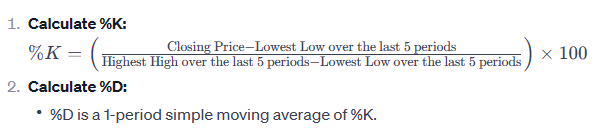

Slow Stochastic Oscillator

The Slow Stochastic Oscillator is a smoothed version of the Fast Stochastic and is less sensitive to price fluctuations. It is calculated by applying a further smoothing process to the %K line of the Fast Stochastic. In the Slow Stochastic:

- %K is a 3-day moving average of the Fast Stochastic’s %K.

- %D is a 3-day moving average of the Slow Stochastic’s %K.

Because of this extra smoothing, the Slow Stochastic produces fewer signals, making it more appropriate for traders with a longer time horizon who want to avoid the noise of small, quick price movements. It’s generally more reliable in trending markets where volatility is lower.

The Slow Stochastic is scaled from 0 to 100. Readings above 80 are considered overbought, suggesting that the asset may be due for a price reversal or pullback while Readings below 20 are considered oversold, indicating that the asset may be undervalued and could experience a potential upward reversal.

The basic formula for the Slow Stochastic %K is:

How to Use: The Slow Stochastic is used similarly to the Fast version, but with more emphasis on reducing false signals. Traders look for crossovers of %K and %D to indicate buying and selling opportunities. Because it produces fewer signals, it’s typically favored by swing traders or those who are aiming for medium-term trades rather than short-term scalps.

Crossings above 80 might suggest that the market is overbought and due for a pullback, while crossings below 20 might suggest that the market is oversold and due for a potential rebound.

The Slow Stochastic is a popular tool among technical analysts for its ability to help identify potential reversals in market momentum. Traders often use it in conjunction with other technical indicators and analysis methods for a more comprehensive understanding of market conditions.