By ATGL

Updated February 8, 2024

Swing trading is a short-term trading strategy with trades typically lasting between a few days and several weeks. During this period, a swing trader aims to hold their position while seeking to capitalize on movements in the price of a commodity or share to generate profits. Timing trades and aligning with current market trends can help maximize returns on one’s investments. With a well-researched and disciplined approach, swing trading becomes a great way to use such short-term market movements to your benefit.

What Is Swing Trading and How Does It Work?

Swing trading is one of the most popular strategies for trading as it attempts to capitalize on short and medium-term price movements to make profitable trades. Traders attempt to invest in swing stocks when they are on the rise, usually holding them for a few days or weeks. This distinguishes swing traders from day traders, as the latter attempt to reach their profit targets by executing multiple trades throughout the day, capitalizing on relatively minor price movements.

Avoiding the need to be constantly in front of a screen for trade execution results in a reduced time commitment. This makes swing trading an attractive choice for both part-time and full-time traders, including beginners. The approach offers the advantage of short-term profits, and given the less frequent trading activity compared to day trading, transaction costs associated with swing trading are generally lower.

Profits are made on price movements, and volatile markets can be profitable for swing trading as long as you know how to navigate them. However, price fluctuations are not consistently advantageous because they can be unpredictable and expose traders to the risk of losses. A precise analysis of the market and effective risk management strategies can increase the likelihood of making profitable trades. Merely relying on price movements is not enough without a well-thought-out strategy. It is also important to consider your personal requirements to decide if swing trading is the best strategy for you.

3 Strategies for Short-Term Profits When Swing Trading Stocks

The following strategies form the basic foundation of high-probability trading and, irrespective of your trading style, can help you make more informed decisions in the financial market. While tracking market indices is an important part of these strategies, you must also understand the underlying economic factors that drive these numbers. Knowing the difference between fundamental analysis and technical analysis allows you to refine your approach depending on your goals and interests. The strategies below, and swing trading in general, depend more on technical analysis.

Since swing trading is more time-sensitive than long-term buy-and-hold strategies, your trading decisions should also be based on up-to-date technical indicators. These swing trading strategies, combined with the eight best indicators for swing trading in 2024, can set you up for success.

1. Fibonacci Retracement: Identify Price Support and Resistance

Fibonacci retracement levels provide traders with potential support and resistance levels based on historical price movements. These are pivotal junctures where price trends can either stall or reverse. The Fibonacci retracement levels are based on the mathematical Fibonacci sequence.

In stock trading, these retracement levels are placed at 23.6%, 38.2%, 50%, 61.8%, and 78.6% and signify different degrees to which a stock’s price may retrace its path. Thus, Fibonacci retracement helps traders identify where a price may experience pullback before resuming its trend. For example, if a security encounters resistance at $10, it is anticipated to either encounter a pause or undergo a decline to consolidate.

Fibonacci retracement levels, in conjunction with an understanding of support and resistance prices, aid in forecasting the extent of a price decline following its reach of the resistance level. Conversely, if a price experiences a decline, understanding the support level of the stock price provides insight into potential points where the fall might be halted or find support. Examining Fibonacci retracement levels enables you to predict the extent of its subsequent rise before the next downturn. Like most trading strategies, Fibonacci retracement becomes a powerful tool when combined with other trading methodologies.

2. Breakout Trading: Identify Stocks That Reach the Breakout Level

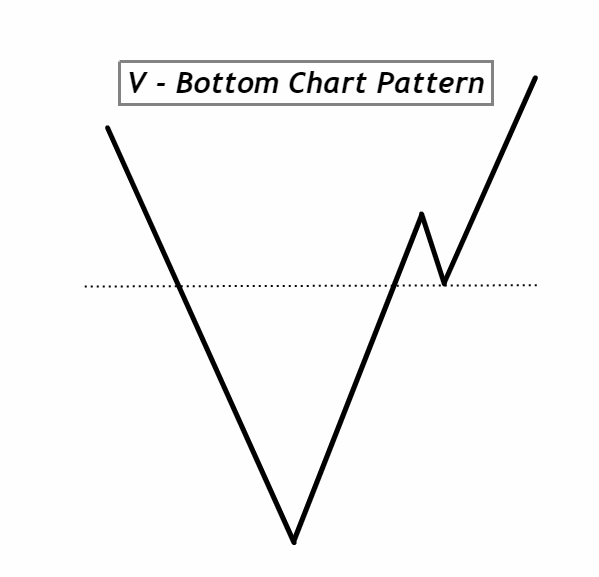

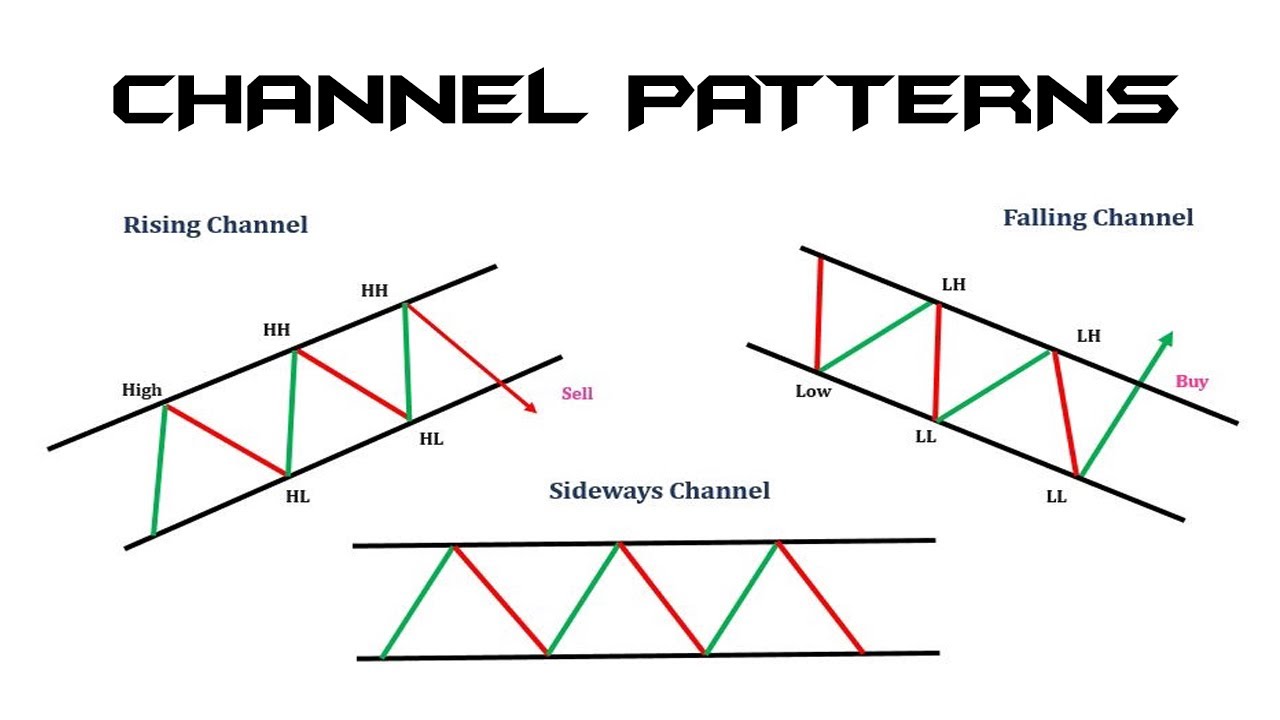

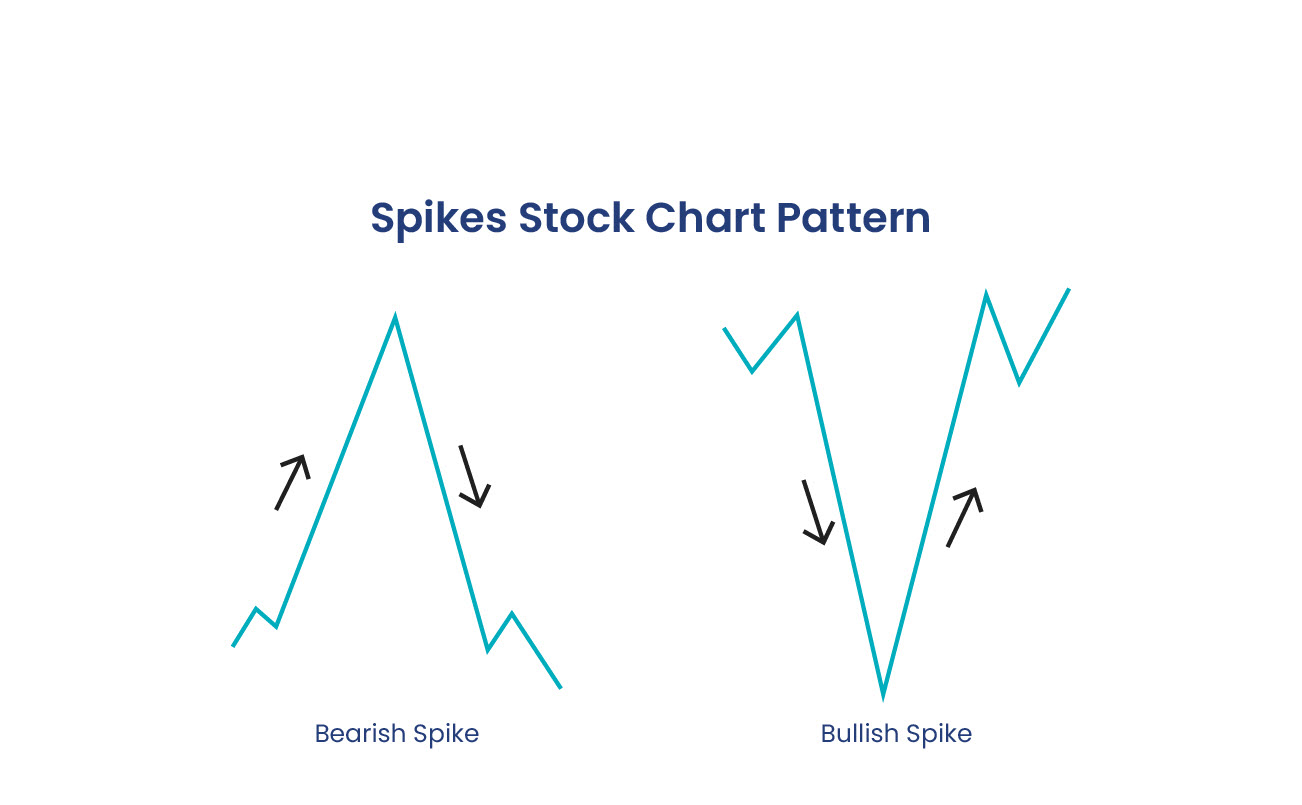

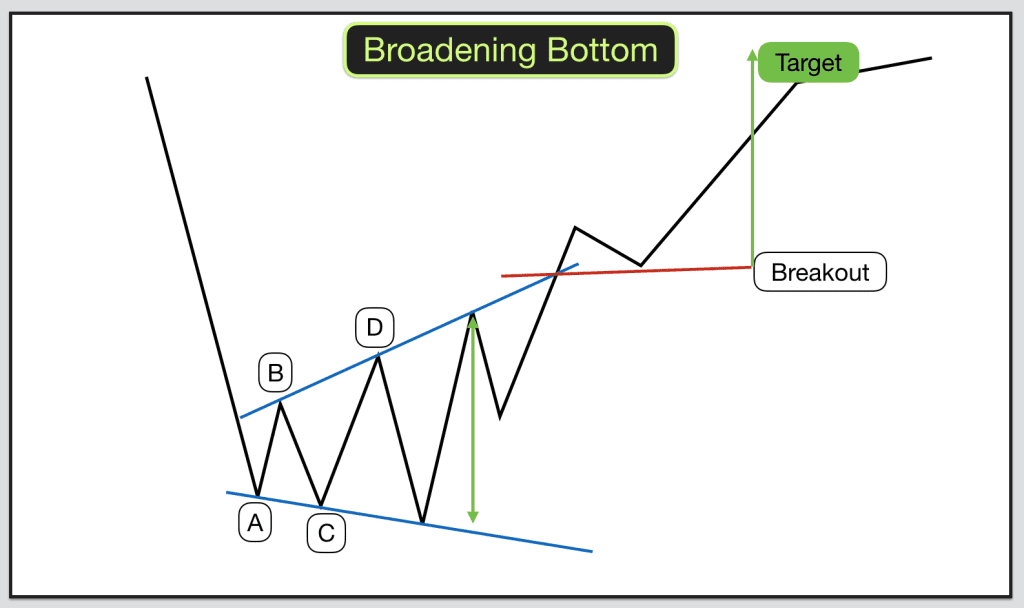

Breakout trading depends on identifying stocks that are expected to break out of their support or resistance levels, opening up significant opportunities to make profits. Swing traders can capitalize on breakouts by using chart patterns and technical analysis to identify when a breakout might occur and then invest in that stock or commodity accordingly. One way to identify a potential breakout is to analyze price pattern trends and look for stocks that are within a few percentage levels of their highs or lows for a given period of time.

When following this strategy, it is important to watch out for false breakouts. These are situations when the price breaks out from a support or resistance level but then quickly reverts back to that level. This is not a true breakout. Fortunately, there are ways to identify false breakouts. For instance, if a breakout is not accompanied by a suitable trade volume or confirmed by other technical indicators, it may lack momentum or conviction and could revert to pre-breakout levels. Traders should, therefore, seek multiple signals to confirm a breakout.

3. Simple Moving Averages: Find Potential Buy-Sell Signals

Simple moving averages (SMAs) are one of the most widely used technical indicators in trading. They are calculated using the average closing price of a stock or commodity over a certain time frame. Because of SMA’s simplicity, they facilitate ease of calculation and smooth out price data to help identify trends. SMAs can be calculated for specific periods, making them particularly well-suited to swing trading strategies. 50-day, 100-day, and 200-day moving averages are most commonly used by traders.

There are alternate indicators to SMAs that traders and analysts regularly use. Each indicator has its own strengths and weaknesses, and traders select them according to their specific use case.

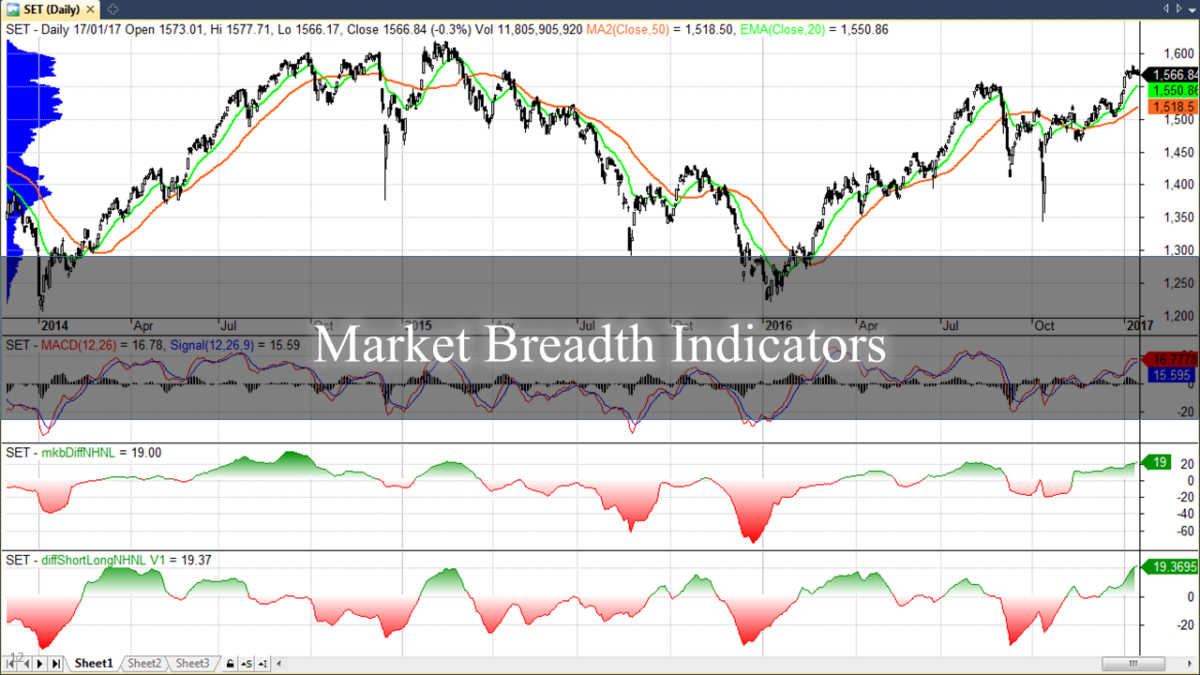

Some popular alternatives to SMA’s are Exponential Moving Averages (EMA), SMMA (Smoothed Moving Average), LWMA (Linear Weighted Moving Average), and Moving Average Convergence Divergence (MACD).

Moving averages can help traders gauge the price action of a stock and, therefore, decide when to enter or exit the market. To time profitable swing trades, it is crucial to understand prevailing market trends and the direction in which prices are moving, all of which moving averages can assist swing traders in identifying.

A rising moving average can hint at a rising price, while a falling average can signal the opposite. The right moving average indicator can, therefore, help you track swing stocks and find the right trading opportunity.

Become an Expert Swing Trader With Above the Green Line

With the right knowledge and tools, swing trading lets you harness gains from financial markets without making trading a full-time activity. Above the Green Line can help you get the most out of this stock trading strategy by refining your trading techniques according to time-tested rules that have proved successful in the market. Learn more about swing trading with Above the Green Line to get started.