Could the US stock market be teetering on the brink of collapse like a precariously stacked house of cards? Understanding the forces that govern market fluctuations is critical as investors navigate uncertainty and seek to secure their financial futures. With historical stock market crashes providing cautionary tales, the current landscape calls for a closer examination.

Recent trends show increased volatility and shifting investor sentiment, provoking questions about the long-term stability of the US stock market. Public perception plays a vital role in shaping market movements, and the influence of external factors, including Japan’s monetary policy and carry trade practices, adds another layer of complexity to the equation.

In this article, we will delve into both historical precedents and contemporary dynamics, assessing key players like Berkshire Hathaway and evaluating the associated risks. This comprehensive approach aims to provide a clearer understanding of whether today’s market truly stands on solid ground or if it resembles a fragile framework waiting to unravel.

Understanding the Stock Market

The US stock market is a complex network where derivatives play a pivotal role. These financial contracts are based on the value of underlying assets, such as stocks, bonds, and indexes. The interconnectivity of these instruments demonstrates the sophisticated dealings within the market ecosystem. A notable driver of market volatility is the prevalence of computer-driven trading, where algorithms respond to minute changes in price, causing swift stock value shifts.

Amidst this dynamic environment, geopolitical tensions and government fiscal policies are garnering attention from the financial community as serious factors that could undermine the stock market’s stability. Notable investors suggest that such events may pose a considerable destabilizing threat to the market’s future gains.

For individuals looking to navigate such uncertain waters, diversification is key. A spread of investments across different asset types can provide a buffer against specific sector downturns. However, analysts are voicing concerns that the market may be riding a high wave of overvaluation. An impending correction, they suggest, could be precipitated by rising interest rates, which investors should closely monitor.

Bear in mind that investment approaches can be diverse, and each strategy carries its unique set of risks and rewards.

Definition of a stock market crash

A stock market crash is a dramatic and swift decline in share prices, occurring unexpectedly after an upward trend. Often, such events are fully understood only in retrospect, making it difficult to predict or react appropriately in real-time. The aftermath of a stock market crash can be an environment rich with opportunities—for example, acquiring undervalued stocks or employing tax strategies such as Roth IRA conversions.

Historical examples of stock market crashes

Throughout history, the stock market has experienced catastrophic failures. The 1929 crash is a prime example, where economic contraction and mass hysteria culminated in a devastating Great Depression. It obliterated 80% of the market value, with recovery spanning over two decades. 1987’s Black Monday saw a 25% drop due to nascent computerized trading and investor panic, a fall that spectacularly rebounded within a mere two years thanks to new regulations. March 2000 marked the burst of the Dot-Com Bubble, a culmination of rampant speculation in internet ventures. Fast forward to August 5, 2024, a crash is drawing comparisons to these historic plunges, echoing the reactive nature of the market to recession fears, reminiscent of the 1987 collapse. Fortune magazine referred this crash as a “stock bloodbath.” The world’s 10 richest billionaires lost $45 billion of wealth in one day. However, it is essential to note that while the stock market is cyclically volatile, crashes of the magnitude seen historically are a rare occurrence.

Current State of the US Stock Market

The current landscape of the US stock market appears nuanced and complex, bearing the significant influence of Federal Reserve interventions, especially during the 2008 financial crisis and the COVID-19 pandemic in 2020. While these actions have been pivotal in staving off a collapse of the financial system, they have also contributed to the narrative that the market operates heavily on derivatives, weaving a tapestry of complexity and potential frailty suggestive of a house of cards.

Contrary to common belief, historical periods of high interest rates have not necessarily forestalled stock market expansion. During the dot-com bubble’s crescendo in the late 1990s, the Nasdaq index soared by an extraordinary 450%, despite the 10-year treasury yield averaging a robust 6%. This serves as an illuminating counterpoint to simple assertions that high bond yields uniformly depress stock market vitality.

In current markets, investor behavior has emerged as a paramount factor, frequently outpacing interest rate movements in influencing market dynamics. Reflecting this shift, the MSCI Japan Index’s meager annual growth of 2% since 2000, alongside consistently low interest rates, exemplifies the disconnection between cost of borrowing and equity market performance. Such observations underscore that more than just macroeconomic policy, a confluence of factors, including psychology and strategy, play pivotal roles in financial market behavior.

Recent trends and volatility

As of August 2023, stock market volatility, as measured by the VIX index, hit its highest mark since the COVID-19 pandemic, signaling heightened investor apprehension amidst fluctuating economic indicators. This unease manifested in stark terms during the significant market drops of that month, marking the most severe plunge since the pandemic inception. On a particularly tumultuous day, the world’s wealthiest experienced staggering losses, with the 10 richest billionaires seeing a collective erosion of $45 billion in net worth, an event covered extensively by Fortune magazine as a “stock bloodbath.”

This turbulence has invited comparisons to historical market downturns, calling into question the stability and longevity of the current bullish market cycle and igniting debates over whether the US stock market is on the precipice of a crash comparable to those seen in prior epochs.

Investor sentiment and public perception

The concentration of U.S. stock ownership underscores a stark divide: 93% of stocks reside in the portfolios of the wealthiest 10% of investors, sharply delineating wealth inequality in market participation. Yet, the narrative expands beyond the investor aristocracy, with 58% of Americans involved in the stock market through mechanisms such as private pensions and 401(k) plans, revealing a deep societal linkage to market fortunes for retirement security.

Public perceptions remain fluid and are particularly susceptible to the ripple effects of elections, which sway investor confidence and conjectures over market resilience and prospects of asset recuperation. Historical patterns of low interest rates and government interventions bolster the notion that market shifts are driven more by collective investor sentiment than by interest rates on their own.

Amidst downturns, investor sentiment wavers, spawning self-doubt and precipitating hasty decision-making. This underscores the incalculable value of expert financial advice in steering investors towards informed, long-term strategies that align with individual risk tolerances and life goals.

Japan’s Low-Interest Rate Environment

Japan’s low-interest rate environment has long been a point of interest for global investors and financial strategists. Spearheaded by the Bank of Japan’s policy to kickstart its nation’s economy, this approach has profoundly influenced the flow of capital across markets, particularly in high-dividend yielding stocks and assets offering the potential for substantial price gains. In much the same way as the US has embraced a zero-interest rate policy, Japan’s strategy operated independently of the traditional economic cycle of production and consumption. This has inevitably led to a cascade of funds pouring into various asset classes, from equities to real estate and bond markets, chasing higher returns.

The monetary policy that underpinned these movements in Japan is not unfamiliar to many arbitrageurs in the United States. This alignment points to a larger global trend where the profit motive, driven by interest rate differentials, outweighs the traditionally slower gains of the real economy.

However, the pivot away from a protracted era of low-interest rates, should it occur in Japan, may upend the current dynamic. This shift could reverberate profoundly, not only across Japanese financial markets but also globally, as investors adjust to a new paradigm of increased borrowing costs and recalibrate their exposure to various asset classes.

Overview of Japan’s Monetary Policy

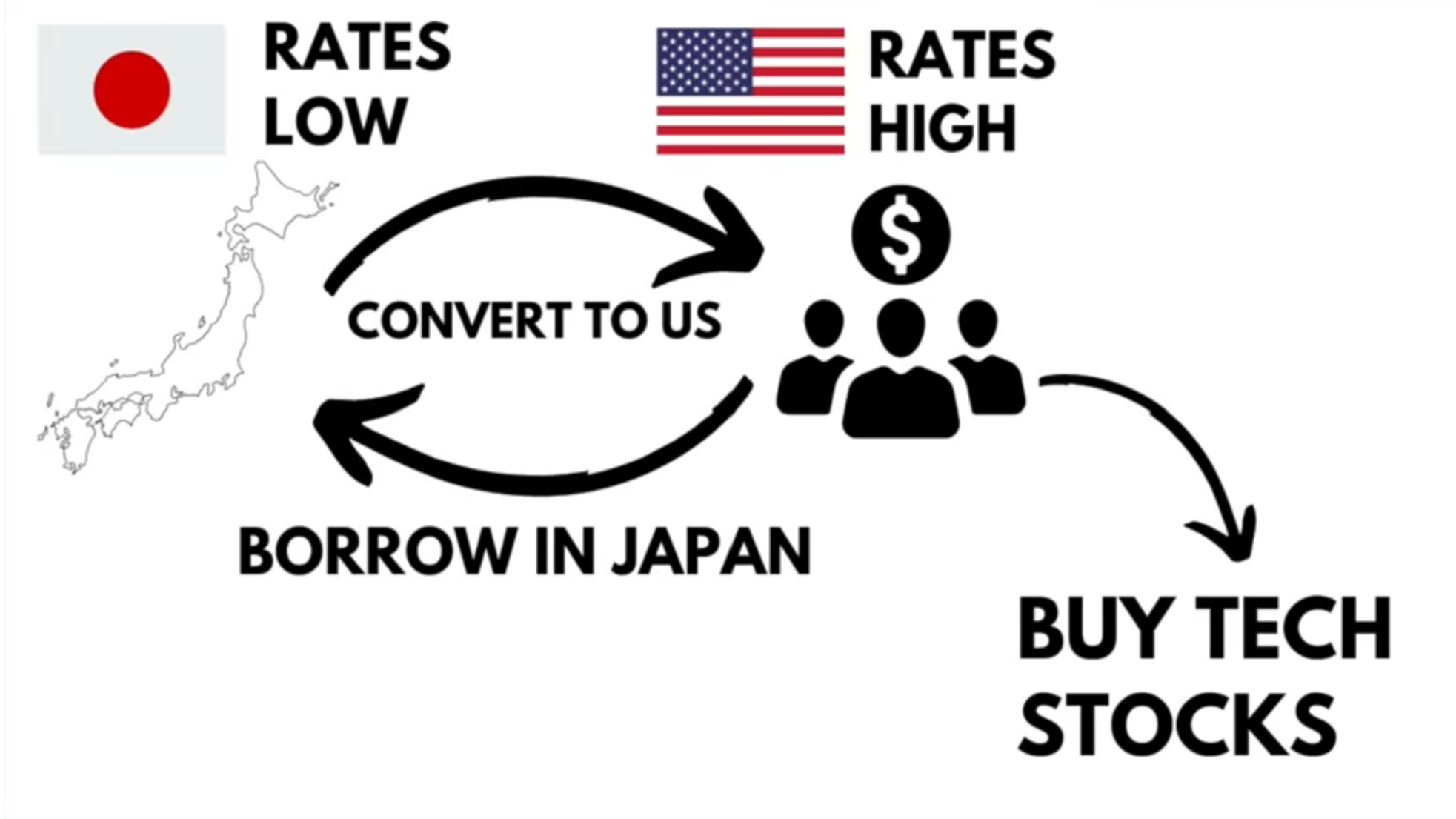

Japan’s monetary policy, characterized by historically low interest rates, has been a catalyst for strategic investment patterns across the globe. One strategy that has thrived in this environment is the yen carry trade. This practice capitalizes on the differential between the interest rates set by Japan’s central bank and those set by the Federal Reserve in the United States. Investors leverage this spread to secure inexpensive yen loans which are then converted into higher-yielding assets elsewhere, often in the U.S.

This delicate interest rate balance is now poised for change. As the Japanese central bank contemplates raising rates, the very foundation of this decades-long policy is shifting, carrying potential ramifications for economies and markets internationally. The Japanese equities market has already felt the tremors of this policy change, as seen in the drops within the Nikkei index, signaling investor discomfort and the recalibration of risk appetites.

Carry Trade: Borrowing Yen to Invest in FAANG Stocks

Investors harnessing the yen carry trade have historically favored borrowing Japanese yen to capitalize on low interest rates and investing the proceeds in more lucrative markets. U.S. assets, particularly FAANG stocks (Facebook, Apple, Amazon, Netflix, Google), have been a popular target given their potential for high returns.

This carry trade strategy hinges on the interest rate differential maintained by Japan and the U.S. When Japanese interest rates remain low, and the U.S. provides fertile ground for higher returns, the trade flourishes. However, this mechanism is stress-tested when Japan’s interest rates start to climb, as they are now. The pressure to service the increasing debt costs can precipitate a correction in markets, with the Nasdaq and other U.S. indices vulnerable due to their heavy tech stock weighting.

As investors recalibrate their positions and manage their exposures, volatility is a natural outcome, with broader implications for the financial markets.

Risks Associated with the Yen Carry Trade

The yen carry trade, despite its widespread use, is not without risks. The initial appeal lies in leveraging Japan’s low-interest rates for investment in higher-yielding U.S. assets. Yet, the landscape changes dramatically when Japan’s central bank tightens monetary policy. Rising interest rates in Japan make the cost of borrowing more expensive for carry trade investors. Consequently, they may face a global margin call, which requires additional collateral to maintain their positions.

This unwinding of the yen carry trade can lead to significant downturns in indices such as the Nasdaq, a barometer heavily influenced by the performance of tech stocks. The profitability, and indeed the sustainability, of the yen carry trade, rests on the intricate seesaw of interest rate differentials between Japan and the U.S. – a seesaw that is currently in flux, bringing with it newfound uncertainty and investment risk.

The Role of Berkshire Hathaway’s Cash Reserves

Amidst a shifting financial landscape, investors grow wary of the increasing real cost of equity and gravitate towards the less risky debt securities. This trend is closely observed by Berkshire Hathaway, whose significant cash reserves prove to be more than a conservative standby but a strategic tool of resilience and opportunity in the face of market turbulence.

Liquidity is a paramount consideration for investment giants like Berkshire Hathaway. Particularly when recalling financial catastrophes—such as the Lehman Brothers’ fall—the value of cash reserves becomes apparent, offering a shield against shocks and fodder for opportunistic acquisitions in downturns. This strategy dovetails with the advice given to individual investors: maintain a cash reserve to mitigate downside risks.

The liquidity challenge is also evident in the case of pension funds straining to fulfill promises to pensioners, a situation that echoes Berkshire Hathaway’s insistence on maintaining significant cash for strategic maneuvers. In summary, the conglomerate’s approach of building cash reserves is a studied posture, preparing them to withstand and capitalize on the market’s vicissitudes.

Overview of Berkshire Hathaway’s Investment Strategy

A strategic move unfolded at Berkshire Hathaway as it halved its stake in Apple, a decisive step for one of its largest investments. Prior to this reduction, a substantial $174 billion allocation in Apple exhibited the company’s stake at around 6%—a testament to its significance in Berkshire’s portfolio.

This substantial divestment, set against a backdrop of broader market volatility, especially in technology stocks, signaled Berkshire Hathaway’s attuned reaction to fluctuating market circumstances. Coinciding with Black Monday, this decision portrayed a proactive risk management style amidst the uncertain market milieu.

Overall, Berkshire Hathaway’s investment pattern has been marked by hefty technology bets, as its prior substantial Apple commitment demonstrates. The shift in its investment strategy highlights a broader narrative of agility and the ability to pivot in response to market context.

Implications for the US Stock Market

The US stock market’s fragility has its roots in several historical and current dynamics. The 2008 financial crisis, fed by the upsurge of the subprime mortgage market, is a stark reminder of the foundational role of real economic phenomena in triggering market disruptions.

Beyond the echoes of the past, the S&P 500 constituents’ revenue exposure to international markets renders stock prices vulnerable to global currency shifts, suggesting a direct link between foreign exchange and market valuation. In a more contemporary context, the struggle for healthy market growth persists even amidst low-interest rates, pointing to the influence of wider factors, including investor sentiment.

In times of crisis, the Federal Reserve’s role has been central to market stabilization—acting as the lender of last resort. However, there remains a distinct concern regarding the market’s stability based on financial derivatives’ prevalence. These instruments, reliant on underlying asset performances, hold potential for systemic risks if mismanaged, emphasizing the criticality of prudent oversight.

Warren Buffett’s Market Perspective

Warren Buffett’s investment philosophy reveals a shrewd awareness of market anomalies. His approach of exiting a market likened to a Ponzi scheme underscores the importance of precise timing in mitigating investment risks. Buffett’s scrutiny extends to firms lacking dividend payouts or profit generation—often seen as harbingers of an unstable market undercurrent.

With the AI sector’s growth trajectory coming into question due to geopolitical complications with China, Buffett’s caution resonates with investor sentiment. Contrarily, his positive view on American companies, focused on domestic sales, appears to reflect a strategy well-suited for an environment of global currency weakening.

Buffett’s veteran counsel speaks to a long-term investment horizon, suggesting that steadfastness in the face of market fluctuations can yield rewards, albeit complemented by strategic short-term allocations in more conservative assets where suitable. This blend of foresight and flexibility shapes Buffett’s celebrated market perspective.

Risks Associated with the Current Market

The US stock market finds itself navigating a labyrinth of risks that have heightened apprehensions about its stability and future. Wall Street investor Paul Tudor Jones epitomizes the sentiment of market skepticism, indicating that geopolitical tensions and the federal government’s fiscal habits are contributing to a pessimistic outlook for US stocks. Such tensions, combined with a decelerating economy, are prompting uncertainty among investors. Economic growth that has slowed from an impressive 4.4% in 2022 to an anticipated 3.6% in 2023 serves as a sobering reminder of the market’s fragility.

Concern mounts as the Federal Reserve’s balance sheet, once less than $1 trillion in 2008, swells to a colossal $9 trillion. This extraordinary expansion feeds into anxiety over the longevity of the stock market’s upward trajectory. The perception that the stock market’s fortunes are increasingly tied to the whims of the Fed has led to comparisons of the market to a house of cards. Investors are cautioning that this delicate structure is at risk, with central bankers echoing warnings of a potential correction amidst the broader economic climate’s risks and recessionary threats.

Inflation Concerns

In the realm of financial markets, inflation looms like an ever-present shadow over the economic landscape. The Federal Reserve, in a balancing act of historic proportions, has elevated interest rates with the intent to curb the encroaching inflation. The consequences of higher interest rates reverberate across the economic spectrum, stoking fears of unemployment hikes that could herald a recession, planting the seeds of trepidation in the stock market.

The International Monetary Fund (IMF) has cast a stark light on inflation’s impact by downgrading global economic growth projections to 3.6%. Inflation, apart from straining consumer wallets, has contributed significantly to asset price inflation, encompassing stocks, bonds, and even housing, often culminating in pronounced capital gains. This inflationary influx, subject to the whims of economic indicators and policy shift reactions, has rendered the stock market susceptible to sharp and unpredictable movements.

Geopolitical Tensions

Another layer of complexity is added to the stock market’s challenges with the escalation of geopolitical tensions, a dynamic that hedge fund manager Paul Tudor Jones believes could cast a long shadow over US stocks. Understanding the intersection of global events and financial markets is critical, as increased geopolitical risks can instigate shifts in government expenditure, potentially undermining investor confidence and destabilizing the market.

Mainstream media discussions on economic factors frequently overlook the importance of a long-range view and often do not include geopolitical context in their analyses. This oversight bypasses the nuanced understanding of how international disputes can shape market conditions and could have lasting consequences on the health of stock performance and the broader economy.

Conclusion: Assessing Market Resilience

When considering the health of the U.S. stock market, it is crucial to assess not just the potential for dramatic declines, but the system’s overall resilience. Investors well-versed in the history of stock market crashes understand that market volatility can yield systemic issues. Looking back, periods of pronounced growth frequently preceded sharp declines, such as the ones in 1929 or more recently in 2008. This has led to concerns that the current period of fast-paced growth could be setting the stage for a correction, especially as valuations are perceived by some as being overstated.

Rising interest rates have emerged as a key concern, potentially triggering a correction by increasing borrowing costs and putting pressure on both consumer spending and corporate profits. Nonetheless, for individual investors, trying to predict the exact timing of a market downturn is an unreliable strategy. Instead, focusing on building resilient, diversified portfolios and maintaining a long-term investment stance can serve as a more effective bulwark against such uncertainties.

Comparing the current market to historical precedents

To appreciate the present conditions of the stock market, it’s instructive to compare them with historical precedents. Since the financial crisis of 2008, the stock market has seen significant growth, riding in part on the expansion of the Federal Reserve’s balance sheet from less than $1 trillion to nearly $9 trillion. However, historic market crashes, like the 1929 crash, or Black Monday in 1987, resulted from a mix of a contracting economy, panic among investors, and technical issues, with recoveries taking from a couple of years to several decades.

Though comparisons between today’s market and these historical events can be alarming, parallels aren’t predictions. Some analysts believe the market is currently undervalued, even as concerns arise about rising interest rates prompting a market correction. The analogy to a house of cards considers the fragility inherent in rapid price growth unsupported by traditional price discovery mechanisms – a worrisome warning for the wary investor.

Final thoughts on market stability versus fragility

The landscape of the U.S. stock market showcases a dichotomy of views. On one side, the S&P 500 index reaching record highs sparks optimism about the market’s strength, while, on the other side, analysts warn of overvaluation, conjuring fears of a looming correction. Rising interest rates are part of this dialog, as they could tip the balance towards market fragility by making borrowing more expensive.

Moreover, institutional dynamics complicate the picture. For example, U.S. pension funds’ reliance on stock market performance, paired with their inadequate funding, pushes them towards riskier endeavors like private equity in search of yield. These moves underscore a fragility within retirement financing itself.

Lastly, currency strength plays a discreet yet profound role in market stability. The relative power of the dollar influences investor behavior and impacts global economic conditions, thus adding another layer of complexity to the construct of market stability.

In sum, while the architecture of the stock market might exhibit signs of instability, its resilience is also evident in its capacity for recovery and adaptation. As always, thorough analysis, expert advice, and prudent, diversified investments appear to be the safest route forward for those navigating the dynamism of financial markets. Join Above the Green Line today.