Pre-Market Trading

What Is Pre-Market?

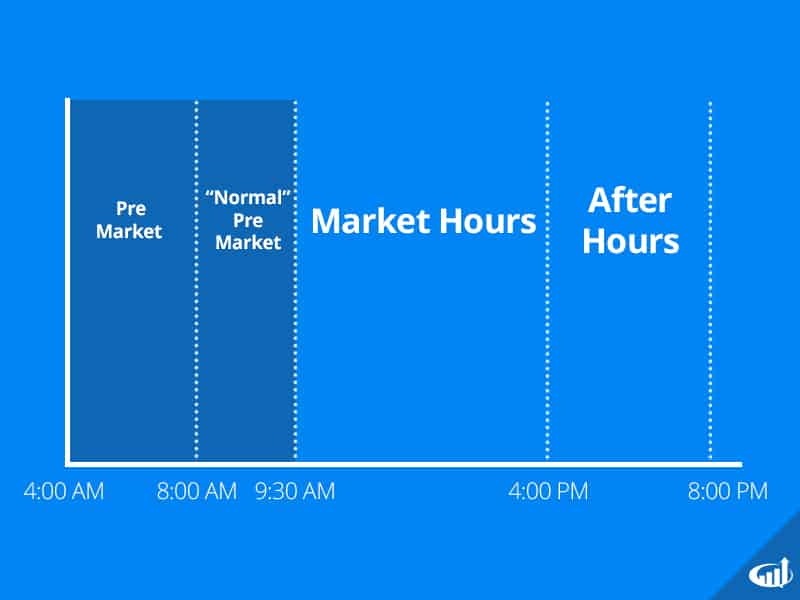

Pre-market is the period of time before the stock market opens; usually between 8:00 AM and 9:30 AM EST each trading day. While many investors disregard the pre-market period, there are also a number of investors and traders who observe the pre-market period in order to gauge the direction and health of the market. It is important to note that pre-market activity tends to have limited volume and liquidity. It also tends to illustrate little activity at all unless there is news. Therefore, due to its thin level of liquidity, many brokers may limit the types of orders that can be executed, and when an investor can make trades. For example, some brokers allow pre-market trades from 4:00 AM to 9:30 AM EST while others may limit the pre-market period from 6:00 AM to 9:30 AM EST. Some brokerage firms do not offer pre-market trading at all.

Pre-Market Trading

In order to trade during the pre-market period, a trader must be aware of the pre-market rules. The first pre-market rule is that a trader may only place limit orders, which is an order to either buy or sell a stock at a predetermined price or better. It is important to note that limit orders are not guaranteed to execute. The second rule of pre-market trading is orders are only good during the pre-market time period, meaning that they do not carry over to the regular trading day. The third rule is the pre-market sessions are typically far less liquid than during the normal trading hours. Liquidity is important for many reasons; however, it is primarily important for how quickly one can open and close their positions. Lastly, brokers can set their own terms for pre-market trading. It is crucial to discuss with your broker before attempting to trade during pre-market hours.

Advantages

An advantage of pre-market trading is the ability to get a headstart on reactions to news releases. Since reactions to the news are the driving force of pre-market activity and most likely the activity throughout the trading day, taking advantage in the early hours may prove beneficial to a trader. Additionally, many traders enjoy the level of volatility during pre-market hours. It comes with a large amount of risk, but the reward proves to be satisfying to many pre-market traders.

Disadvantages

However, the risk involved with pre-market trading is quite high and should not be taken lightly. Pre-market indications for a stock can be especially misleading and should not be interpreted as solid indications. Stocks often appear strong during pre-market periods and reverse as soon as the market opens and vice-versa. Furthermore, having only the opportunity to place limit orders during the pre-market period is another disadvantage. Once purchased, there is not a way for a trader to bail on their order. Lastly, the trading volume is incredibly low during pre-market hours. Thus, there is not a guarantee that an investor’s order will be placed before the opening bell.

Conclusion

Placing trades during the pre-market period may not be the best option for new traders; there are many risks associated that can cause significant losses. However, some traders eventually become comfortable with the level of risk involved. If you want to attempt pre-market trading, it is recommended to start out small and test the waters before diving in.