By ATGL

Updated November 26, 2025

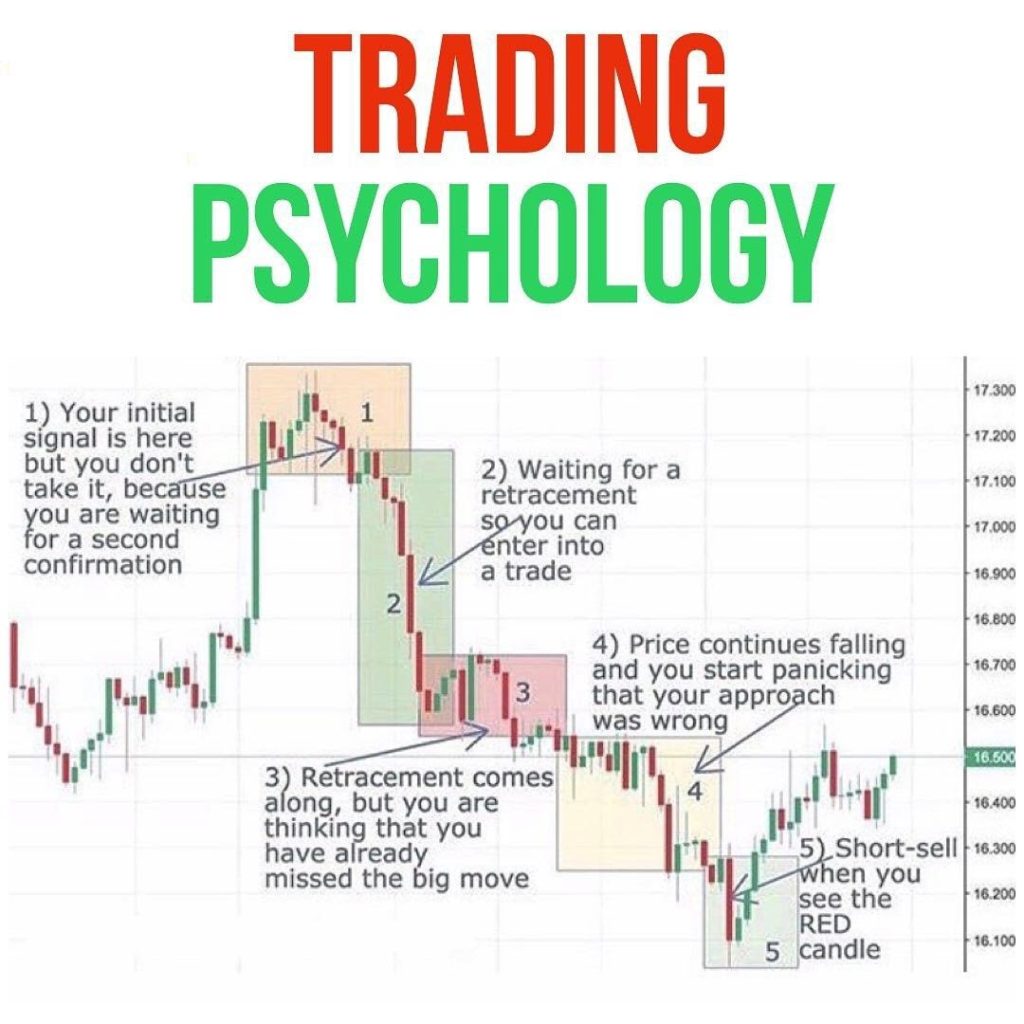

Successful trading depends on more than technical indicators, chart patterns, or market timing. Your mindset plays a central role in shaping decisions, influencing risk tolerance, and determining how you respond to gains and losses. Even the most advanced strategies can break down when emotions override discipline. Understanding trading psychology helps you make objective decisions and maintain consistency regardless of market conditions.

The psychological side of trading is especially important because financial markets move quickly and unpredictably. Volatility, uncertainty, and information overload often trigger fear, greed, or hesitation. When left unmanaged, these reactions weaken judgment and increase the likelihood of errors. A strong psychological foundation helps traders stay aligned with their strategy and improves long-term performance.

What Is Trading Psychology (and Why It Matters More Than Strategy)

Trading psychology refers to the emotional and behavioral factors that influence your decisions when buying or selling financial assets. It encompasses mindset, discipline, emotional control, and your ability to follow a structured plan. While technical or fundamental analysis helps identify opportunities, psychology determines whether you execute your strategy accurately.

Well-known financial education sources such as Investopedia, Britannica, and Corporate Finance Institute define trading psychology similarly: a framework that explains how cognitive biases and emotional responses affect market behavior and individual performance. You improve results not only by studying markets, but also by training your mind to avoid impulsive decisions.

Emotional discipline is more critical than many traders realize. Markets can be unpredictable, and even well-planned trades experience drawdowns. Without a steady mindset, frustration or overconfidence can lead to inconsistent actions. A structured approach keeps you focused on your system, allowing you to remain objective even when price movement challenges your expectations.

For foundational guidance on building structured trading habits, see Stock Trading for additional educational support.

The Key Emotions That Drive Trading Decisions

Several core emotions influence market behavior. Understanding these reactions helps you identify patterns that may be affecting your performance.

Fear

Fear appears when trades move against you or when markets become unstable. It leads to premature exits, hesitation, or avoidance of opportunities. Traders who allow fear to influence decisions may miss valid setups or take profits too early, limiting potential gains.

Greed

Greed pushes traders to overstay profitable positions or take unnecessary risks. Pursuing unrealistic gains often results in ignoring exit rules or increasing position size beyond what your strategy supports. This behavior reduces consistency and increases exposure to sudden reversals.

FOMO (Fear of Missing Out)

FOMO causes traders to enter trades late after a move has already occurred. These reactive decisions often lead to poor entries because the initial opportunity has passed. FOMO is common during strong market trends or news-driven moves, where traders feel pressure to participate regardless of conditions.

Overconfidence

Winning streaks can lead to overconfidence. When traders feel invincible, they may take larger positions, widen stop-losses, or ignore risk management rules. Overconfidence is subtle because it often feels like improved skill rather than emotional bias.

Regret and Revenge Trading

Regret occurs after missed opportunities or losses. Some traders respond by trying to recover quickly, entering impulsive positions without validation. This “revenge trading” approach usually leads to additional mistakes.

Loss Aversion

Loss aversion describes the tendency to hold losing trades too long to avoid realizing a loss. Many traders close winning trades early but allow losing trades to continue, hoping the market reverses. This imbalance damages overall performance.

Confirmation Bias

Confirmation bias drives traders to seek information that supports their existing opinion. Instead of assessing data objectively, they filter out conflicting signals. This bias can undermine strategy development and reduce adaptability in changing markets.

These emotional forces influence every trader, regardless of experience level. The goal is not to eliminate emotions entirely, but to recognize them early and prevent them from overriding your rules.

For signals that can influence your mindset, review Market Sentiment Indicators to understand how crowd behavior affects conditions.

Day Trading Psychology vs. Stock Trading Psychology

Your psychological environment changes depending on your trading style. Day trading and stock trading (longer-term strategies) present different challenges because of their pace, time pressure, and market exposure.

Day Trading Psychology

Day trading requires rapid decision-making during intraday movements. Price swings occur quickly, and trades may last only minutes or hours. This environment often creates:

- High stress levels, especially during volatility

- Pressure to react quickly

- Increased temptation to trade impulsively

- Stronger emotional responses to short-term gains and losses

- A need for strict discipline to avoid overtrading

Day trading psychology emphasizes maintaining composure under fast conditions. Traders must manage adrenaline, avoid impulsive entries, and avoid reacting emotionally to each price tick.

Stock Trading Psychology

Stock trading focuses on medium- to long-term positions. Trades may last days, weeks, or months. This approach emphasizes:

- Patience during slow market periods

- Trust in analysis over time

- Avoiding emotional reactions to short-term volatility

- Staying committed to well-defined entry and exit plans

- Resistance to external noise or conflicting opinions

Longer-term traders must manage the urge to react to daily fluctuations. They must analyze trends objectively and avoid emotional decisions based on short-term sentiment.

Understanding the differences helps you adapt your mindset to your chosen style. For analysis patterns that connect to longer-horizon strategies, see Broadening Top Chart Pattern.

Practical Trading Psychology Tips for Staying Consistent

Improving your psychological approach begins with structured habits. The following practices support focus, emotional control, and consistency.

- Follow a Trading Plan

Your plan should include predefined entry rules, exit criteria, position sizing, and risk limits. A complete plan reduces uncertainty during fast markets and minimizes emotional reactions.

- Use Risk Management as a Foundation

Sound risk controls help preserve capital and reduce stress. Allocating smaller position sizes and using stop-loss orders ensures that a single trade cannot damage your account significantly. See Risk Management for deeper guidance.

- Maintain a Trading Journal

Record entries, exits, observations, and emotions throughout the trade. Journaling helps you recognize patterns in behavior and identify psychological issues that affect performance.

- Develop a Routine

Establish a consistent pre-market and post-market process. Reviewing charts, analyzing volatility levels, and checking economic calendars prepares you for the trading day and improves readiness.

- Focus on Objective Data

Use technical analysis, volume patterns, and market structure rather than reacting to rumors or noise. Fact-based decisions reduce emotional interference.

- Set Realistic Goals

Instead of aiming for large wins, focus on consistency. Well-defined goals improve confidence and reduce pressure to chase aggressive returns.

- Avoid Overtrading

Entering too many trades often stems from boredom, revenge trading, or impatience. Recognize when markets are not presenting quality setups and avoid forcing trades.

- Use Breaks Strategically

If you sense increasing frustration or fatigue, step away from the screen. Temporary breaks reduce impulsive behavior and allow you to reset.

These techniques apply across all trading styles and help build stable performance habits. For understanding fast-moving markets, refer to Market Volatility.

How to Control Emotions During Volatility

Market volatility often magnifies emotional responses. Sharp price swings increase uncertainty and trigger instinctive reactions. To maintain objectivity, consider the following methods.

Use Higher Time Frames

Higher time frames reduce noise and help you maintain context. Stepping back from rapid price fluctuations improves confidence in your analysis.

Rely on Data, Not Instinct

Review volume trends, market structure, and significant levels before making decisions. Data-driven choices reduce the influence of fear or greed.

Protect Capital First

Adjust position sizes or tighten stop-loss orders when volatility increases. Preserving capital allows you to participate in future opportunities without psychological setbacks.

Step Away During Stress

If market movement becomes difficult to interpret, pausing for several minutes helps you regain focus. Emotional resets prevent rushed decisions.

Use Predefined Rules

Having clear entry and exit criteria removes the pressure to decide in emotional conditions. Rules replace intuition with structured guidelines.

Avoid Trading During Extreme Conditions

If market volatility surpasses your comfort level, limit activity. Not every environment requires participation, and protecting emotional stability improves long-term consistency.

To expand your skills with discipline-based trading and structured learning, consider joining our rules-focused community. You can explore membership options here: https://abovethegreenline.com/memberships/