How to Use Net Present Value (NPV) for Dividend Stocks

Dividend investors often focus on yield, payout ratios, and dividend growth streaks. Those metrics matter. But they don’t answer the ...

Free Cash Flow: The Ultimate Guide to Financial Strength and Dividend Sustainability

Free Cash Flow (FCF) is one of the most important financial concepts an investor can understand, yet it is also ...

Dividend Reinvestment Plan (DRIP): How Automatic Reinvestment Builds Long-Term Wealth

Building Wealth Through Automatic Compounding A Dividend Reinvestment Plan—commonly referred to as a DRIP—is one of the most powerful yet ...

Reinvestment Strategy: Turning Income into Compounding Wealth

The Decision That Shapes Long-Term Outcomes Every investor eventually reaches a recurring decision point: what should be done with incoming ...

Dividend Growth vs High Yield: Choosing the Right Income Strategy for Long-Term Investors

Income investing often begins with a simple question: How can I generate reliable cash flow from my portfolio? Yet beneath ...

Dividend Sustainability

Dividend sustainability is the foundation of dividend growth investing. A dividend is only valuable if it can survive stress—recessions, margin ...

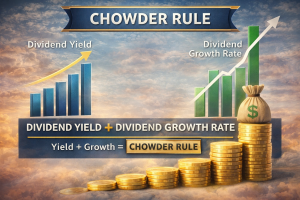

The Chowder Rule: A Practical Guide to Dividend Growth Investing

The Search for a Simple but Powerful Filter Dividend investing often attracts individuals seeking income stability, compounding growth, and financial ...

Dividend Aristocrats

Building Durable Wealth Through Consistent Dividend Growth Dividend Aristocrats represent one of the most respected groups of income-producing stocks in ...

Portfolio Diversification Methods

Building Stability Through Structured Asset Allocation Portfolio diversification is one of the most frequently cited principles in investing, yet it ...

Reinvestment vs Income Approach

Choosing the Right Dividend Strategy for Your Financial Goals Dividend investing is often presented as a single strategy, but in ...

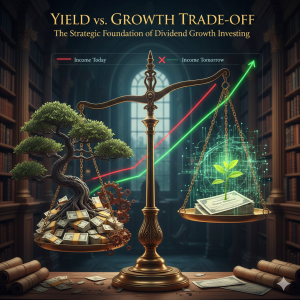

Yield vs Growth Trade-off

The pursuit of financial independence through the stock market often feels like a perpetual tug-of-war between the present and the ...

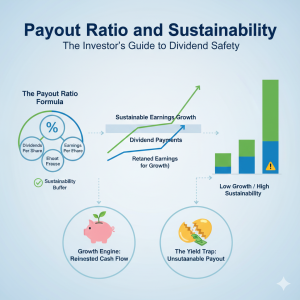

Payout Ratio and Sustainability

The Investor’s Guide to Dividend Safety In the world of income investing, there is a common siren song: the high ...