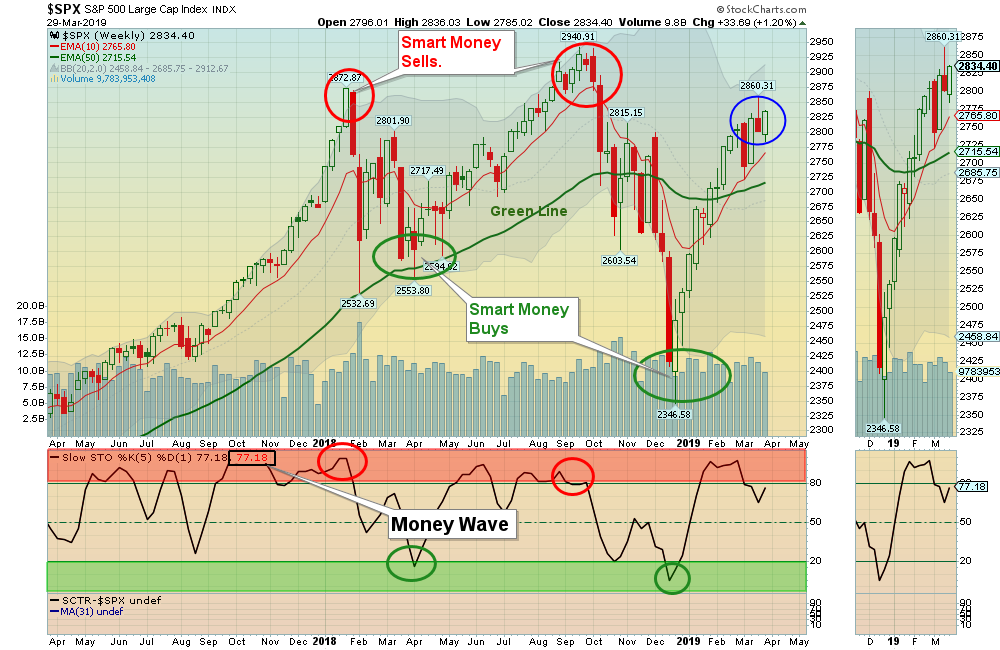

03/31/2019: Markets were up for the week, as the major Indices are going back up the re-test the Highs of 7 days ago. The low Volume indicates a lack of much Buying at these levels. The S&P 500 has Support at 2785.

Please be patient and WAIT for the Leaders and Indices to return to their Green Zones for Money Way Buys soon.

For the week the Dow was up 0.82%, the S&P 500 was up 1.16%, and the Nasdaq 100 was up 0.72%. The very Long Term Trend on the Stock Markets is UP.

The Inflation Index (CRB) was down 0.22% and is Below the Green Line, indicating Economic Weakness.

Bonds were up 1.27% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was up 0.89 and is back up in the Red Zone.

Crude Oil was up 1.86% for the week at $60.14, and GOLD was down 1.05% at $1298.50.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 7 logged Open Positions, for the Short & Medium Term. There are 3 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM TRADES

Buy the Leading Investments that are down near the weekly Green Zones.

AVP AVON PRODUCTS Buy if is Closes above $3.41 on High Volume.

CROX CROCS INC. Wait for a Close above the Red Line of $26.25.

CIEN CIENA CORP. Wait for Weekly Money Wave Close > 20.

KTOS KRATOS DEFENSE Wait for a Close above the Red Line of $15.80.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

QUESTION: Michael C. writes “Thanks for sharing your methodology on StockCharts. I’ve been having a look and noticed that today’s comment says “Please WAIT for the Leaders to return back down to the Green Zones for Money Wave Buys soon”.

Does this mean that no Money Wave Buy signals should be taken until the Leaders have returned back to the Green Zones?

ANSWER: Money Wave Buy Signals can be taken at any time, but results are usually better when the Strongest Leaders and the S&P 500 Index are ALSO down in their Green Zones. (The weakest ones go down to their Green Zones first).

Good trading, and tell your friends!