How the Federal Reserve Impacts the Stock Market

The Federal Reserve System is the central banking system of the United States that is responsible for encouraging healthy operations within the economy as well as reflecting public interest. It advertises five primary duties that help maintain and grow the U.S. economy. To begin, the Fed conducts the country’s monetary policy in order to boost employment, stabilize prices, and to attempt to ensure moderate long-term interest rates. Additionally, the Fed seeks to minimize the ramifications of potentially detrimental events that could affect the U.S. economy. Thirdly, the Fed is responsible for keeping financial institutions secure while also monitoring their activities. Furthermore, the Fed promotes consumer safety and community development by researching new trends and developments. Lastly, the Fed facilitates services between the banking industry and the United States government. There are twelve Federal Reserve Banks dispersed throughout the country; to see where they are, click here.

Impacts on the Stock Market

The primary concern of the Fed surrounds preventing inflation from destroying the economy. If the economy grows too quickly, inflation can skyrocket and severely affect economic conditions. On the other hand, if the economy slows down too quickly, inflation will stall. Inflation and interest rates have an inverse relationship; thus, the Fed attempts to regulate inflationary conditions by utilizing interest rates. When the economy is growing too quickly and inflation is high, the Fed will increase interest rates to reverse the rise of inflation. Conversely, when the economy is slowing down and inflation is low, the Fed will decrease interest rates to stimulate the economy.

The Fed’s control over interest rates has a direct effect on investors of the stock market. Take bonds for example. The price of bonds is inversely related to interest rates. When rates are high, bond prices are low and vice versa. If an investor purchased a bond with an interest rate of 5%, and then shortly after the Fed lowered the interest rate to 4%, the investor’s older bond would be paying more interest than bonds accrued in the present. Conversely, if an investor purchased a bond with an interest rate of 5% and then shortly after interest rates were raised to 6%, an investor would be losing out on current gains. To capture the higher return, the investor would have to pay a premium on their bond.

The effects of interest rates on bonds are clear-cut and carry certainty. However, the same cannot be said about the effects of interest rates on stocks. According to multiple studies, there is conflicting data surrounding the relationships between stocks and interest rates; many consider it to be impossible to make informed decisions about one’s portfolio based on interest rates. Though the relationship between the two is unclear, it does not mean that stocks entirely lack a relationship with interest rates. When interest rates decline, businesses can acquire loans to pursue new projects and operations at a lower cost. Consequently, a business’s customers spend less on service debt and more on the products and services of the business. Thus, declining interest rates can cause an increase in the price of a business’s stock. It should be noted that purchasing stock in a declining-rate environment is not always straightforward; simply because interest rates are low does not signal that the price of a stock will increase in the future. The Dimension Fund Advisors conducted a large study surrounding the relationship between interest rates and equity. By comparing stock returns to interest rates between 1954 and 2016, it found that there was “no discernible relationship” between the two. Furthermore, the study found that while interest rates were increasing stock returns ranged from -15.56% to 14.27%. In months when rates were declining, stock returns ranged from -22.41% to 16.52%. While interest rates and stocks sometimes illustrate a relationship, the correlation is not defined and should be used carefully when making investment decisions.

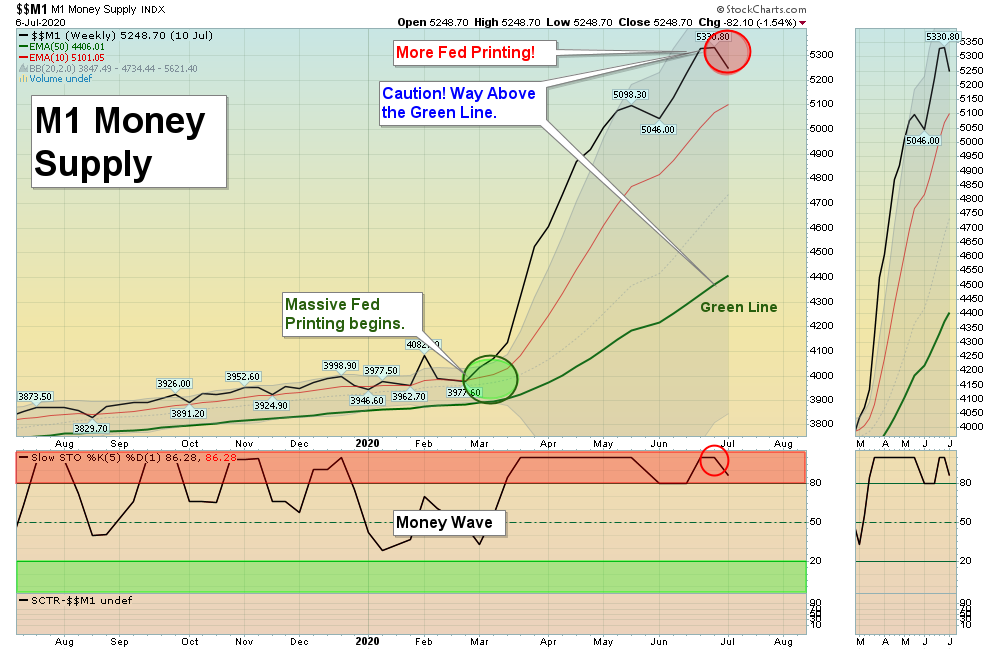

The Effects on the Stock Market Today

In early/mid-March, the financial markets experienced extreme volatility due to COVID-19. The global pandemic caused a multitude of consequences for the U.S. economy; it became difficult to borrow for longer than overnight, trading became impaired, and borrowers found that credit became unavailable. The ramifications on those markets affected those that participated in them, yet they also affected those who did not due to their central role within the U.S. financial system. COVID-19’s effects on the markets could potentially lead to families having trouble receiving mortgages with affordable interest rates, businesses having trouble operating and paying their workers, and governments having trouble funding essential enterprises. Thus, the Fed was forced to act quickly to prevent could be deemed the worst economic decline since the Great Depression.

How does this affect investors? Take short-term funding markets for example. As previously mentioned, these short-term funding markets became extremely debilitated at the beginning of March. Due to this, investors became hesitant to purchase commercial paper. Funds that invested in commercial paper saw an outflow of $150 billion in March alone as investors became concerned that they would not be able to sell their holdings.

Conclusion

It might not always be wise to observe the actions of the Fed and make financial decisions based upon them. However, it is important to comprehend the financial markets of today, including but not limited to international dollar funding, mortgage-backed securities, and credit markets, and how are deeply interwoven they are with each other. Financial stress in one market leads to stress within another, and can ultimately cause an economic disaster. Investors are not exempt to this strain, neither are individuals, nor corporations, nor governmental entities. During a time of crisis, economic conditions affect everyone’s ability to own a home, to feed themselves, to build a future, etc. Thus, the actions of the Fed should be of great importance to everyone, investors and citizens alike.