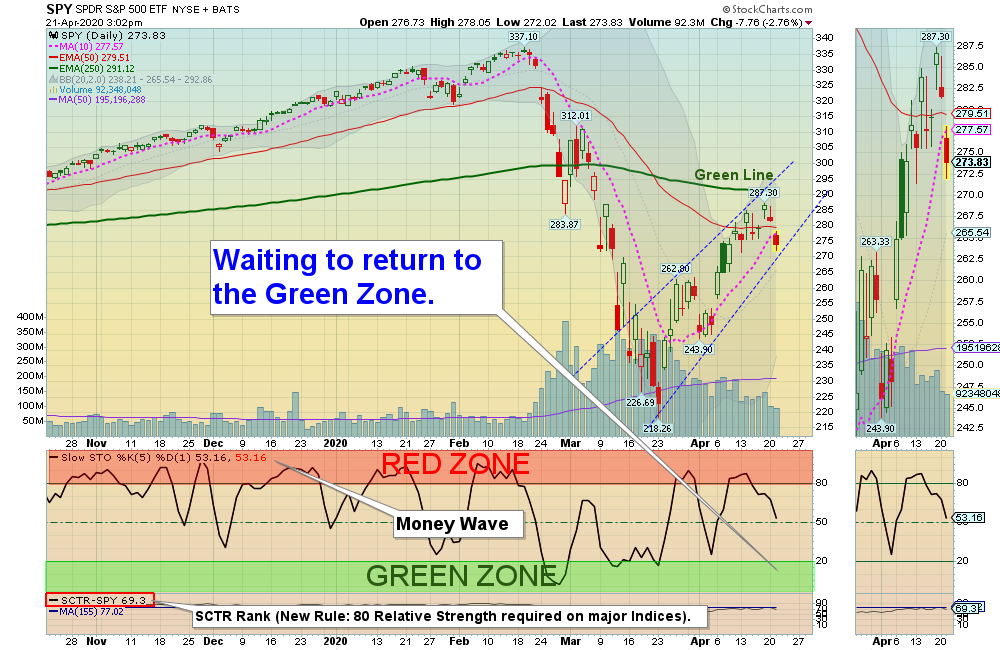

Markets were down again today on mild selling. The very strongest Leaders are holding above the Pink Lines to avoid Short Term Sell Signals, but the major Indices will probably close below the Pink Lines today. The S&P 500 Index needs to hold above the Pink Line (10-day avg.) around 2784.

So far the selling has been weak… Maybe another bounce coming. The weaker Indices like the Small Caps, Transports & NYSE could easily go back down once more. This rally from the Lows could be an A-B-C up on Elliott Wave count, and then maybe back down again. All of the major Indices except the NASDAQ 100 are still Below the Green Lines, which is Bearish.

NEW SUBSCRIBERS: The Green Line System has captured many nice trades from the recent March Lows. Be patient and WAIT for the S&P 500 Index and the Leaders to come back down and return to the Green Zones for more Money Wave Buys soon (it does not take that long).

Bonds were up today.

Crude Oil was down $6.90 today on the June contract at $13.47.

The Following Investments will probably have a Money Wave Buy Signal soon. (Slow Stochastic Closing > 20) on today’s Close.

BUYS TODAY 4/21/2020

DOG DOW INVERSE FUND Relative Strength is Below 90. ABORT.

UIS UNISYS CORP. Price is currently Below the Green Line and the Volume is below average of 1.2 MIL. ABORT.

VXX VOLATILITY FUND VXX Gapped Up above $43.72 today. VXX will not be logged as it is already up 10 % today.

We will “Not Log” trades if the Reward/Risk is not at least 2:1.

Money Wave Buys Signals Soon (Short Term): (Best to Buy these when the S&P 500 is also in the Green Zone.)

“JUMP START” Candidates: (Buy Signal should be very soon… Click on the Jump Start link for more info.)

_______________________________________________________________________________________________________________________________________________

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Click on Watch List.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

___________________________________________________________________________________________________

SELLS TODAY

QQQ NASDAQ 100 FUND Lower the Sell Stop Loss to the Red Line (50-day avg.) of $201.83.

TMUS T-MOBILE USA Lower the Sell Stop Loss to the Red Line (50-day avg.) of $85.32.

AAPL APPLE INC. EXIT if it is going to Close below the Pink Line of $275.70. AAPL should be back down in the Green Zone soon, so you might want to hold on if you are longer term. This trade was not logged.

NVDA NVIDIA CORP. EXIT if it is going to Close below the Pink Line of $276.97. This trade was not logged.

Click for PORTFOLIO (Open Positions) and adjust your Sell Stops.

Click for CLOSED POSITIONS,

NEW ETF SECTOR ROTATION SYSTEM (LINK)

NEW! TOP 100 LIST Updated Mar 31, 2020

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1.

Related Post

– Bonds