08/11/2016 Daily Commentary: Markets continued the bounce up off the Pink Lines (10-day avgs.) today… Looks like the S&P 500 is about to complete Wave 5 up, since the bounce off the Green Line in late June.

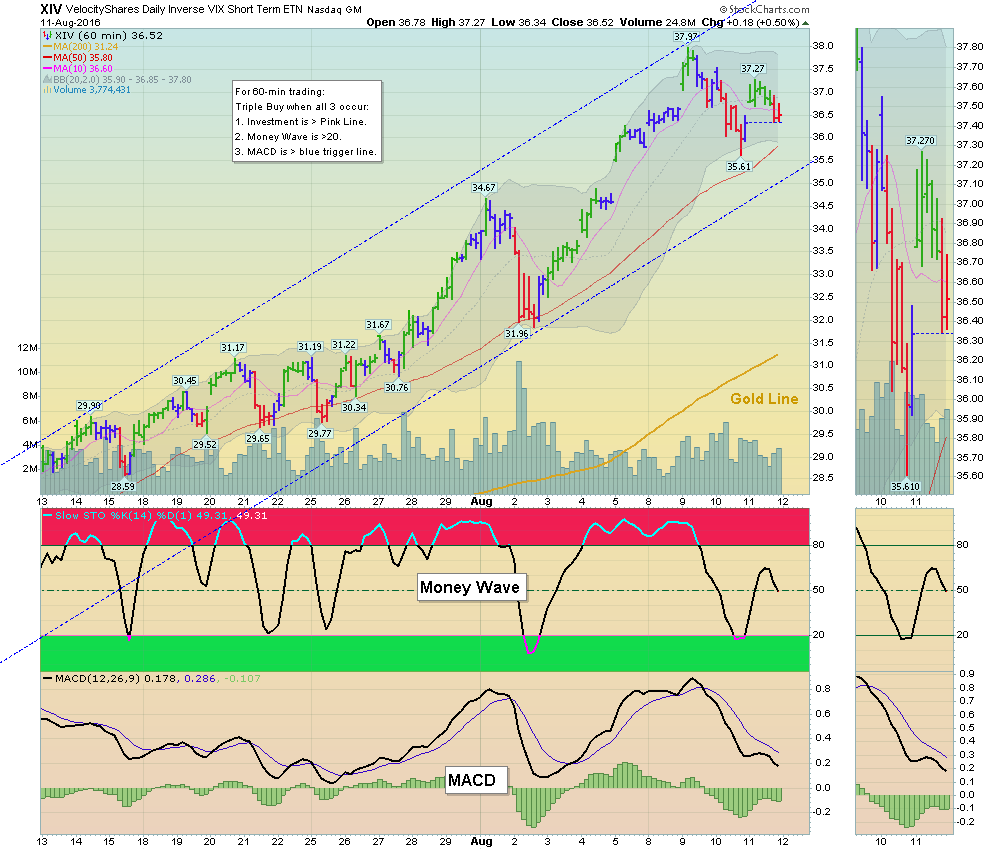

The Inverse VIX XIV and Small Caps IWM were not able to make new Highs this time up, indicating exhaustion. After Wave 5 up is complete, the S&P 500 should drop down to test Support around 2130.

Current Open Positions Nimble traders should have plenty of Cash for a pull-back soon.

Money Wave Buys soon for AKS CLF X XME & Z We will email you when they are ready.

When the Market breadth is narrow like it is now (few new highs), either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

Many Funds are having trouble staying Above 90 Relative Strength. None of the major Indices have Above 90 Relative Strength. Only ETFs of Metals GDXJ, GDX XME, SLV, Semis SMH, and a few Country Funds EWZ, & EWT have good Volume and Above 90 R S.