8/15/2021 Markets were higher again for the week, as the S&P 500 & DOW 30 Indices made New Highs. The Markets don’t seem to care about anything negative like Inflation or the Virus until the FED slows down on Printing. The 12 year Bull Market (longest in history) has been propped up from FED Printing, and most do not expect to the FED to begin tapering until their September meeting, at the earliest.

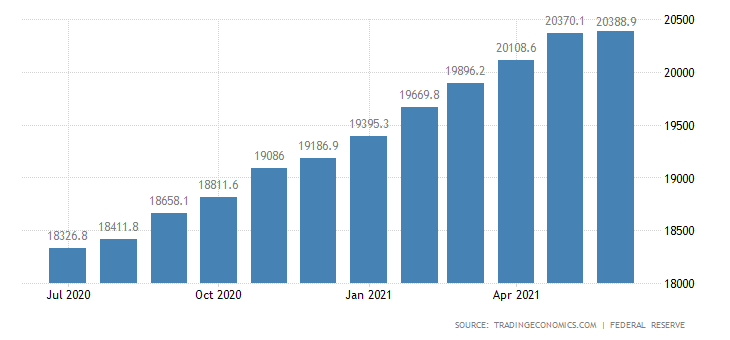

However, Market internals have been weakening (breadth, Volume, New Highs, etc.) which are normally warning signs of a Market pull-back. Smart Money is watching the M2 Money Supply, which is still growing monthly and is giving the Markets a “sugar high”. From the Chart above, you can see that the M2 Money Supply monthly growth rate could be flattening out. This slowdown on the Money Supply growth is probably the cause for the Market internals to weaken. And maybe the FED is finally getting worried about the Investment “bubbles” they have created from super low Interest Rates.

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets. No predicting here, just Following the Money.

For the week the Dow was up 0.94%, the S&P 500 was up 0.78%, and the Nasdaq 100 was up 0.21%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 1.15% for the week and is Above the Green Line, indicating Economic Expansion.

Bonds were up 0.52 % for the week, and are back Above the Green Line, indicating Economic Contraction.

The US DOLLAR was down 0.31% for the week.

Crude Oil was up 0.23% for the week at $68.44 and GOLD was up 0.86% at $1778.20.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in 3 logged Current Positions, for the Short & Medium Term. There are 6 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Some Leaders have pulled back , but Markets are near Highs.)

Long Term Scrolling Charts (Real Time)

AMC AMC ENTERTAINMENT Buy if it Closes above the Red Line (50-day avg.) with High Volume.

CZR CAESARS ENTERTAINMENT Buy if it Closes above the Red Line (50-day avg.) with High Volume.

F FORD MOTOR CO. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

GME GAME STOP CORP. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

KIRK KIRKLAND’S INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

KOPN KOPIN CORP. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

TRIP TRIPADVISORS INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

URA URANIUM FUND Buy if it Closes above the Red Line (50-day avg.) with High Volume.

XOP OIL & GAS EXPLORATION FUND Buy if it Closes above the Red Line (50-day avg.) with High Volume.

ZKIN ZK INT’L. GROUP Buy if it Closes above the Red Line (50-day avg.) with High Volume.

______________________________________________________________________________________

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Aug 1, 2021

Dividend Growth Portfolio

ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

___________________________________________________________________________________________

QUESTION: Praveen writes “I am not receiving intra-day alerts for the buy and sell I am just getting end of day email. can you help?”

Thanks.

ANSWER: We currently have 1 email going out Daily, the Money Wave Alert! which is sent between 3:40 -3:50 EST. Most members do best with Swing Trading (3 days to 3 weeks trade) than with the intra-day alerts for Day Trading (most Day Traders lose money).

We are sending out Day Trading Tweets to subscribers on a free Twitter account @AboveGreenLine (please set up your Twitter account for mobile notifications).

But most follow the Swing Trading Scrolling Charts and Day Trading Scrolling Charts Lists during the day, as they are constantly being updated.

We are have Live Streaming on YouTube, which has these current Watch Lists running “real time”.

Thank you for writing,

ATGL