Markets were higher again today as the Indices try to retest the recent Highs. Volume was low on most, but there were more Money Wave Buy Signals today. Some Buy Signals have already popped up too much to safely Buy on the Close.

We are concerned about the weaker Buying, and once again the Indices are almost back on the Highs. The Risk of Buying Way above the Green Lines does not calculate where we could have a 2:1 Reward to Risk, from Buying up at these levels. Let someone else be the hero. Low Volume says Smart Money is not Accumulating stocks here, just more weak Buying from the “Buy on Dip” Bulls who don’t seem to have much Money left.

NEW SUBSCRIBERS: The Markets finally pulled back to the 50-day averages on Monday, but the pull back was so tiny that the rally up will probably be small also. Many Investors are spending ALL of their Money up here, because of FOMO (FEAR OF MISSING OUT). The better trades happen when the S&P 500 Index is also in the Green Zone (almost happened on Monday).

Several nice bounces today on DAY TRADING SETUPS

Bonds were down today, and are back above the Green Line.

Crude Oil was up $3.09 today at $70.29.

BUYS TODAY 7/21/2021

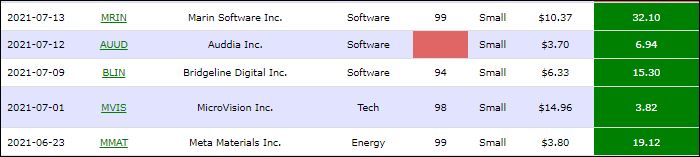

BLIN BRIDGELINE SOFTWARE Money Wave Buy today. BLIN will not be bought or logged as it is already up 14 % today.

MRIN MARIN SOFTWARE INC. Money Wave Buy today. MRIN will not be bought or logged as it is already up 33 % today.

MVIS MICROVISION INC. Bought above the Pink Line around $14.56, but MVIS will not be bought or logged as the Volume is below average of 11.6 MIL.

XLC COMMUNICATIONS FUND Money Wave Buy today. XLC will not be bought or logged as the Volume is below average of 4.1 MIL.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

_______________________________________________________________________________________________________

JUMP START SCROLLING CHARTS: (Buy Signal should be very soon… Click on the Jump Start link for more info.)

AUUD AUDDIA INC. Buy above $4.03 with High Volume with a 5% Trailing Sell Stop Loss below it.

NEGG NEWEGG COMMERCE Buy above $30.99 with High Volume with a 5% Trailing Sell Stop Loss below it.

____________________________________________________________________________________________________________

WATCH LIST SCROLLING CHARTS (Real Time)

ATOS ATOSSA GENETICS Wait for Money Wave Close > 20 with High Volume.

BB BLACKBERRY LTD. Buy above the Pink Line around $10.82 with High Volume with a 5% Trailing Sell Stop Loss below it.

MMAT META MATERIALS INC. Buy above the Pink Line around $4.05 with High Volume with a 5% Trailing Sell Stop Loss below it.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines). DSX DIANA SHIPPING EXIT if it is going to Close below Support of $4.09. This trade was not logged.

____________________________________________________________________________________________________________

SELLS TODAY

LB L BRANDS INC. Target Hit at $77 for a 3.46 % Gain.

Click for CURRENT POSITION CHARTS – Real Time (Please check and adjust your Sell Stops).

Click for CLOSED POSITIONS,

NEW: MY TRADING DASHBOARDDAY TRADING SETUPS

NEW: TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

ETF SECTOR ROTATION SYSTEM

TOP 100 LIST Updated Jul 5, 2021

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.