How to make Money in a tired Stock Market.

The S&P 500 Index has had an incredible upward move since the 2009 Recession. This move up is historic in length and time (15 years). So far the S&P has made no Gains this year, as Stocks are expensive by most Historical measures. And to expect 20% annual Gains forever on the S&P 500 without another Recession is not realistic, historically.

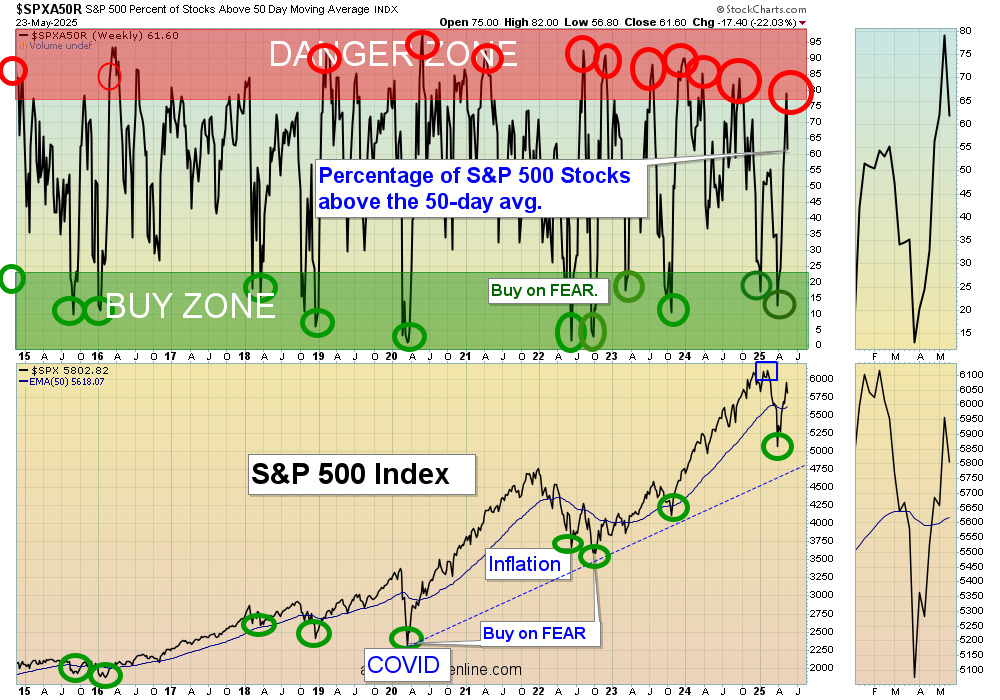

But once or twice most years a great Buying Opportunity occurs, where the Markets have Bad News “Fear Flushes”. The chart above dips down to the Green Zones where less than 25 % of all Stocks are still above the 50-day averages, and then we BUY! This System could be used for Retirement or 401k Plans that only offer a few Stock & Bond Fund options to choose from. This chart link is above is always on the Weekly emails, or is current by clicking here:

Rules:

- When Greed is High (FOMO), and the chart above is in the Red Zone, maybe MOVE your Stock Fund to Money Market (CASH).

- When Fear is High (FEAR FLUSH) and the chart is in the Green Zone, maybe MOVE your Money Market (CASH) back to Stock Fund.

It you had moved to CASH in February after the MAX FOMO Top, then you would have had CASH to LOAD UP and Buy during the April FEAR Flush down to the Green Zone. This could have resulted in a 20% Gain, and then you could spend the rest of the year in a Money Market Fund (CASH earning > 4%).