Conditional Orders

What Are Conditional Orders?

Conditional orders in investing are advanced trade instructions that execute only when specific conditions are met. These conditions are usually tied to the price of a stock, index, or other financial instruments. Unlike traditional market or limit orders, which execute immediately or at a specified price, conditional orders remain inactive until the market price or other variables meet the set criteria. Examples include stop-limit orders, one-cancels-the-other (OCO) orders, and if-touched orders.

For example, with a stop-limit order, you can specify a trigger price and a limit price. Once the stock reaches the trigger price, the order becomes active, and the stock will be bought or sold only if it can be executed at the limit price or better. This allows investors to have more precise control over their trades without needing to constantly monitor the market.

How to Use Conditional Orders

To use a conditional order, first decide the type of condition you’d like to set, such as a price threshold or a combination of market factors. Once the condition is set, your broker will automatically execute the trade when the criteria are met. Conditional orders can be applied to both buying and selling strategies. For example, you can set a buy order to be executed only if a stock falls to a certain price, or a sell order to trigger when a stock reaches a specific profit level.

These orders are particularly helpful for traders who are unable to monitor the markets constantly or for those who want to automate their trading strategies. Traders can set various conditions, such as a combination of price, volume, or time, which ensures that the order is executed only in favorable circumstances.

When to Use Conditional Orders

Conditional orders are best used when you want more control over trade execution, especially in volatile markets or when trading illiquid assets. For example, if you want to buy a stock only if it falls to a certain price but also want to prevent buying during a sharp sell-off, you can set both a stop price and a limit price. Similarly, you can use conditional orders to lock in gains or limit losses without constantly watching the market.

They are also helpful for swing traders or investors with time constraints. If you have a target price in mind for entering or exiting a position but don’t want to execute the trade immediately, a conditional order can ensure the trade is made only when market conditions align with your goals.

Pros and Cons of Conditional Orders

Pros:

- Precision: Conditional orders allow for more precise control over trades, ensuring they are executed only under specific conditions.

- Automation: They reduce the need to constantly monitor the market, freeing up time and mental bandwidth for traders.

- Risk Management: Conditional orders, such as stop-loss or trailing-stop orders, help protect profits and limit potential losses by automatically triggering trades when prices move in your favor or against you.

- Flexibility: With conditional orders, traders can set multiple conditions, creating complex strategies that align with specific market conditions.

Cons:

- Partial Fills: Conditional orders, especially in illiquid markets, may not always be fully executed if the stock price hits the condition briefly or there isn’t enough volume to complete the trade at the desired price.

- Market Gaps: In fast-moving or volatile markets, prices can gap beyond the trigger price, leading to an execution that’s significantly worse than expected.

- Complexity: Setting up conditional orders requires a good understanding of the market and technical analysis, making them less suitable for beginner investors. Misconfigured conditions can also result in unintended trades.

- Missed Opportunities: If the conditions are too strict, you might miss out on potential opportunities where a trade could have been beneficial but didn’t meet all the specified criteria.

In conclusion, conditional orders are a powerful tool for active traders looking for precision, automation, and improved risk management. However, they require careful planning and understanding of the market to avoid potential pitfalls such as missed opportunities or unfavorable executions.

<h4>Recent Articles</h4>

How to Use Net Present Value (NPV) for Dividend Stocks

Free Cash Flow: The Ultimate Guide to Financial Strength and Dividend Sustainability

Dividend Reinvestment Plan (DRIP): How Automatic Reinvestment Builds Long-Term Wealth

Reinvestment Strategy: Turning Income into Compounding Wealth

Dividend Growth vs High Yield: Choosing the Right Income Strategy for Long-Term Investors

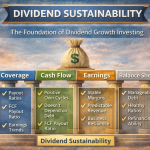

Dividend Sustainability