By ATGL

Updated February 9, 2026

Payout Ratio and Sustainability: The Investor’s Guide to Dividend Safety

In the world of income investing, there is a common siren song: the high dividend yield. For many investors, a yield of 8%, 10%, or even 15% acts as a powerful lure, promising immediate cash flow and a shortcut to financial freedom. However, history is littered with the portfolios of investors who chased yield without understanding the engine behind it.

The single most important metric in determining whether a dividend is a promise or a ticking time bomb is the Dividend Payout Ratio. This article serves as a foundational deep dive into the payout ratio, its nuances across different sectors, and how it serves as the ultimate barometer for dividend sustainability.

1.Defining the Core Concept: What is the Payout Ratio?

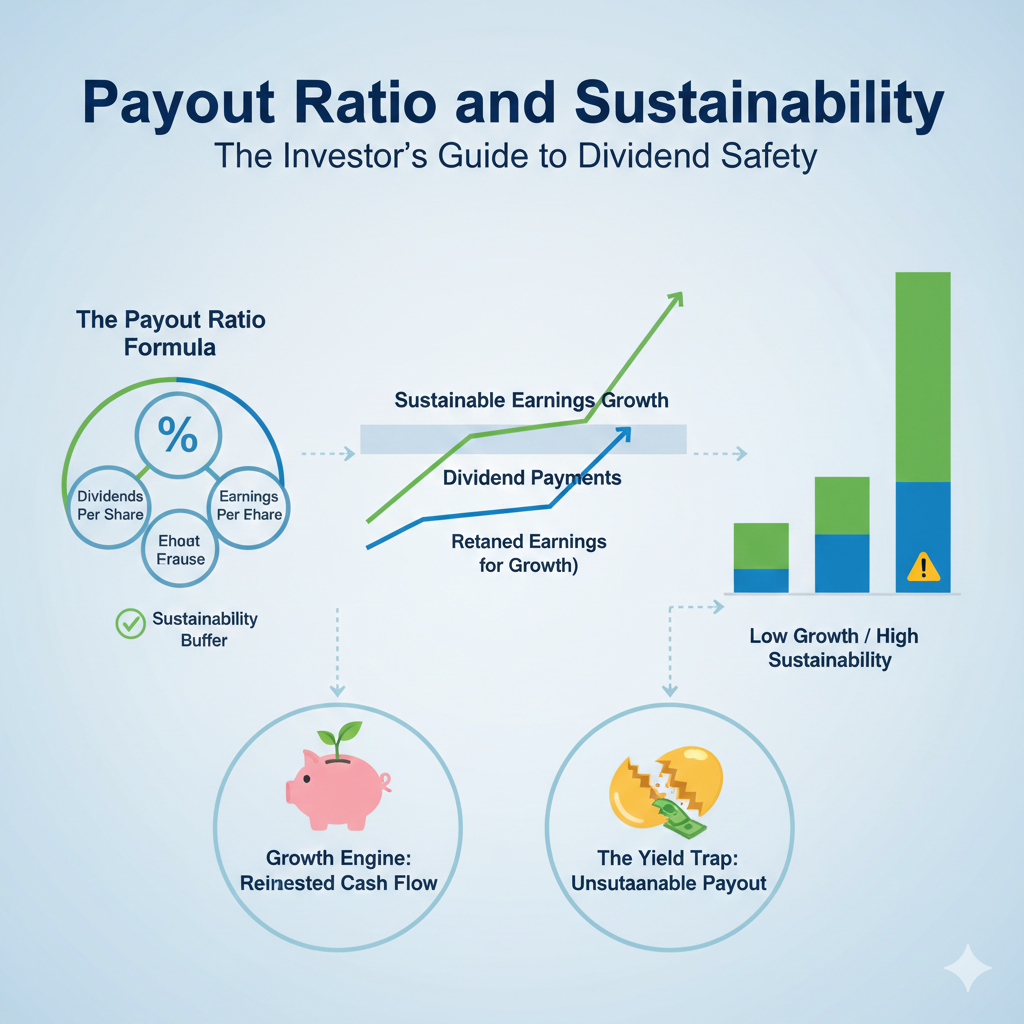

At its most fundamental level, the payout ratio is a measurement of how much of a company’s earnings are distributed to shareholders in the form of dividends, compared to how much is retained by the company to reinvest in its operations, pay down debt, or bolster the balance sheet.

The Basic Formula

The most common way to calculate the payout ratio is by using Net Income (Earnings Per Share):

$$Payout\ Ratio = \frac{Dividends\ Per\ Share\ (DPS)}{Earnings\ Per\ Share\ (EPS)}$$

For example, if a company earns $5.00 per share over a fiscal year and pays out $2.00 in dividends, its payout ratio is 40%. This means the company is returning 40% of its profits to shareholders and keeping 60% to run the business.

Why It Matters

The payout ratio is the “margin of safety” for an income investor. A low payout ratio suggests that even if the company hits a rough patch and earnings decline temporarily, the dividend can still be paid. A high payout ratio suggests that the company is “stretched thin,” leaving no room for error.

2. The Spectrum of Sustainability: What is a “Good” Ratio?

There is no universal “perfect” number, as the ideal payout ratio depends heavily on the company’s growth stage and the industry in which it operates. However, we can establish general benchmarks for the broader market.

The Conservative Range (0% – 35%)

Companies in this range are often in high-growth phases or are extremely conservative with their capital.

- Pros: Massive room for future dividend increases; highly sustainable.

- Cons: Investors may feel the company is “hoarding” cash that could be better used as a higher yield.

The “Sweet Spot” (35% – 60%)

This is widely considered the ideal range for established, “Blue Chip” dividend growers.

- Pros: Balances immediate income for shareholders with enough retained earnings to fund future growth.

- Cons: Requires consistent monitoring to ensure earnings aren’t stagnating.

The Warning Zone (60% – 80%)

For most standard corporations, this range indicates a maturing business that has limited opportunities for reinvestment.

- Pros: High current income.

- Cons: Very little margin of safety. A 20% drop in earnings could push the ratio to 100%, making a dividend cut likely.

The Danger Zone (80%+)

Unless the company is a specialized entity (like a REIT), an 80%+ payout ratio is often unsustainable. It suggests management is prioritizing appearances over the long-term health of the company.

3. Sector Nuances: Why “100%” Isn’t Always a Red Flag

Context is everything. If you apply a standard 60% limit to every stock, you would miss out on some of the best income-producing assets in the market.

Real Estate Investment Trusts (REITs)

REITs are legally required to distribute at least 90% of their taxable income to shareholders. Furthermore, they use Funds From Operations (FFO) instead of Net Income because depreciation (a non-cash expense) artificially lowers their EPS.

- Sustainable Ratio: Often 70%–90% of FFO.

Master Limited Partnerships (MLPs)

MLPs, common in the energy infrastructure sector, focus on Distributable Cash Flow (DCF). Because they have massive infrastructure assets that depreciate over decades, their net income rarely reflects the actual cash they have available to pay dividends.

Utilities

Regulated utilities have very predictable, recession-resistant cash flows. Because their business is so stable, they can safely maintain payout ratios in the 70% range without alarming the market.

4. Cash is King: Payout Ratio vs. Free Cash Flow (FCF)

One of the most dangerous mistakes an investor can make is relying solely on the EPS-based payout ratio. Earnings are an accounting construct; dividends are paid with cold, hard cash.

The FCF Payout Ratio

The Free Cash Flow Payout Ratio is often a much more accurate measure of sustainability. Free Cash Flow is the cash left over after a company has paid all its operating expenses and capital expenditures (CAPEX).

$$FCF\ Payout\ Ratio = \frac{Total\ Dividends\ Paid}{Free\ Cash\ Flow}$$

If a company’s EPS-based payout ratio looks healthy (40%), but its FCF-based payout ratio is 110%, it means the company is likely borrowing money or selling assets to pay that dividend. This is a massive red flag.

5. Technical Nuances: GAAP vs. Non-GAAP Payouts

To truly understand sustainability at a foundational level, an investor must look beneath the surface of reported earnings. Generally Accepted Accounting Principles (GAAP) often require companies to include non-cash charges that can distort the payout ratio.

Identifying One-Time Charges

A company might report a massive “loss” on paper due to a goodwill impairment or a legal settlement. This can cause the EPS to drop to near zero or even become negative, making the payout ratio look infinite (e.g., -500%). In these cases, the dividend might still be perfectly safe because the “loss” didn’t involve any cash leaving the bank account.

Adjusted Earnings (Non-GAAP)

Experienced investors often use “Adjusted Earnings” to calculate the payout ratio. This removes the “noise” of one-time events to show the company’s core earning power. However, be wary: management teams sometimes exclude legitimate recurring costs to make their payout ratio look better than it is. For investors seeking a simpler comparative lens that avoids some accounting complexity, analysts often turn to an inverse metric that presents sustainability as a coverage multiple rather than a percentage.

6. The “Dividend Coverage Ratio” Alternative

While the payout ratio is the most popular metric, many professional analysts prefer the Dividend Coverage Ratio. It is simply the inverse of the payout ratio.

$$Coverage\ Ratio = \frac{Earnings\ Per\ Share}{Dividends\ Per\ Share}$$

A coverage ratio of 2.0x is the same as a 50% payout ratio. Some find it easier to think in terms of “multiples.” A 3.0x coverage means the company earns three times what it pays out, providing a massive cushion for economic downturns.

7. The Lifecycle of a Dividend: From Growth to Maturity

Every company exists on a lifecycle curve, and the payout ratio usually tracks this progression.

Phase 1: The High-Growth Reinvestor

Tech startups often have a 0% payout ratio. They need every dollar to build data centers or hire engineers. Sustainability isn’t the question here—opportunity cost is.

Phase 2: The Initiator

As a company matures (think Apple in 2012), it begins to generate more cash than it can effectively spend. It initiates a dividend with a very low payout ratio (10-20%).

Phase 3: The Dividend Grower

The company enters its prime. It raises the dividend consistently, and the payout ratio slowly creeps up to the 40-50% range. This is the “sweet spot” for [Internal Link: Dividend Growth Strategy Overview].

Phase 4: The Cash Cow

Growth slows down. Reinvestment yields are low, so management returns 70-80% of earnings to shareholders. These are “income stocks” rather than “growth stocks.”

8. Case Study: The Anatomy of a Dividend Cut (The GE Example)

General Electric (GE) was once the gold standard of dividend safety. However, its downfall provides a masterclass in reading payout ratio warnings.

Leading up to its massive 2017 cut, GE’s GAAP payout ratio began to diverge wildly from its cash flow. While the “earnings” suggested the dividend was covered, the industrial free cash flow was plummeting. The company was essentially using its financial arm to mask the rot in its industrial core. When the FCF payout ratio exceeded 100%, the dividend’s fate was sealed.

9. Sector-Specific Benchmarks: A Comparative Guide

To avoid misjudging a stock, use this table as a reference for “normal” payout ratios across the 11 GICS sectors.

| Sector | Typical Sustainable Range | Why? |

| Technology | 20% – 40% | High need for R&D reinvestment. |

| Consumer Staples | 50% – 70% | Very stable demand; predictable cash. |

| Utilities | 65% – 85% | Regulated monopolies; high debt tolerance. |

| Financials | 30% – 45% | Subject to regulatory capital requirements. |

| Energy | 40% – 60% | Volatile; requires cushion for oil price drops. |

| REITs (FFO) | 75% – 95% | Tax-advantaged structure requires high payout. |

10. Macroeconomic Impacts on Sustainability

Sustainability is not just internal; it is external. Interest rate environments and inflation play a massive role.

The Interest Rate Squeeze

When interest rates rise, companies with high debt loads must spend more on interest payments. Since interest is paid before dividends, a rising rate environment can squeeze the payout ratio from the top down. This is particularly dangerous for “bond proxies” like Utilities and REITs.

Inflationary Pressure

If a company cannot pass on rising costs to its customers, its margins will shrink. As margins shrink, EPS falls, and the payout ratio rises—even if management doesn’t raise the dividend by a single penny.

11. Identifying a “Dividend Trap”

A dividend trap occurs when a high yield lures investors into a company with a failing business model. The payout ratio is the primary tool for spotting these traps.

The Death Spiral

- Earnings begin to decline due to competition or poor management.

- The stock price drops, causing the dividend yield to spike (e.g., to 12%).

- Management, fearing a further stock price collapse, maintains the dividend.

- The payout ratio climbs to 95%, then 110%.

- The company eventually cuts the dividend to zero to save the business.

- The stock price crashes another 30% on the news.

How to avoid it: Always cross-reference the current yield with the 5-year average payout ratio. If the ratio is significantly higher than its historical average, proceed with extreme caution.

12. Psychological Sustainability: Management’s Commitment

While the numbers are vital, the “qualitative” side of sustainability matters too.

The Dividend Culture

Some companies, like the Dividend Aristocrats, view their dividend as a sacred contract. For these companies, cutting the dividend is a last resort that usually results in the firing of the CEO.

Investors should look for “Dividend Policy Statements” in annual reports. Management that explicitly states a target payout ratio (e.g., “We aim to maintain a payout ratio between 40% and 50%”) provides much-needed transparency and predictability.

13. International Considerations: Different Payout Cultures

Not all markets value the “slow and steady” increase favored in the United States.

The European Model

Many European companies pay dividends based on a fixed percentage of annual profits. This means if profits double, the dividend doubles; if profits drop 50%, the dividend is cut in half. In this culture, a “dividend cut” isn’t a sign of failure—it’s just a reflection of that year’s business cycle.

The Australian Model

Australia has a high-payout culture due to “franking credits” (tax benefits for shareholders). Payout ratios in Australia are often much higher than in the US, but are supported by different tax incentives that encourage cash distribution.

14. The Role of Share Buybacks in Sustainability

To understand the full scope of dividend sustainability, one must analyze Share Buybacks. Often, a company will pay a dividend and buy back its own shares simultaneously.

Total Shareholder Yield

While the payout ratio only looks at dividends, the “Total Shareholder Yield” includes buybacks. Buybacks act as a secondary “safety valve.” If a company hits financial trouble, it will almost always stop buying back shares before it cuts its dividend. Therefore, a company with a 50% dividend payout ratio and a massive buyback program is actually much safer than a company with a 50% payout ratio and no buybacks.

Reducing the Future Burden

Every share bought back is one less share management has to pay a dividend on in the future. In this way, a consistent buyback program actually lowers the future payout ratio over time, making the remaining dividends more sustainable.

15. Debt Covenants: The Invisible Boundary

A foundational understanding of sustainability requires looking at a company’s credit agreements. Debt covenants are legal restrictions placed on a company by its lenders (banks or bondholders).

Negative Covenants

Many debt agreements include clauses that strictly forbid a company from paying dividends if certain financial ratios (like Debt-to-EBITDA) exceed a specific limit. In these cases, even if a company has the cash to pay the dividend, they are legally prohibited from doing so.

Investors should check the “Risk Factors” or “Debt” section of a company’s 10-K filing to see if such restrictions exist. A rising payout ratio combined with a heavy debt load is the most common precursor to a “forced” dividend cut.

16. Capital Expenditure (CAPEX) Intensity

Sustainability is also a function of how much “maintenance” a business requires.

High-CAPEX vs. Asset-Light

A railroad or a steel mill must spend billions of dollars every year just to keep its tracks and furnaces in working order. This is called “Maintenance CAPEX.” If a company ignores this maintenance to keep its payout ratio low, it is “cannibalizing” its future. Eventually, the equipment will fail, earnings will vanish, and the dividend will disappear.

Conversely, “Asset-Light” businesses (like software companies) have very low maintenance costs, meaning their payout ratios are inherently more sustainable because more of their cash is “discretionary.”

17. The Impact of Corporate Taxation

Finally, we must consider the tax environment. Dividend policy is often driven by how the government taxes corporate distributions versus capital gains.

Double Taxation

In many jurisdictions, dividends are taxed at the corporate level and then again at the individual level. If tax rates on dividends rise, management might choose to lower the payout ratio and instead use that cash for buybacks or acquisitions to give shareholders “capital gains” instead of “income.”

18. The “Retained Earnings” Growth Formula

One of the most profound, yet overlooked, aspects of the payout ratio is its direct link to the Sustainable Growth Rate (SGR). This is a foundational mathematical principle in finance that tells you how fast a company can grow its earnings without having to borrow more money or issue new shares.

The Retention Ratio

The retention ratio is simply 1 minus the payout ratio. If a company has a 40% payout ratio, its retention ratio is 60%.

$$SGR = Retention\ Ratio \times Return\ on\ Equity\ (ROE)$$

This formula proves that the payout ratio is a double-edged sword. If management pays out too much (a 95% payout ratio), they only retain 5%. Even if they have a brilliant 20% ROE, their sustainable growth is capped at a meager 1% ($0.05 \times 0.20$). Thus, a payout ratio that is “too high” actually kills the long-term sustainability of the dividend by starving the business of growth capital.

19. Behavioral Finance: The “Sticky” Dividend

Lastly, we must understand the psychology of management. In finance, dividends are considered “sticky.”

The Signaling Effect

Management teams know that the market punishes dividend cuts with extreme prejudice. Therefore, they often treat the current dividend level as a “floor.” This leads to behavioral biases: management might keep a payout ratio at 110% for two years, hoping for a turnaround, rather than cutting it immediately.

For the investor, this means the payout ratio is a leading indicator, while the dividend cut itself is a lagging indicator. If you wait for the cut to sell, you have already lost. If you see the payout ratio rising sustainably above 80% (outside of specialized sectors), the behavioral “stickiness” of the dividend is merely buying you time to exit before the inevitable collapse.

20. Summary: Integrating the Payout Ratio into Your Strategy

The payout ratio is not a “buy” or “sell” signal in isolation. Instead, it is the filter through which all other financial data must pass. By mastering the nuances of the payout ratio — from GAAP distortions and debt covenants to the mathematical Sustainable Growth Rate — investors move from being “yield chasers” to disciplined business owners focused on sustainability rather than headline income.

Payout ratio analysis often complements dividend growth strategies, ETF allocation models, and broader rules-based investment frameworks, helping investors balance income reliability with diversification and long-term capital preservation.

You stop looking at the dividend as a gift and start seeing it for what it truly is: a structured, sustainable distribution of a company’s hard-earned success — one that reflects both financial strength and management discipline rather than short-term market sentiment.

Final Cheat Sheet: The Sustainability Audit

| Factor | Healthy Sign | Red Flag |

| Earnings Payout | 30% – 60% | > 80% (Non-REIT) |

| FCF Payout | < 70% | > 100% |

| Debt Load | Low/Declining | High Interest/Strict Covenants |

| Buybacks | Consistent | Non-existent or fueled by debt |

| Capex | Fully funded maintenance | Maintenance deferred to pay dividends |