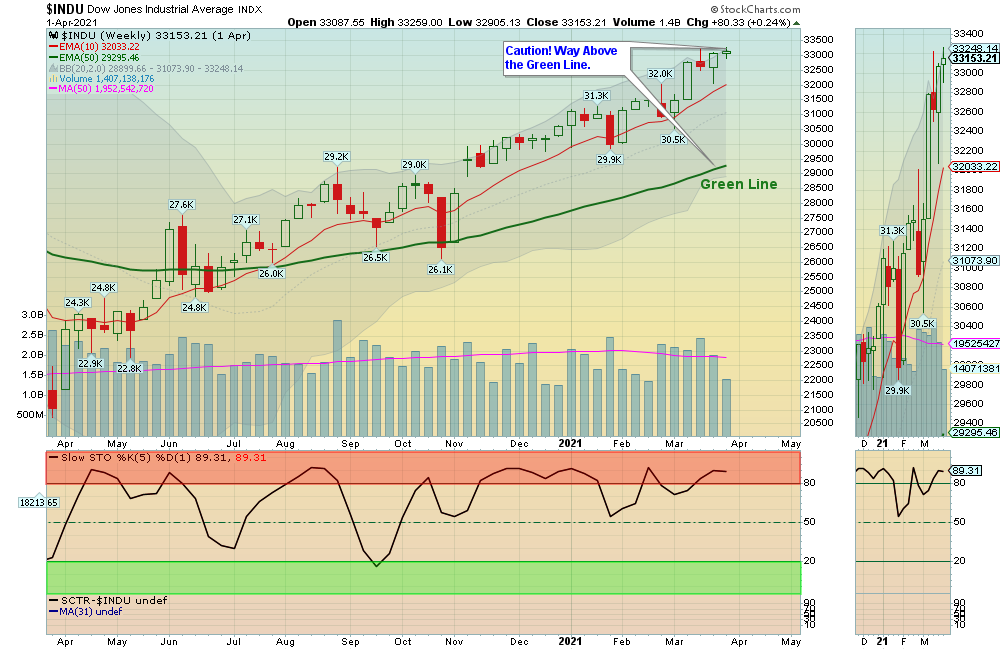

4/04/2021 Markets were higher for the week and the S&P 500 and DOW 30 Indices were able to make New Highs, Now the Small Caps, NASDAQ 100 and the Leaders need to make New Highs for the 1 year rally to continue. So far the Buying Volume has been low, which could mean that most Investors are now Fully Invested on all of the Good News (Virus Ending & more Stimulus $$$).

Last week the Leaders bounced up from the Green Zones and are now back up in the Red Zones, but the bounces have been weak. This is not because the Green Line System did not Buy the best Investments. It is because Smart Money is Cashing in on a huge 1 year 80+ % rally in the last 12 months on lots of Good News. Expecting more of a rally up from these over bought levels without a pull-back would historically be a low probability.

The DOW 30 Index (see chart above) could go up another 2000-4000 points from these levels, but the DOW 30 is currently 4000 points Above the Green Line (which it will eventually return to). Before you ever Buy any Investment, you should determine that your Gain potential could be at least 2 times your Risk (a 2:1 Reward / Risk ratio). So if the DOW 30 can drop 4000 point back to the Green Line, then the Gain needs to be 8000 points higher from today’s level. If you are confident that the Dow 30 will continue up another 8000 points without a pull-back, then remain on course. The Low Volume lately probably indicates that Smart Money has been profit taking, and will WAIT for some Bad News and then Buy Stocks lower.

Completed Logged Trades this week:

FUTU FUTU HOLDINGS Mar 31 Sold on Close via Email for 32.9 % Gain.

GT GOODYEAR TIRE Stopped out for a -0.06 % Loss.

For the week the Dow was up 0.25%, the S&P 500 was up 1.17%, and the Nasdaq 100 was up 2.71%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was down 0.55% for the week and is Above the Green Line, indicating Economic Expansion.

Bonds were up 0.76% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.21% for the week and returned up to the Green Line..

Crude Oil was up 0.79% for the week at $61.45 and GOLD was down 0.23% at $1728.40.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in 5 logged Current Positions, for the Short & Medium Term. There are 3 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Several Leaders have pulled back near the Green Lines.)

ARKK ARK INNOVATION ETF Long Term Buy on Mar 30 at $114.42. Target $140.

NIO NIO INC. Long Term Buy on Mar 30 at $37.55. Target $50.

BE BLOOM ENERGY CORP. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

FCEL FUELCELL ENERGY INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

LL LUMBER LIQUIDATORS Buy if it Closes above $26.80 on High Volume.

PLUG PLUG POWER INC. Buy if it Closes $39.97 with High Volume.

PTON PELOTON INTERACTIVE Buy if it Closes above $119.12 on High Volume.

ROKU ROKU INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

TSLA TESLA INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

XBI BIOTECH FUND Buy if it Closes above the Red Line (50-day avg.) with High Volume.

Z ZILLOW GROUP Buy if it Closes above the Red Line (50-day avg.) with High Volume.

______________________________________________________________________________________

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

New: My Trading Dashboard

Day Trading Watch List

NEW TOP 100 LIST Apr 4, 2021

Dividend Growth Portfolio

ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Alert! Market Risk is HIGH (Red Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

___________________________________________________________________________________________

Emails can be sometimes delayed at your server or can go into your Spam Folder.

You might want a backup also… Twitter notifications are the best and fastest.

4 Ways to Get your Daily Money Wave Alert:

- Emailed to your box between 3:40 3:50pm EDT.

- Website menu Commentary/Buy/Sell Signals

- Twitter notifications @AboveGreenLine

- Text messages: Email us your Cell number & phone carrier.

Thank you,

ATGL