May 11, 2025.

For busy investors that don’t have time to Swing Trade, we now have a simple Strategy:

Top Pick of the Week. You Buy the “Pick” on Monday morning, and then Sell on Friday’s Close. It’s a time-efficient approach designed to capture short-term gains without requiring constant market monitoring.

This “Pick” is emailed to you with this Weekly Commentary (more details here).

The Top Pick of the Week: VERONA PHARMA PLC VRNA Buy on the Open on Monday, and Sell on the Close Friday.

The 26 Top Picks of the Week Trades were up 24.04 % before compounding, and the S&P 500 Fund (SPY) is down -1.2 %.

You can view the current Weekly Stock Performance.

______________________________________________________________________________

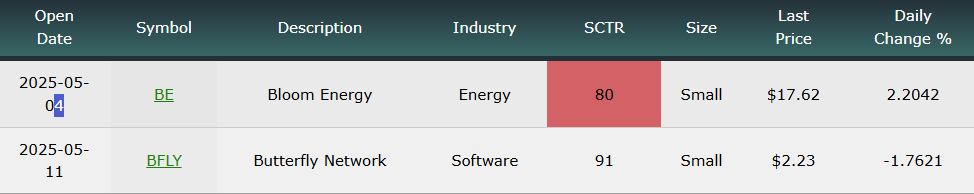

DAILY SWING TRADING (SHORT TERM)Watchlist and Charts to Buy Soon.

| Daily Swing Watch List | Daily Swing Charts to Buy |

| Current Swing Positions | Current Swing Charts |

| Closed Results | Trading Dashboard |

5/11/2025 Markets were mixed to lower for the week, as the Indices are no longer over-sold from FEAR, and many of the Leaders are back up in the daily Red Zones (probably too late to Buy for the short term). So Caution in Buying now, until we see some pullback.

The Buying Volume from the lows has not been above average or impressive and the Indices are still below the 200-day averages (that’s when bad events usually happen).

We Buy the strongest Leaders that make new highs, on pull-backs. So follow the Green Line System and you should continue to win more than you lose. SEE WATCH LIST

With the Green Line System, your Money should flow into the Strongest areas and your Account value should be able to grow in both Bull and Bear Markets. Follow the MONEY, not the MEDIA.

______________________________________________________________________________

For the week the Dow was down 0.15%, the S&P 500 was down 0.43% and the NASDAQ 100 was down 0.18%. The major Indices still have a Relative Strength below 80, so you should currently own the stronger Funds here.

The Inflation Index (CRB) was up 1.66% the week and is Above the Green Line, indicating Economic Expansion.

Bonds were down 0.74% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.21% for the week.

Crude Oil was up 4.75% for the week at $61.06 and GOLD was up 2.62% at $3239.34.

_______________________________________________________________________

DAY TRADERS: We are doing many profitable Day Trades on our Discord Trading Hub (free). Please join Discord or X (Twitter) with your cell phone app for the fastest Trade Alerts and Daily email notifications during the day. Other methods of notification have been too slow. Also, please check our our Live Trading Room on YouTube during Market hours.

_______________________________________________________________________

SWING TRADE COMPLETED TRADES:

ERJ & HIMS were Stopped Out even.

We are now in 2 Three Star logged Swing Trading Positions for the Short Term. There are 4 investments on the Short Term Watch List.

Completed Swing Trades thru Mar 2025: 68 Trades, + 194.14% Total. Avg. Trade = 2.86 % Gain (before taxes and commissions).

______________________________________________________________________________

LONG TERM WATCH LIST

ATGL Long Term Weekly Watchlist- Click here for scrolling charts.

BCRX BIOCRYST PHARMA. Target was Hit $11 with a 21.5 % Gain.

GBTC BITCOIN FUND Target was Hit at $80 with a 19.5% Gain.

HOOD ROBINHOOD MKTS. Target was Hit at $55 with a 31% Gain.

PRCH PORCH.COM Target was Hit at $8.01 with a 35.5% Gain.

XLU UTILITY FUND Target was Hit at $81 with a 5.9% Gain.

Completed Long Term Trades in 2024: 51 Trades, +333.46% Total, or 9.6 % / Trade (before taxes & commissions).

______________________________________________________________________________

Important Links| Top 100 | Stage Chart Investing | CNN Fear & Greed Index |

| Dividend Growth Portfolio | ETF Sector Portfolio | Dogs of the Dow |

| Long Term Strategy | Stage Chart Investing | Articles |

Alert! Market Risk is Medium (YELLOW). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

______________________________________________________________________________

QUESTION: Winter writes ““Don’t take a Loss” confuses me. What does that mean?”

ANSWER: When the Investment has a Money Wave Buy Signal, it should pop up 3-6 % in just a few days.

If it is not popping up well, and the Money Wave > 50, either Get out soon , and Don’t Take a Loss! (Get Out Even).

Something must be Wrong. There will be plenty more Money Wave Signals soon… Raise Cash, and don’t get Stuck! Wait for the next one.

Good trading and tell your friends!

[…] – AGTL Top Pick of the Week! May 11, 2025 […]