Markets “Gapped Up” today on hopeful News, but the Volume was low. The S&P 500 Index is back above the Red Line (50-day avg.) but the Buying was average. The Markets should hold up OK until they break the Pink Lines (10-day avgs.) Most of the Leaders are currently over-bought for the Short Term. All of the major Indices except the NASDAQ 100 are still Below the Green Lines, which is Bearish.

The Reward / Risk of Buying up here is not good now, so we are slowly taking profits. The weaker Indices like the Small Caps, Transports & NYSE could easily go back down once more. This rally from the Lows could be an A-B-C up on Elliott Wave count, and then maybe a “W” pattern back down again. Wait for the Leaders to return to their Green Zones (it does not take that long). The Watch List is very small… WAIT.

NEW SUBSCRIBERS: Please realize that the DOW 30 Index has just rallied up 5800 points (or 30% from the March Lows) and is still Below the Green Line. That is NOT GOOD. The Green Line System has captured many nice trades from the recent Lows, but now we have to WAIT. Be patient and WAIT for the S&P 500 Index to come back down from the Red Zone and return to the Green Zone for more Money Wave Buys.

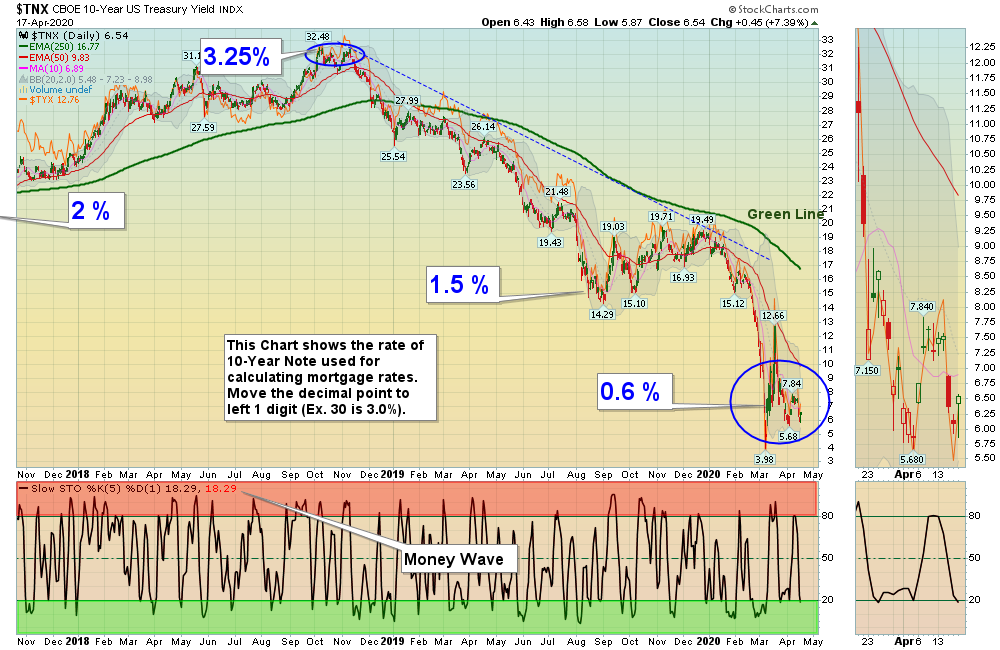

Bonds were down today after Stocks rose.

Crude Oil was down $1.81 today at $18.06, a New Low.

The Following Investments will probably have a Money Wave Buy Signal soon. (Slow Stochastic Closing > 20) on today’s Close.

BUYS TODAY 4/17/2020 NONE TODAY

Money Wave Buys Signals Soon (Short Term): (Best to Buy these when the S&P 500 is also in the Green Zone.)

“JUMP START” Candidates: (Buy Signal should be very soon… Click on the Jump Start link for more info.)

_______________________________________________________________________________________________________________________________________________

VXX VOLATILITY FUND Buy if it Closes above $43.72 on High Volume.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Click on Watch List.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

___________________________________________________________________________________________________

SELLS TODAY

PLUG PLUG POWER INC. EXIT on the Close today, or have a tight Sell Stop Loss below it. We bought the first position too early, and it has rallied 45 % from the April Lows. Need to get in sync with the cycles.

TLT US GOV’T BOND FUND EXIT if it is going to Close below your Buy Price, or $168.18. This trade was not logged.

Click for PORTFOLIO (Open Positions) and adjust your Sell Stops.

Click for CLOSED POSITIONS,

NEW ETF SECTOR ROTATION SYSTEM (LINK)

NEW! TOP 100 LIST Updated Mar 31, 2020

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1.

HAVE A SAFE WEEKEND!