonQ Inc. Target was Hit at $47 with a 4.8% Gain.

OKLO Oklo Inc. Stopped Out at $61 via email for a 9.8 % Gain.

PLTR Palantir Tech. Target was Hit at $145 with an 8.2% Gain.

QBTS, D-Wave Quantum Target was Hit 18.25 with a 13% Gain.

SMR NuScale Power Target was Hit $43 with a 22.6% Gain.

EOSE, KC, & VNET all slipped down to the Buy Prices and were Stopped Out even.

We are now in 2 Three Star logged Swing Trading Positions for the Short Term. There are 4 investments on the Short Term Watch List.

Completed Swing Trades thru June 2025: 115 Trades, + 293.7% Total. Avg. Trade = 2.55 % Gain (before taxes and commissions).

______________________________________________________________________________

LONG TERM WATCH LIST

| Open Date | Symbol | Description | Industry | SCTR | Size | Last Price | Daily Change % | ATGL 60 Min | Comments | id | Strategy | Position | Sell Date | Sell Price | Purchase Price | Net Profit | Realized Gain/Loss % | ATGL Rule | Stop Loss | color | Chart | Update Date | Status | Unrealized Gain/Loss % | Volume | Post Type | # Shares | Amount Invested | Portfolio Weight | Dividend Rate | Current Yield | Current Value | Yield on Cost | Projected Annual Dividends | Total Dividends Received | Pay Back | Profit / Loss | Annualized Profit/Loss | Star Rating | Target Price | News Alert % | Target Triggered |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2026-02-27 | ASTS | AST SpaceMobile Inc. | Telecom | 93 | Mid | $79.19 | -7.6609 | Wait for next Weekly Money Wave Close > 20 with High Volume. | 4977 | Long Term | Long | $0.00 | 0.00% | https://stockcharts.com/sc3/ui/?s=ASTS&a=2126221744&p=W&yr=1&mn=6&dy=0&id=p29553607318 | 2026-02-28 03:00:35 | open | 0.00% | 24056607 | Watch List | $0 | 0.00% | 0.00 | 0 | $0 | 0.00% | $0 | $0 | 0.00% | 0.00% | - | $105.00 | |||||||||||

| 2026-02-26 | W | Wayfair Inc. | Retail | 87 | Small | $76.33 | -3.343 | Wait for next Weekly Money Wave Close > 20 with High Volume. | 4978 | Long Term | Long | $0.00 | 0.00% | https://stockcharts.com/sc3/ui/?s=W&a=2137920242&p=W&yr=1&mn=0&dy=0&id=p05093830249 | 2026-02-28 03:33:08 | open | 0.00% | 3264357 | Watch List | $0 | 0.00% | 0.00 | 0 | $0 | 0.00% | $0 | $0 | 0.00% | 0.00% | - | $100.00 | |||||||||||

| 2026-02-22 | LMND | Lemonade Inc. | Financial | 85 | Small | $51.74 | -6.2171 | Wait for next Weekly Money Wave Close > 20 with High Volume. | 4968 | Long Term | Long | $0.00 | 0.00% | https://stockcharts.com/sc3/ui/?s=LMND&a=2202277875&p=W&yr=1&mn=6&dy=0&id=p22051746327 | 2026-02-22 17:51:21 | open | 0.00% | 3384257 | Watch List | $0 | 0.00% | 0.00 | 0 | $0 | 0.00% | $0 | $0 | 0.00% | 0.00% | - | $85.00 | |||||||||||

| 2026-01-31 | SOFI | SoFi Tech Inc. | Financial | 90 | Mid | $17.76 | -7.0157 | Wait for next Weekly Money Wave Close > 20 with High Volume. | 4939 | Long Term | Long | $0.00 | 0.00% | https://stockcharts.com/sc3/ui/?s=SOFI&a=2183259619&p=W&yr=1&mn=6&dy=0&id=p74166054978 | 2026-02-19 17:51:08 | open | 0.00% | 117792487 | Watch List | $0 | 0.00% | 0.00 | 0 | $0 | 0.00% | $0 | $0 | 0.00% | 0.00% | - | $29.00 | |||||||||||

| 2026-01-23 | PLTR | Palantir Tech. | Software | 86 | Large | $137.19 | 0.9195 | Wait for next Weekly Money Wave Close > 20 with High Volume. | 4930 | Long Term | Long | $0.00 | 0.00% | https://stockcharts.com/sc3/ui/?s=PLTR&a=1569702963&p=W&yr=1&mn=6&dy=0&id=p65099276184 | 2026-01-27 19:42:45 | open | 0.00% | 59540740 | Watch List | $0 | 0.00% | 0.00 | 0 | $0 | 0.00% | $0 | $0 | 0.00% | 0.00% | - | $190.00 |

ATGL Long Term Weekly Watchlist- Click here for scrolling charts.

KC KingSoft Cloud Shot up 37.6 % for the week. Target is $18.

RGTI Rigetti Computing Target was Hit at $16.50 with a 22.6 % Gain.

Completed Long Term Trades in 2024: 51 Trades, +333.46% Total, or 9.6 % / Trade (before taxes & commissions).

______________________________________________________________________________

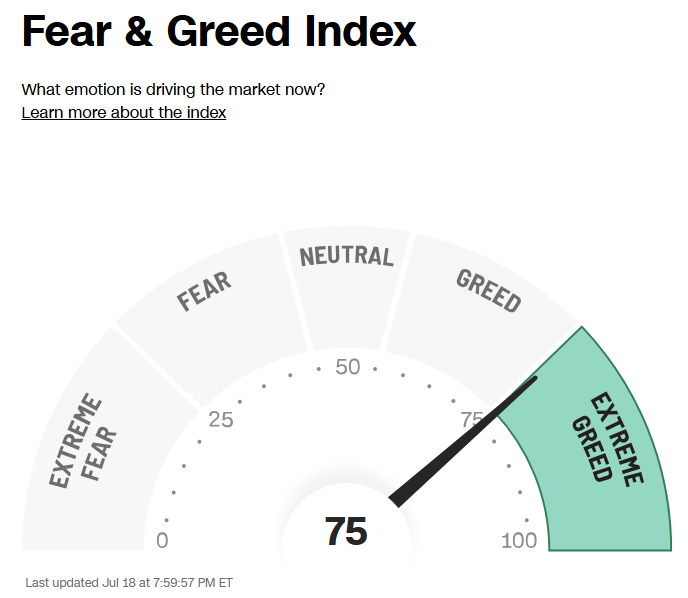

Important Links| Top 100 | Stage Chart Investing | CNN Fear & Greed Index |

| Dividend Growth Portfolio | ETF Sector Portfolio | Dogs of the Dow |

| Long Term Strategy | Stage Chart Investing | Articles |

Alert! Market Risk is High (RED). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

______________________________________________________________________________

QUESTION: Kerry writes: “I am a relatively new member and am curious about the rationale for one of the rules. As I understand it, to qualify as a buy, a security must close below the the Money Wave (slow stochastic) reading of 20 for at least one day; merely dipping below the 20 reading for a part of the day and then breaking out above it that same day is insufficient to qualify for a buy. I am curious about the rationale for that distinction.

Thanks so much in advance,”

ANSWER:

Sometimes the Strongest Investments do not Close on the Green Zone, and take off again. But we need firm Rules to have a System, so we require a Close in the Green Zone.

If many Investments are coming down in the Green Zone together on a Market drop, it is fine to fudge on the Rule (and sometimes better) and Buy the strongest ones that “Tag & Go”. Just have a Sell Stop Loss on the trade.

Good trading, and tell your friends!