Markets were lower today as there were few Buyers to be found. Some of the Leaders have gone slightly lower than on Tuesday, but most are still holding above the Red Lines (50-day avgs.) The decline has been very slow, which normally means that we should see a rally back up soon.

There have been several Money Wave Buy Signals this week, but most of them have popped up on weak Volume. We like to see Heavy Volume, to show strong Buying Conviction.

New Investors: The Leaders have bounced up out of the Green Zones for Money Wave Buy Signals, but the Buying is unusually weak. Normally we won’t see a big advance until the Volume picks up. The better trades happen when the S&P 500 Index is in the Green Zone (Like yesterday).

Triple Buys today on CHS (+4%), OCGN (+5%), & DVAX (+3.5%). Soon for ANY BBIG GREE GSAT & GSM in DAY TRADING SETUPS.

Bonds were lower today, but are Above the Green Line.

Crude Oil was down $0.62 today at $71.99.

BUYS TODAY 9/17/2021

DVAX DYNAVAX TECH Money Wave Buy today, but DVAX will not be Bought or Logged as the Volume is below average of 4.1 MIL.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

_________________________________________________________________________________________________

JUMP START SCROLLING CHARTS: (Buy Signal should be very soon… Click on the Jump Start link for more info.)

BBIG VINCO VENTURES INC. Wait for Money Wave Close > 20 with High Volume.

CHS CHICOS FAS INC. Buy above the Pink Line around $4.71 with High Volume with a 5% Trailing Sell Stop Loss below it.

_________________________________________________________________________________________________

WATCH LIST SCROLLING CHARTS (Real Time)

BTU PEABODY ENERGY Wait for Money Wave Close > 20 with High Volume.

GSM FERROGLOBE PLC. Wait for Money Wave Close > 20 with High Volume.

HUT HUT 8 MINING CORP. Wait for Money Wave Close > 20 with High Volume.

NEGG NEWEGG COMMERCE INC. Buy above $21.22 with High Volume with a 5% Trailing Sell Stop Loss below it.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE.

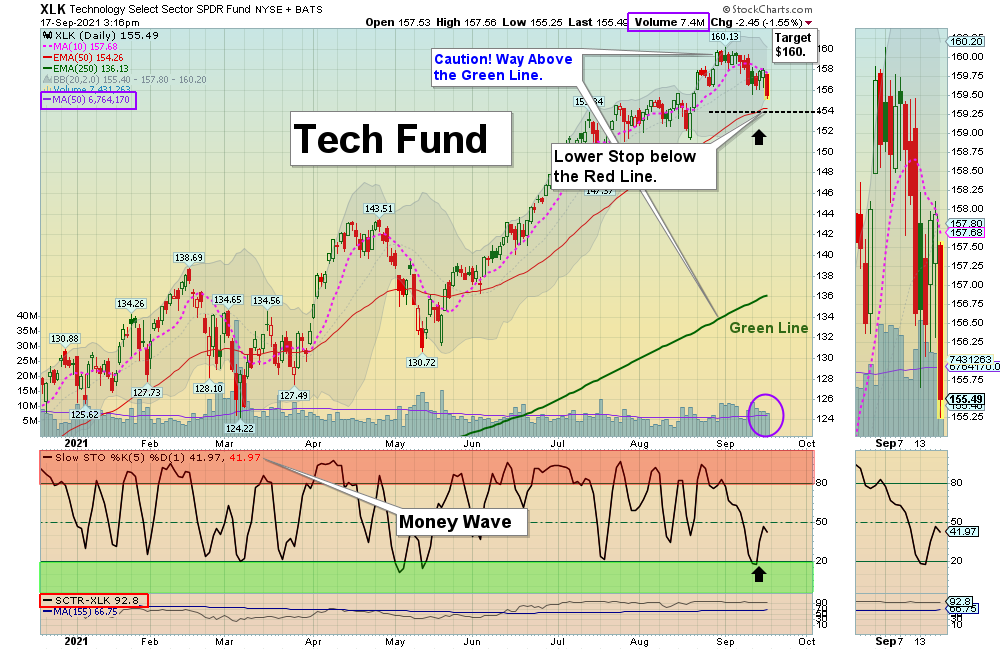

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

____________________________________________________________________________________________________________

SELLS TODAY

AA ALCOA CORP. EXIT if it is going to Close below the Pink Line around $48.26. The Target was already Hit.

M MACY’S INC. EXIT if it is going to Close below your Buy Price, or $21.64.

MRNA MODERNA INC. EXIT if it is going to Close below the Pink Line around $432.30. The Target was already Hit for a 12.8 % Gain.

NUE NUCOR CORP. EXIT if it is going to Close below Support of $105.82. This trade was not logged.

PXLW PIXELWORKS INC. EXIT if it is going to Close below your Buy Price, or $5.32. This trade was not logged.

QQQ NASDAQ 100 FUND LOWER the Sell Stop Loss below the Red Line of $368.69.

SPY S&P 500 FUND LOWER the Sell Stop Loss below the Red Line of $440.47.

XLK TECH FUND LOWER the Sell Stop Loss below the Red Line of $154.26.

Click for CURRENT POSITION SCROLLING CHARTS – Real Time (Please check and adjust your Sell Stops).

Click for CLOSED POSITIONS,

NEW: MY TRADING DASHBOARD

DAY TRADING SETUPS

NEW: TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

ETF SECTOR ROTATION SYSTEM

TOP 100 LIST Updated Sep 1, 2021

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

HAVE A NICE WEEKEND!