Imagine you're at a fork in the investment road: one path leads to traditional bonds, and the other to bond ETFs. Knowing which path to take can greatly influence your financial journey. Before embarking on this critical choice, it's essential to … [Read more...]

Bond ETF vs Stock ETF: Key Differences

Understanding the diverse options within the investment landscape is crucial for effective portfolio management. Exchange-traded funds (ETFs), including bond ETFs and stock ETFs, present distinct opportunities for investors aiming to meet their … [Read more...]

What Are Short Term Corporate Bonds? | A Guide

Short-term corporate bonds serve as financial instruments that companies issue to raise capital for a relatively brief duration, usually ranging from one to five years. These bonds are characterized by their shorter maturity periods compared to … [Read more...]

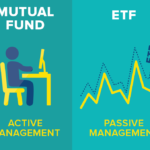

Active ETFs: A Beginner’s Guide to Active Management

Embarking on the journey of investing can be both exciting and overwhelming, and for beginners, understanding the landscape of Exchange-Traded Funds (ETFs) is a crucial first step. Among the diverse array of ETFs, Active ETFs stand out as a … [Read more...]

What Are Sector ETFs and How Do You Invest in Them?

Sector ETFs, which stands for exchange-traded funds, offer a means to invest in specific sectors or industries of the economy. They concentrate on collections of companies within a single industry sector, such as technology, health care, or finance. … [Read more...]

ETF Strategies

Introduction to Exchange-Traded Funds (ETFs) Exchange-Traded Funds (ETFs) are investment funds that are traded on stock exchanges, similar to individual stocks. ETFs combine features of both mutual funds and stocks, offering investors a convenient … [Read more...]

What Are Single Stock ETFs? Everything You Need To Know

Single Stock ETFs, or exchange-traded funds, are investment vehicles that provide exposure to a single individual stocks rather than a diversified portfolio of various assets. It is designed to track the performance of the underlying stock and … [Read more...]

3 Sector Rotation ETF Strategies for Maximizing Returns

Sector rotation ETF strategies are a popular type of investment strategy that seeks to improve risk-adjusted returns and automate the investing process via dynamic asset allocation. This dynamic asset allocation involves systematically shifting … [Read more...]

Currency Hedged ETFs: A Comprehensive Guide

Currency-hedged Exchange-Traded Funds (ETFs) offer a strategic solution for investors looking to minimize the risks associated with fluctuating exchange rates in foreign markets. This guide provides an in-depth look at how these ETFs work, as well as … [Read more...]

5 Key Components of the Forex Market Structure

Understanding the Forex market structure is critical to profitable investments in this market. Forex is the foreign market exchange, and the structure refers to patterns and relationships of banks and other participants in the market. The Forex … [Read more...]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- Next Page »