09/24 /2016: Markets were up for the week, as the S&P 500 is going back up to re-test the August high of 2194. If the S&P 500 does not blow thru the August highs, the Markets could be in trouble. The NAZDAQ 100 made new Highs

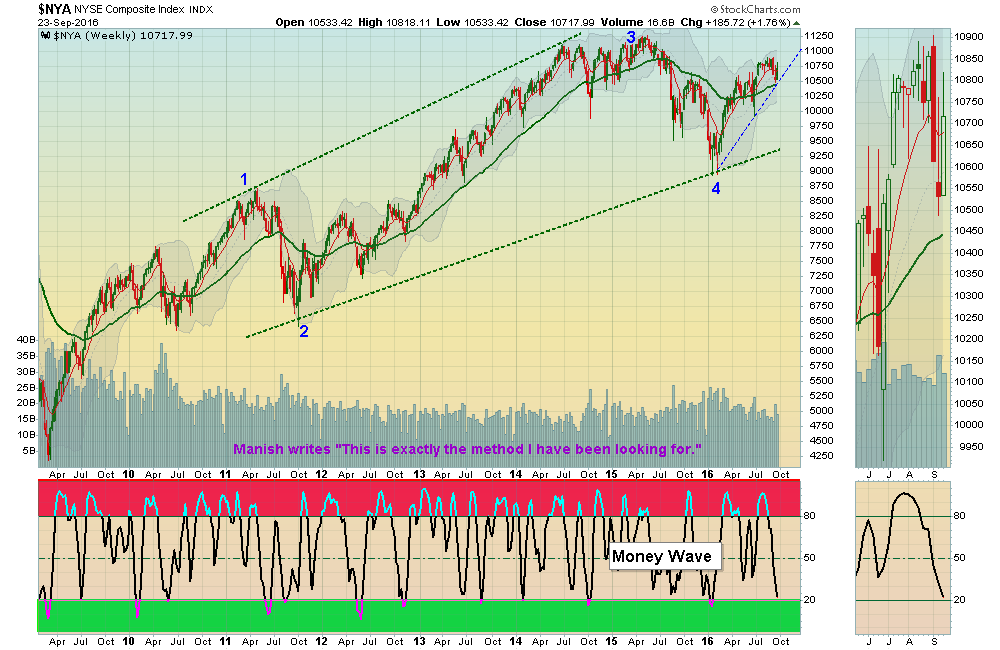

Last time the Markets went up to highs, Bonds were also making new Highs, and Interest Rates were on new Lows. Not this time, and Low Interest Rates seem to be keeping the Markets up. The New York Index, is making Lower High which could be a FAILURE, so we are being cautious. We are only doing Short Term Money Wave trades now, since this Bull is almost 8 years old.

When Commodities finally bottom after making a 13 year lows last year, Bonds should peak.

The Precious Metals popped this week on NO FED RAISE, and we were able to capture Gains on GDX AG PAAS EWZ CDE & SLV.

Oil did not perform and we stopped out of PE WPX & CLR for small losses. See Closed Positions.

Most Leading Funds are now in the Red Zones (probably too late to Buy for the Short Term). We will wait for Green Zone Buys, when Money Waves > 20 . We will email you when they are ready.

Charts for Leaders Watch List Page Current Open Positions

Alert! Market Risk High (Red Zone). The probability of successful Short Term Trades is lower, when the S&P 500 is Way Above the Green Line. Even the Strongest Funds can get chopped up. Either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

QUESTIONS: David asked “I noticed that a lot of the open positions have stops at the same price as the purchase vs “place at recent low (support)”. Can you clarify the stop strategy? Thanks!”

ANSWER: After the Money Wave is > 50, raise your Stop Loss to where you bought it. See RULES.