Markets were up slightly today after some Selling this morning. The Pink Line (10-day avg.) could be resistance for the Indexes for a while. Many are waiting to see if the Indices are going to Hold and Bounce at the Support of the October Lows.

If the S&P 500 can make a Higher Low or Double Bottom soon, we could see a “W” pattern for a much larger rally up.

Try to own only the Strongest Leaders that can hold above their Green Lines here, and then could see nice moves up.

Crude Oil was up $0.15 today at $51.75.

____________________________________________________________________________________

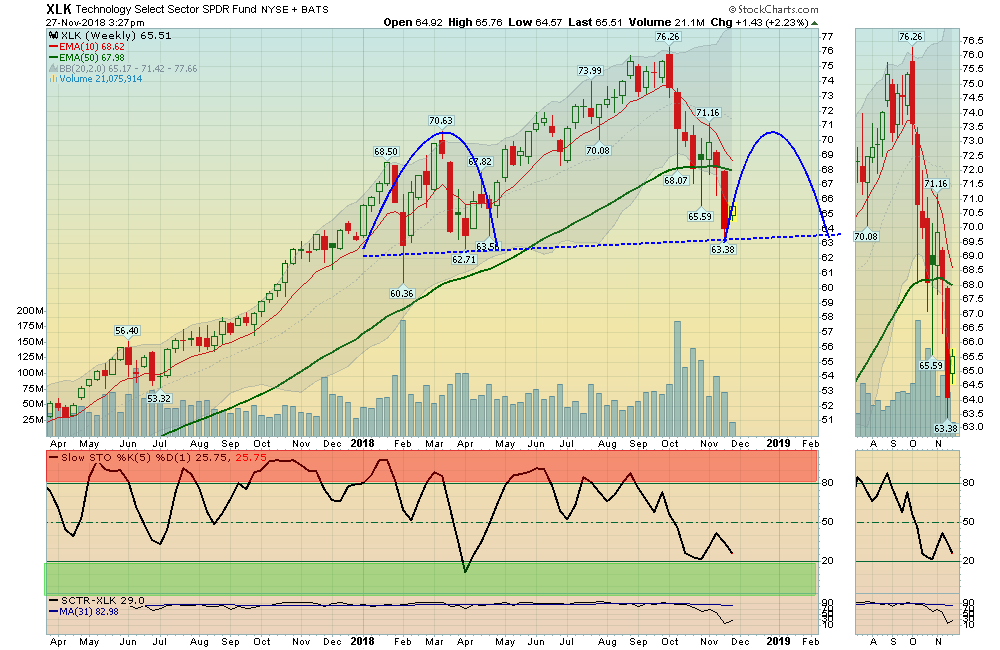

The Following Investments will probably have a Money Wave Buy Signal soon.

(Slow Stochastic Closing > 20) on today’s Close.

BUYS TODAY

XLP CONSUMER STAPLES FUND Money Wave Buy today. Target is $58.00. Place Sell Stop Loss below $54.42 on the Close.

Money Wave Buys Signals Soon:

AMD ADVANCED MICRO

SBUX STARBUCKS CORP.

XLU UTILITIES FUND Money Wave must Close in the Green Zone.

XLV HEALTH CARE FUND Money Wave must Close in the Green Zone.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Click on Watch List.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE. The Leaders are still Way Above the Green Lines (all Investments eventually return to their Green Lines).

______________________________________________________________________________________

SELLS TODAY

EXIT I INTELSAT GLOBAL (2nd Buy only) on the Close today, or have a tight Sell Stop Loss below it to capture a 9% Gain.

Change VKTX VIKING THERA. to Long Term (Sell Stop Loss Below the Green Line of $9.33) until it bottoms.

Please Check PORTFOLIO (Open Positions) and adjust your Sell Stops.

Click for CLOSED POSITIONS.

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days. We will “Not Log” trades if the Reward/Risk is not at least 2:1.