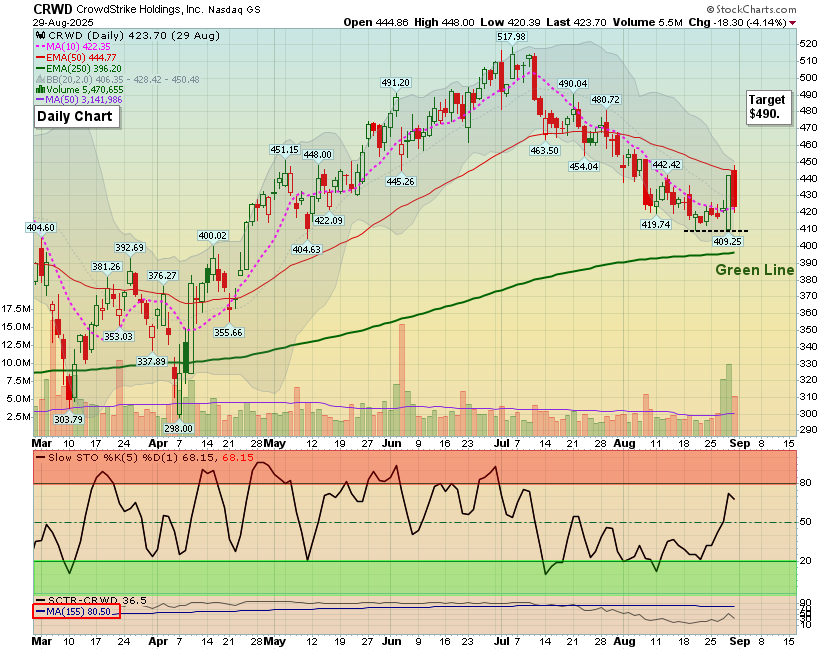

This week’s Top Pick of the Week (TPOW) was CrowdStrike Holdings (CRWD), selected based on our strict criteria of SCTR above 90, a breakout above the Green Line, and high relative volume. We entered the trade at $422.61 on Monday with expectations of continued upside momentum. However, following our rules-based approach, we exited the position early on Wednesday, August 27, ahead of CRWD’s earnings announcement, as our system avoids holding positions into earnings. We closed at the same price we entered, resulting in no gain or loss for the trade.

After CRWD posted its earnings later in the week, the stock gapped higher and finished the week up strongly. While it’s always tempting to hold through earnings to capture potential upside, this scenario highlights why our discipline is critical. The system prioritizes capital preservation and risk management over speculation. In this case, we didn’t participate in CRWD’s post-earnings rally, but by following our rules, we avoided potential downside if the report had disappointed.

The broader market also showed underlying strength this week. The S&P 500 (SPY) posted modest gains, driven largely by continued leadership in large-cap tech and AI-related names. SPY remains well above its 50-day moving average, and support levels continue to hold as buyers step in. Market breadth remains somewhat mixed, with leadership concentrated among growth and momentum stocks, while defensive sectors like healthcare and utilities continue to lag.

Overall, the market trend remains constructive, and our TPOW strategy continues to focus on identifying high-probability setups while minimizing exposure to unpredictable earnings-related volatility. By sticking to our process, we ensure that we capture meaningful gains when the odds are in our favor, while protecting capital when risks are elevated.

We’ll be scanning for next week’s Top Pick of the Week, looking for candidates with strong momentum, confirmed breakouts above the Green Line, and no upcoming earnings events. Our rules-based system remains focused on consistency and discipline, which has been the foundation of long-term performance.

For more TPOW recaps and strategy insights, visit:

https://abovethegreenline.com/tpow