By ATGL

Updated September 25, 2025

In a world of constant market noise and emotional impulses, the most successful traders often share a common secret: they don’t rely on gut feelings. Instead, they operate with a disciplined, methodical approach guided by a well-defined trading system. With retail investment growing significantly, as evidenced by a 13% year-over-year increase in U.S. retail investment volume, more individuals are seeking a structured path to navigate the markets. This guide is your entry point into that world.

Building your own trading system is about transforming your investment approach from a series of reactive decisions into a proactive, rule-based business. It’s about creating a personalized framework that dictates not just when you buy or sell, but how you manage risk, size your positions, and maintain discipline through market volatility. This article will demystify the process, walking you through the essential components, from initial system design to rigorous testing and optimization, empowering you to build a strategy that fits your unique goals and risk tolerance.

What Is A Trading System?

At its core, a trading system is a complete set of objective rules that guide every aspect of a trader’s decision-making process. It specifies precisely when to enter a trade, how much capital to allocate, and when to exit—both for profits and for losses. The goal is to remove emotion and inconsistency from trading, replacing them with a logical, repeatable process.

A defined system enforces discipline, creates consistency, and provides a framework for improvement. Because every rule is explicit, you can test and refine components over time. If you’re new to structuring rules, supplement your reading with foundational trading strategies that can be embedded into a full system.

How Trading Systems Differ From Strategies?

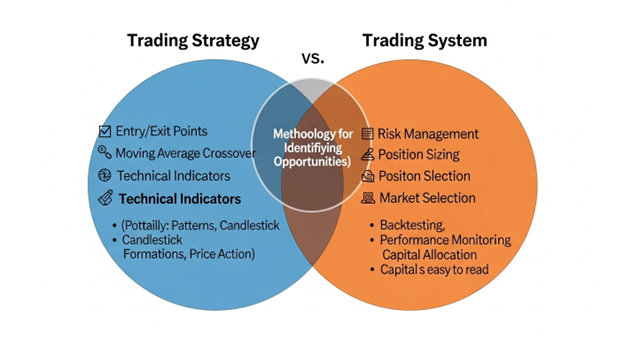

A trading system is more comprehensive than a trading strategy, encompassing risk management, position sizing, and market selection in addition to the entry and exit strategy.

While often used interchangeably, a “trading strategy” and a “trading system” are distinct. A strategy is the methodology for signaling entries and exits (e.g., a moving average crossover). It answers when to act—but not how much, on what, or how to manage risk.

A trading system is the complete architecture that houses the strategy and also covers:

- Risk Management: How much of your portfolio to risk on a single trade. (Deep dive: Trading risk management)

- Position Sizing: How many shares/contracts to buy based on account size and volatility.

- Market Selection: Which assets fit your edge and time commitment.

- Trade Management: Order types, adjustments, and rules for exceptional events.

In short, the strategy finds the opportunity; the system governs the entire process from selection to exit and review.

Types Of Trading Systems

Trading systems can be categorized by the level of human intervention and technological sophistication.

Manual

You make final decisions and execute orders by hand, following pre-defined rules. This offers flexibility and context awareness but is time-intensive and vulnerable to emotion. Manual systems still benefit from structure, including pre-trade checklists and Trading patterns to know that align with your rules.

Automated

Rules are encoded and executed by software without manual intervention, removing hesitation and enabling 24/7 monitoring. To avoid “black box” risk, start with transparent logic and consider tooling such as alerts or dashboards that surface real-time stock alerts aligned with your signals.

Algorithmic

More advanced automation using statistical and quantitative models. Institutions run complex models across venues; retail traders can deploy simpler algorithms inside broker platforms. If you move this direction, standardize your indicators and inputs (e.g., your core Technical indicators for trading and Market breadth indicators) to ensure signals are consistent across tests and live trading.

Building Blocks Of An Effective System

A robust system rests on clear, interconnected rules:

- Markets: Define which instruments you will trade—indices, sectors, FX pairs, or specific equities. Specialization helps you understand context (breadth, catalysts, session behavior). Tools like Market breadth indicators can also gate when your system is “allowed” to take risk.

- Position Sizing: Specify how much to allocate per trade (e.g., risk 1–2% of equity). Volatility-adjusted sizing can stabilize outcomes across different symbols.

- Entries: Objective conditions that must be met. Build from a small set of Technical indicators for trading and a limited library of Trading patterns to know to keep rules simple and testable.

- Stops: Pre-defined exits for losing trades—price-based, ATR/volatility-based, or thesis invalidation.

- Exits: Profit-taking logic (targets, trailing stops, time stops). Consistency here does more for equity curve shape than most entry tweaks.

- Rules: Execution details (market vs. limit), what to do on gaps/news, and whether to rely on real-time stock alerts to trigger actions.

How To Test And Optimize Your Strategy

Create confidence through backtesting (on historical data) and forward testing (paper/live-sim). Guard against overfitting with out-of-sample tests and keep parameter sets small.

Evaluate with:

- Profit Factor (gross profit ÷ gross loss)

- Sharpe Ratio (risk-adjusted return)

- Maximum Drawdown

- Win Rate & Avg Win/Loss

Schedule reviews (quarterly or semi-annually) or after a material drawdown, and let your test plan drive changes—not emotions. When you iterate, rotate through a fixed menu of candidate trading strategies to avoid endless tinkering.

Staying Consistent And Avoiding Common Mistakes

Your system only performs if you execute it. Common pitfalls include overcomplication, ignoring friction (fees/slippage), and abandoning rules after a losing streak. Standard operating procedures and real-time stock alerts can reduce reaction time without improvising.

Over-Optimization And Emotional Bias

Curve-fitting to the past creates fragile rules that fail in live markets. Favor simplicity, validate logic across regimes, and cap the number of tunable parameters. Emotional bias—fear after losses, greed after wins—is the other failure mode. Journaling and pre-commitments (e.g., “three-strike” rules before changing a parameter) help keep you inside the system.

Importance Of Risk Control And Drawdown Limits

Risk control is foundational. Define per-trade risk and portfolio heat, then set a hard max drawdown (your circuit breaker). If hit, stop trading, diagnose, and resume only with a documented change. Build this from the start with a rule set grounded in Trading risk management so survival isn’t left to chance.

Developing Discipline To Follow Your System

Discipline compounds. Trade small while you prove execution fidelity. Keep meticulous records—entry, exit, size, rationale, and emotion snapshot. Trust the edge over a series of trades; any single outcome is noise. Consistency is your moat.

Make More Money From the Best Trading Systems Today

Building and optimizing your own trading system transforms you from a speculator into a systematic operator. By defining rules, testing thoroughly, and executing with discipline, you align your process with long-term success. Pair your system with curated trading strategies, signal hygiene via real-time stock alerts, and informed context from Market breadth indicators to keep decisions consistent.

If you are ready to take the next step and gain access to proven approaches and a community of disciplined traders, explore the resources available at Abovethegreenline.com/memberships.

Conclusion

The path to consistent trading isn’t a “perfect” indicator—it’s a complete, rule-based trading system. We’ve defined what a system is, how it differs from a strategy, and the core building blocks: markets, entries, stops, exits, position sizing, and execution rules. We covered testing and optimization, the dangers of overfitting, and the practical realities of discipline, risk control, and drawdown limits.

Your next step is to draft a simple rule set and refine it deliberately—anchored in Technical indicators for trading and shaped by robust trading strategies—while protecting capital through rigorous Trading risk management. Start small, measure honestly, and let the process—not emotion—do the heavy lifting. Join Above the Green Line and learn more.