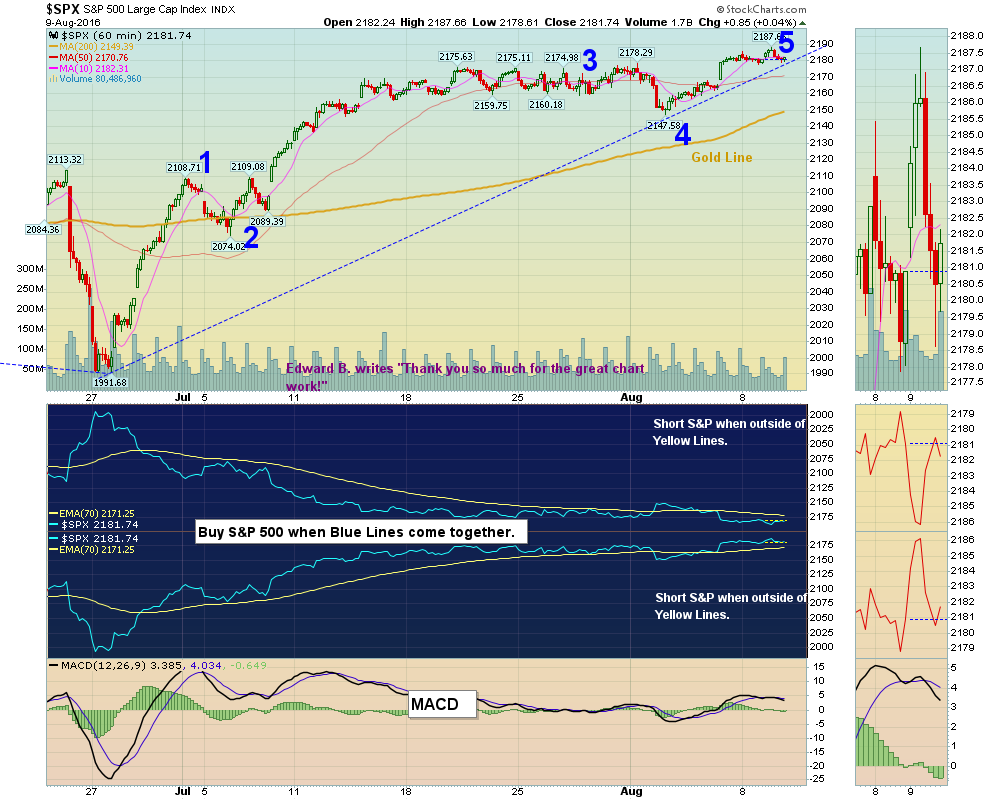

08/09/2016 Daily Commentary: Markets look like the S&P 500 is about to complete Wave 5 up, since the bounce off the Green Line in late June. After Wave 5 is complete, the S&P 500 should drop down to test Support around 2130.

Current Open Positions We have Closed out all but 2 positions. Nintendo had a 7% pop today. Raise Cash for pull-back soon.

Most Leaders are in the Red Zones. Money Wave Buy soon for SLV. We will email you when it is are ready.

When the Market breadth is narrow like it is now (few new highs), either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

Many Funds are having trouble staying Above 90 Relative Strength. None of the major Indices have Above 90 Relative Strength. Only ETFs of Metals GDXJ, GDX XME, SLV, Semis SMH, and a few Country Funds EWZ, & EWT have good Volume and Above 90 R S.