10/10/2021 Markets were higher this week, as the major Indices bounced up from being over-sold for the Short Term. Many Leaders popped up out of the Green Zones (probably too late to Sell for the Short Term) for Money Wave Buys. However, the Buying Volume was still below average. Now the Indices need to make New Highs for the rally since the March 2020 Lows to continue.

Stocks now have some competition as Long Term Bonds fell more (higher Interest Rates) and Commodity Prices made New Highs again this week. Adjust your portfolio to always own Investments that are Above the Green Line, even if you are not familiar with these Investments. We want to own Investments with High Volume and High Relative Strength. Follow the Smart Money.

Don’t let the Media talk you into holding on to inferior Investments that are Below the Green Lines.

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets.

For the week the Dow was up 1.27%, the S&P 500 was up 0.83%, and the NASDAQ 100 was up 0.27%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 2.19% for the week (a New High) and is Above the Green Line, indicating Economic Expansion.

Bonds were down 2.39% for the week, and are back Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.03% for the week and is Above the Green Line.

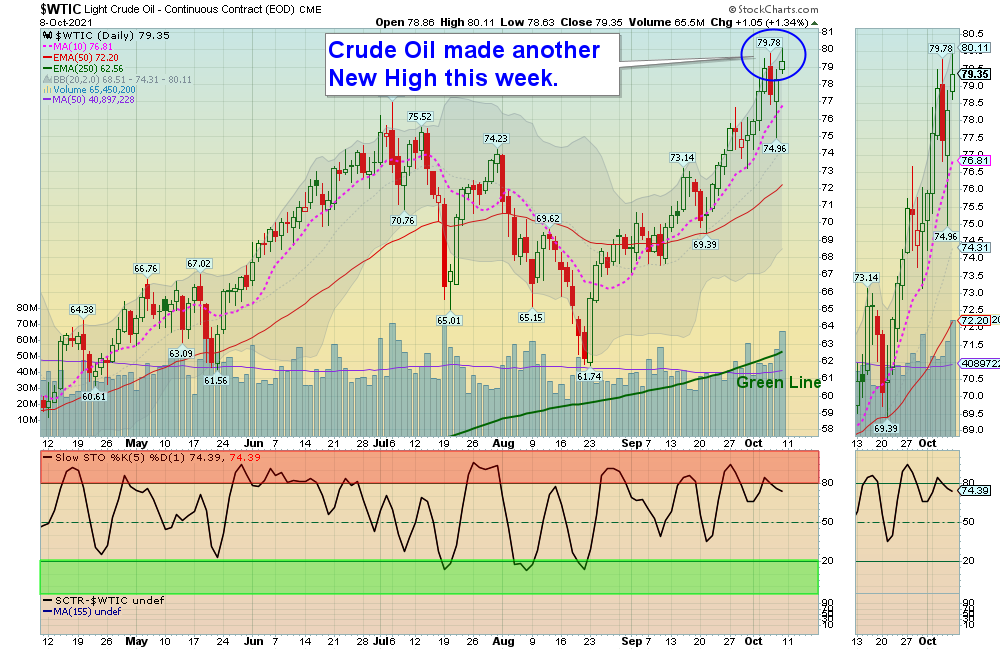

Crude Oil was up 4.57% for the week at $79.35 and GOLD was down 0.06% at $1757.40.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in 5 logged Current Positions, for the Short & Medium Term. There are 6 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (A few Leaders have pulled back , but most Large Caps no longer have 80 Relative Strength required.)

Long Term Scrolling Charts (Real Time)

BNTX BIO N TECH Wait for the next Daily Money Wave Buy Signal.

CLF CLEVELAND-CLIFFS INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

MT ARCELOR METTAL SA Wait for the next Daily Money Wave Buy Signal.

MGI MONEYGRAM INT’L. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

XLRE REAL ESTATE FUND Wait for the next Daily Money Wave Buy Signal.

YETI YETI HOLDINGS Wait for the next Daily Money Wave Buy Signal.

______________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Oct 1, 2021

Dividend Growth Portfolio

ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

______________________________________________________________________________________

QUESTION: Jose M writes “Morning, I seem to have difficulties on finding the Money Wave chart on the ETFs. Thanks.”

ANSWER: First go to MY TRADING DASH BOARD. Then the Charts with the Money Waves can be pulled up by clicking on the Symbol of the Investment on the Watch List or Current Positions links in every Daily email.

The Money Wave is the Red and Green Zone on the bottom part of the Chart. Buy when the Money Wave has gone down into the Green Zone, and then turns up above 20.