The market this week showed steady upward momentum as investors continued to lean into growth and momentum names despite mixed economic headlines. Broader sentiment was positive, with traders showing confidence in the market’s resilience even as interest rate expectations remained a key talking point. Volatility remained relatively muted, allowing selective stocks to push toward breakout levels.

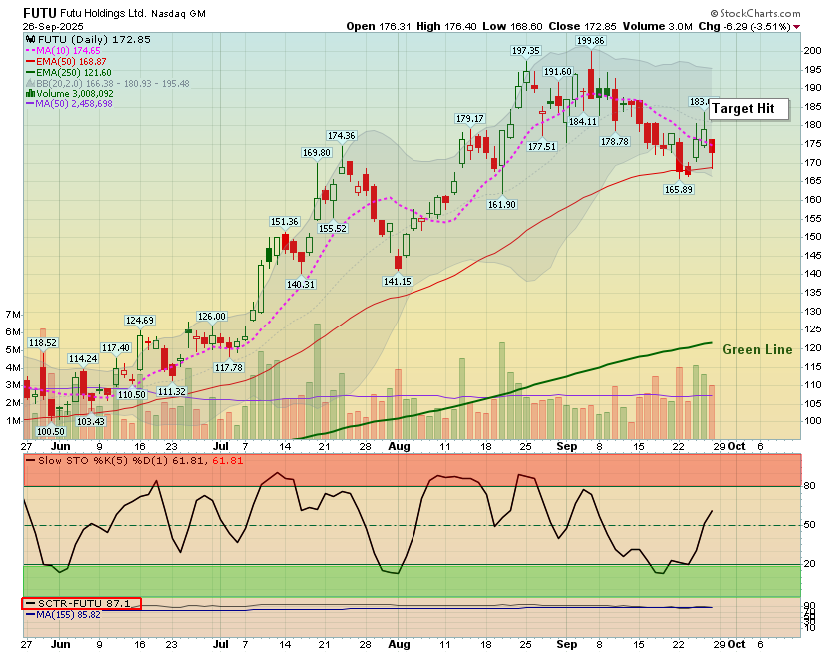

For our Top Pick of the Week (TPOW), we purchased FUTU at the open on Monday, September 22. The stock quickly gathered strength, and by Thursday, September 25, FUTU had reached our conservative 4% profit target, at which point we closed the trade. The disciplined exit aligned perfectly with our rules-based approach, securing gains while managing risk effectively.

Looking at the benchmark, the SPY ETF continued to climb but on a more modest trajectory compared to our strategy. SPY advanced steadily, reflecting the broad market’s constructive tone, but it trailed the sharper move we captured in FUTU. This highlights once again how the TPOW methodology is designed to identify high-probability trades that outpace the general market.

Since inception in October 2024, TPOW has achieved an impressive 77.22% return, far ahead of SPY’s 15.18% over the same period. With 44 trades completed — 29 wins and 13 losses — the system has demonstrated consistent edge. Notably, our current win streak has extended to four consecutive trades, underscoring the strength of our rules-based process.

As always, we remain focused on discipline, risk management, and following the rules that keep us Above the Green Line.