Is Swing Trading The Best Strategy For You?

What Is Swing Trading?

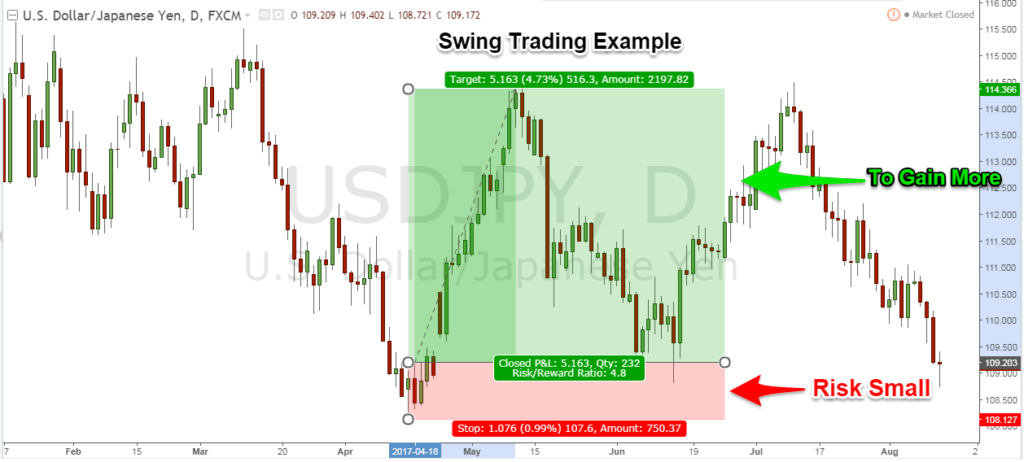

Swing trading is a trading style that broadly describes a plethora of short term trading strategies that are ultimately designed to capture gains from a financial instrument. Most commonly exemplified with stocks, swing trading involves purchasing a security and holding onto it for anywhere between a few days to a few weeks. The time frame for swing trades is what drastically differentiates this form of trading from the long term buy-and-hold strategy. Many investors who choose to engage in swing trading inform their decisions utilizing aspects of technical analysis; though, for some investors, additionally employing fundamental analysis can also be beneficial.

The goal of swing trading is to capture a sizeable profit from short term price movements. Thus, depending on the investor’s chosen strategy, investors typically purchase stocks that exhibit various levels of volatility stocks and as such experience quick price fluctuations. Stocks with higher levels of volatility experience quicker price fluctuations and thus tend to be shorter holdings. On the other hand, stocks with lower levels of volatility experience slower price fluctuations and as such tend to be longer swing trade holdings. However, it is important to note that these price fluctuations are not always to the benefit of the investor. Therefore, perhaps the most crucial component of swing trading is an investor’s careful analysis of the stock itself. A precise analysis of a stock aids investors in predicting the likely direction of its price movements as well as the length of time an investor can expect to hold their shares.

Is Swing Trading Right For You?

As of recent, due to increasing technological developments that have given way to online trading platforms, swing trading has become more accessible and more popular among investors. However, its accessibility and popularity do not signify that this trading strategy is beneficial for all. In fact, some would argue that overall swing trading does more harm than good to its participants. Determining whether or not swing trading is right for you all depends on your personality, your lifestyle, and the amount of time you have to dedicate. There is an abundance of information available to investors to guide them through the prospect of swing trading; let’s examine some of the pros and cons together.

Pros

Swing trading has become popular for many investors due to its ability to capture profits from market swings. In other words, traders can maximize their profits in a shorter amount of time rather than waiting for long term investment profits. Swing traders also usually only employ technical analysis for examing potential short term trades, which shortens the time commitment to their investment compared to others that utilize more forms of analysis. For investors who enjoy short term returns and active participation, swing trading can be appealing; for many, it is more appealing than day trading which requires investors to glue themselves to their computers.

Cons

Swing trading comes with a fair amount of risk: the investments are subjected to overnight and weekend risk and at any time can experience abrupt reversals that ultimately may result in a substantial amount of loss. In addition to the level of risk associated with swing trading, there is much evidence to suggest that opting to swing trade rather than buy-and-hold actually hurts your long term performance. Brad Barber and Terrence Odean of the University of California conducted a well-known study that analyzed the returns of over 66,000 households. They discovered that those who traded frequently earned an average annual return of 11.4%, while those who did not earned an average of 16.4%.

Conclusion

For many investors, swing trading is a fun activity that requires a sufficient amount of attention and expertise yet still is not entirely consuming. With the right skills and knowledge, an investor may find themselves successful at swing trading and quickly accruing profits. However, it comes with many risks and does not guarantee profitability. Further, the chances of significantly losing a trade are quite high. As previously stated, a trader’s success lies in their ability to analyze themselves, to question if swing trading suits their lifestyle, personality, and time availability. So if you’re thinking about day trading, be sure to be honest with yourself and realistic with your goals. And if you decide swing trading is for you, check out our swing trading page for more information.