TPOW Recap: EFA Breaks Out with Strong Global Momentum

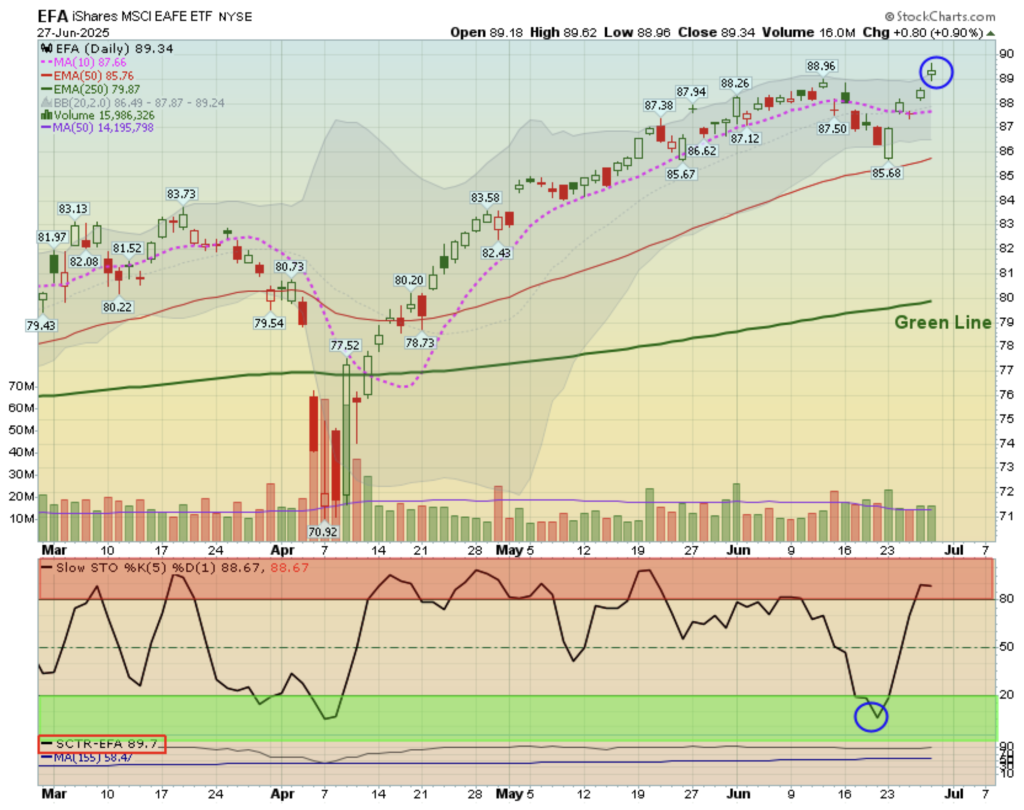

For the week ending June 27, 2025, the Top Pick of the Week (TPOW) was EFA, the iShares MSCI EAFE ETF. This ETF tracks large- and mid-cap equities across developed markets outside of the U.S. and Canada and was chosen based on its breakout above the Green Line, strong technical setup, and elevated relative strength.

EFA opened the week on Monday at $85.72 and showed consistent upside throughout the week, closing Friday at $89.34. This resulted in a gain of $3.62 per share, or a 4.22% return for the week. The move was supported by broad-based strength in international markets, particularly in Europe and Japan, as easing inflation pressures and stronger-than-expected economic data drove investor optimism abroad.

Meanwhile, the U.S. markets also posted moderate gains. The S&P 500 ETF (SPY) rose from $533.55 to $537.38, reflecting a 0.72% gain for the week. Investors remained focused on upcoming Fed commentary and earnings season signals, but domestic momentum lagged slightly compared to international sectors—making EFA a timely and technically sound selection.

This week’s trade once again underscores the value of the TPOW strategy in identifying high-probability setups that benefit from sector rotation and global trends. As always, our approach focuses on technical breakouts with confirmation from volume and strength indicators.

To view prior TPOW trades and weekly commentary, visit abovethegreenline.com/tpow.

We’re scanning now for the next opportunity—stay tuned for next week’s breakout pick.