By ATGL

Updated February 18, 2026

The Search for a Simple but Powerful Filter

Dividend investing often attracts individuals seeking income stability, compounding growth, and financial independence. However, the challenge most investors face is not finding dividend-paying stocks — it is determining which dividend stocks offer both current income and future growth. The financial markets are full of companies that pay dividends, yet many of them fail to grow those payments meaningfully over time. Others grow rapidly but offer yields so small that the income impact is negligible.

This is where the Chowder Rule emerges as a practical and surprisingly elegant solution. Rather than forcing investors to choose between high yield and high growth, the Chowder Rule blends both elements into a single numerical guideline. It is not a rigid law, nor is it a predictive formula, but it is an effective screening metric that helps dividend growth investors identify companies that balance income today with expansion tomorrow.

The Chowder Rule gained popularity through dividend-focused investing communities and has since become a staple heuristic for income-oriented portfolios. While it may appear simple on the surface, its power lies in its ability to quickly filter large universes of stocks into a manageable list of candidates worthy of deeper analysis.

What Is the Chowder Rule?

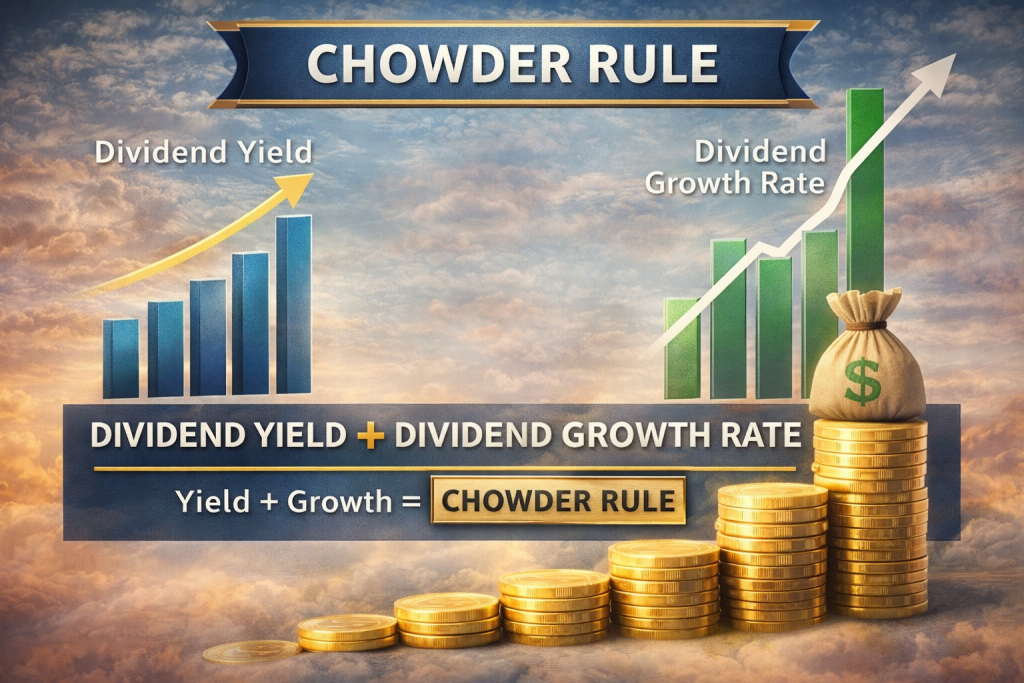

At its core, the Chowder Rule is a formula that combines two key dividend metrics:

Dividend Yield + Dividend Growth Rate (DGR) = Chowder Number

The result is a single value used to determine whether a stock meets a minimum threshold for inclusion in a dividend growth portfolio. The idea is straightforward:

- Dividend Yield represents the income you receive today.

- Dividend Growth Rate represents how quickly that income may increase in the future.

By adding these two figures together, investors obtain a snapshot of the stock’s total income potential. The Chowder Rule essentially asks the question:

“Is the combination of present income and future growth strong enough to justify ownership?”

The typical thresholds often cited are:

- 12 or higher for general dividend growth stocks

- 8 or higher for utilities or high-yield sectors (because their growth rates are usually lower)

These numbers are not absolute truths, but rather practical guidelines that help investors avoid low-quality dividend traps or stagnant income producers.

Why the Chowder Rule Matters

Dividend investing is not merely about collecting checks. True dividend growth investing focuses on rising income streams that outpace inflation and contribute to long-term wealth creation. A high yield alone can be misleading; companies with unsustainably high yields often face declining earnings or excessive payout ratios. Conversely, companies with extremely low yields may grow quickly but fail to provide meaningful current income.

The Chowder Rule addresses this dilemma by ensuring that neither dimension is ignored. It creates a balance between present and future, encouraging investors to select companies that offer both stability and upward trajectory.

This balance is especially important in retirement planning and income-focused portfolios. Investors relying on dividends to supplement living expenses must ensure that their income grows over time. Inflation erodes purchasing power, and stagnant dividends can quietly undermine financial security. The Chowder Rule acts as an early defense mechanism against this risk.

Understanding Dividend Yield in Context

Dividend yield is the annual dividend payment divided by the current stock price. While yield appears simple, it must be interpreted carefully. A rising yield may signal opportunity, but it can also signal distress if the stock price has fallen sharply due to deteriorating fundamentals.

Within the Chowder Rule framework, yield is not evaluated in isolation. Instead, it is paired with growth. This pairing reduces the risk of being lured into so-called yield traps — companies offering attractive payouts that are unlikely to sustain or increase them.

A moderate yield combined with strong growth often proves more powerful than a very high yield with minimal growth. Over a decade, a company yielding 2.5% with consistent 10% dividend growth can surpass the income generated by a static 6% yield stock. The Chowder Rule encourages investors to think in terms of trajectory rather than snapshots.

Dividend Growth Rate: The Engine of Compounding

If yield is the present, dividend growth rate is the future. The dividend growth rate measures how quickly a company increases its dividend payments year over year. Consistent growth signals financial strength, disciplined capital allocation, and management confidence.

In practical terms, dividend growth fuels compounding income. Each increase raises the investor’s yield on cost — the percentage return based on the original purchase price rather than the current market value. Over time, this compounding effect can transform modest investments into substantial income streams.

The Chowder Rule gives equal weight to growth because growth is what differentiates a dividend growth stock from a mere income stock. Without growth, income stagnates. With growth, income evolves.

Sector Adjustments and Practical Thresholds

Different sectors exhibit different dividend characteristics. Utilities, telecommunications, and real estate investment trusts often provide higher yields but lower growth. Technology and healthcare firms may offer lower yields but stronger growth rates.

Because of these natural differences, investors often adjust Chowder Rule thresholds by sector. For example:

- Utilities: A combined score of 8 may be acceptable due to stable but slow growth.

- Consumer Staples: A score of 10–12 is often targeted.

- Technology: Higher growth expectations may push desired scores above 12.

These adjustments recognize that dividend dynamics are not uniform across industries. The Chowder Rule remains flexible, allowing investors to tailor expectations to sector realities while still maintaining disciplined screening.

Strengths of the Chowder Rule

One of the primary advantages of the Chowder Rule is its simplicity. Investors can quickly evaluate thousands of stocks without complex financial modeling. It serves as an efficient first filter, narrowing the universe before deeper fundamental analysis.

Additional strengths include:

- Balance: Encourages a blend of yield and growth.

- Clarity: Provides a numeric benchmark for decision-making.

- Scalability: Works for both small and large portfolios.

- Behavioral Discipline: Reduces emotional bias by anchoring decisions to objective criteria.

For investors overwhelmed by financial data, the Chowder Rule acts as a compass pointing toward sustainable income growth rather than short-term temptation.

Limitations and Misconceptions

Despite its usefulness, the Chowder Rule is not a standalone strategy. It does not account for payout ratios, debt levels, earnings stability, or free cash flow coverage. A company can meet the Chowder threshold while still carrying financial vulnerabilities.

Additionally, dividend growth rates can fluctuate, especially during economic downturns. Past growth does not guarantee future increases. Investors must therefore treat the Chowder Rule as a screening tool, not a final verdict.

Another misconception is that a higher Chowder Number automatically indicates superiority. Extremely high scores may result from temporary spikes or unsustainable conditions. Context and qualitative judgment remain essential.

Integrating the Chowder Rule Into a Broader Strategy

The most effective use of the Chowder Rule occurs when it is paired with other evaluation metrics such as:

- Payout Ratio Analysis

- Free Cash Flow Coverage

- Debt-to-Equity Ratio

- Earnings Consistency

- Technical Trend Confirmation

By combining quantitative filters with qualitative assessment, investors transform the Chowder Rule into part of a comprehensive dividend growth framework rather than a standalone shortcut.

Many disciplined investors also incorporate portfolio diversification and sector balancing alongside Chowder screening. This ensures that income growth is not overly dependent on a single industry or economic cycle.

Long-Term Impact on Portfolio Income

The real power of the Chowder Rule becomes evident over extended time horizons. Investors who consistently select companies meeting balanced yield-plus-growth criteria often experience accelerating income streams. The compounding effect can be dramatic over 10–20 years.

This long-term focus aligns well with retirement planning and generational wealth building. Rather than chasing short-term gains, investors prioritize sustainability and upward progression. The Chowder Rule thus serves as a behavioral anchor, encouraging patience and strategic consistency.

Final Perspective: A Tool for Discipline, Not Perfection

The Chowder Rule does not promise guaranteed returns, nor does it replace detailed analysis. Its value lies in its ability to simplify the complex world of dividend investing into a practical decision framework. By blending current income with growth potential, it addresses one of the most common pitfalls in income investing: the false choice between yield and expansion.

When used responsibly, the Chowder Rule becomes more than a formula — it becomes a mindset emphasizing balance, discipline, and forward thinking. Investors who adopt it as part of a structured dividend growth strategy often find that it reduces emotional decision-making and enhances portfolio consistency.

In the end, the Chowder Rule is not about chasing the highest numbers. It is about cultivating sustainable income growth, aligning financial decisions with long-term objectives, and respecting the mathematics of compounding. For dividend growth investors seeking clarity amid market noise, it remains one of the most practical heuristics available.

Ready to apply these strategies in real time? Join Above the Green Line and receive rules-based stock ideas, technical charts, and disciplined entry and exit guidance delivered every week.