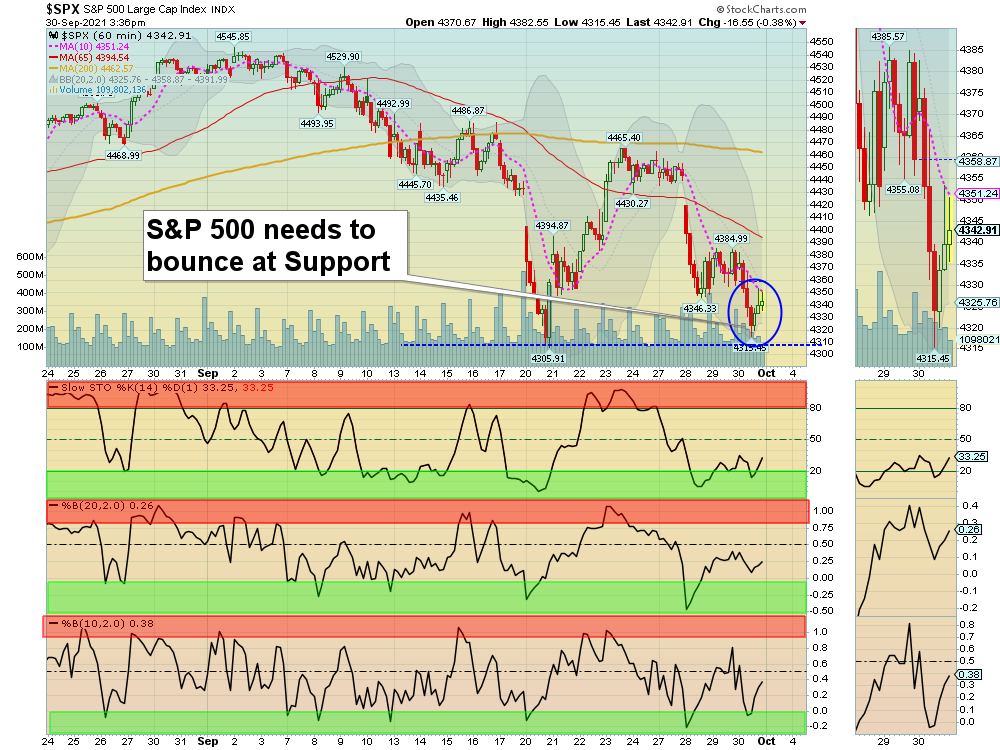

Markets were lower today as the S&P 500 Index went all the way back down near last week’s Low of 4306. Then some mild Buying came in on higher Volume. Now the S&P 500 Index needs to hold at last week’s Low, and then maybe we will see a “W” pattern back up to re-test the Highs.

Try to only Buy new money investments that hold above the Red Lines, as they tend to bounce first.

New Investors: Please realize that the Markets have Doubled since March 2020 Covid Lows. Smart Money is hesitant to Buy up near the Highs, as eventually the Indices will return back down to the Green Lines (on some Bad News). Maybe look into DAY TRADING SETUPS. The better trades happen when the S&P 500 Index is in the Green Zone.

Many great Triple Buys today for AMC (+15%) AFRM (+6%) BBIG (+11%) BTU (+11%) DNN (+9%) GSAT (+7%) NXE (+6%) & UUUU (+11%. Soon for BNTX CRVS IRNT SPY & OPAD in DAY TRADING SETUPS.

ETF SECTOR ROTATION SYSTEM END OF 3RD QUARTER – All 5 Positions will be Sold today on the Close, and then 20 % will be allocated to each of these 5 Funds at the Opening tomorrow (Oct 1st): XLF (Financial), XLE (Energy), SPY (S&P 500 Fund), IWM (Small Caps), & XRT (Retail Fund). Or you can simply SWAP SLV and XLI for SPY and XRT. Please try to have 20% in each Fund.

Bonds were down slightly today, and are back Below the Green Line.

Crude Oil was up $0.19 today at $75.01.

BUYS TODAY 9/30/2021

AMC AMC ENTERTAINMENT Tried to hold above the Pink Line around $39.41 today, but it was already up 15% and the Volume was not High. Maybe you bought early on the Jump Start. AMC will not be bought or logged. Maybe tomorrow around $37.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

_________________________________________________________________________________________________

JUMP START SCROLLING CHARTS: (Buy Signal should be very soon… Click on the Jump Start link for more info.)

MRNA MODERNA INC. Wait for Money Wave Close > 20 with High Volume.

NVDA NVIDIA CORP. Wait for Money Wave Close > 20 with High Volume.

ZS ZSCALER INC. Wait for Money Wave Close > 20 with High Volume.

XLRE REAL ESTATE FUND Wait for Money Wave Close > 20 with High Volume.

_________________________________________________________________________________________________

WATCH LIST SCROLLING CHARTS (Real Time)

DKS DICKS SPORTING GOODS Wait for Money Wave Close > 20 with High Volume.

LIFE ATRY PHARMA INC. Wait for Money Wave Close > 20 with High Volume.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

____________________________________________________________________________________________________________

SELLS TODAY NONE TODAY

Click for CURRENT POSITION SCROLLING CHARTS – Real Time (Please check and adjust your Sell Stops).

Click for CLOSED POSITIONS,

NEW: MY TRADING DASHBOARD

DAY TRADING SETUPS

NEW: TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

ETF SECTOR ROTATION SYSTEM

TOP 100 LIST Updated Sep 1, 2021

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.