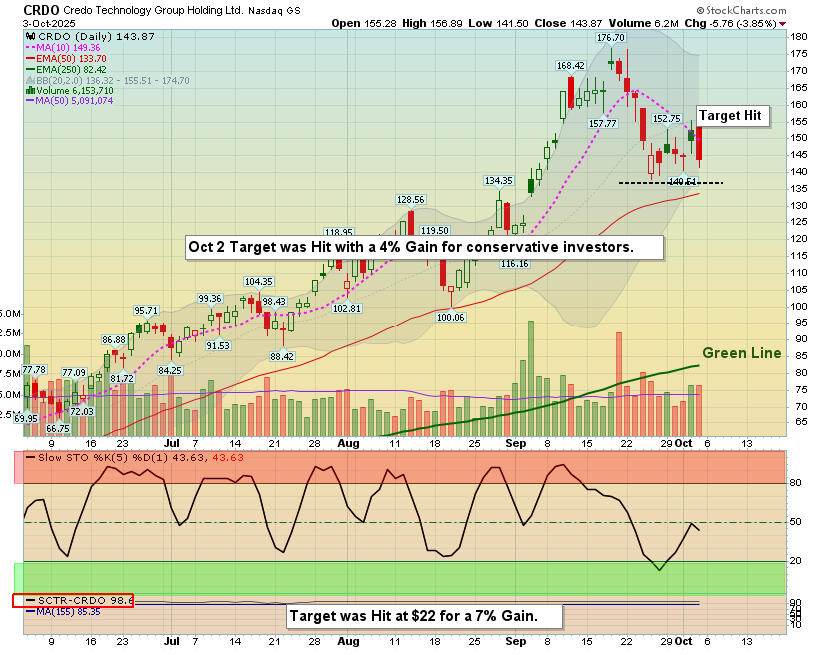

This week’s Top Pick of the Week (TPOW) was CRDO, which opened on Monday at $148.40 with a position size of 119 shares. The stock moved steadily higher, and by Thursday it had reached $154.39. At that point, we chose to sell early and secure a gain of just over 4%, consistent with our conservative exit target. While the strategy often calls for holding through Friday’s close or aiming for up to 8%, locking in profits when the conservative level is achieved mid-week is a key part of disciplined execution.

The broader market also performed well, with the S&P 500 and SPY extending their winning streak to new highs. SPY finished the week at 669.22, up modestly but continuing a trend of record closes. Technology once again led the advance, with semiconductors and AI-related names pushing higher. Investor optimism was supported by the prospect of Federal Reserve rate cuts, though the government shutdown delayed key economic data releases, leaving some uncertainty in the macro picture.

Despite the strong tape, there are still reasons for caution. Several indicators suggest growing confidence that can sometimes precede pullbacks, and analysts are watching closely for any signs of overextension. Financial stocks were in focus late in the week as Fair Isaac announced a new model allowing lenders to bypass traditional credit bureaus, sending its stock sharply higher while weighing on Equifax and TransUnion. Global markets also lent support, with optimism in Asia and easing U.S. Treasury yields creating a favorable environment for equities.

Overall, the week reinforced the strength of the current market trend while also reminding us of the importance of risk management. Exiting CRDO at a 4% gain may have left room on the table, but it demonstrated the discipline that keeps the TPOW strategy on track week after week. As we look ahead, the focus remains on finding stocks with strong momentum and technical breakouts while respecting exit rules and protecting capital. This steady, rules-based approach is what allows us to capture opportunity in strong markets without overreaching.

To understand why this weekly approach compounds differently than buy-and-hold investing, see Understanding Why Weekly Trading Works Long Term