By ATGL

Updated February 9, 2026

The Compounding Engine: A Comprehensive Guide to Dividend Growth Investing

Wealth creation is often portrayed as a high-stakes sprint toward the “next big thing.” However, for many of the world’s most successful long-term investors, the path to financial independence is less of a sprint and more of a steady, disciplined march. At the heart of this approach lies the Dividend Growth Strategy.

This strategy does not merely seek companies that pay dividends; it targets companies with the financial strength and management commitment to increase those payouts year after year. It is a philosophy built on quality, sustainability, and the mathematical power of compounding.

Equally important, dividend growth investing aligns naturally with a rules-based investing framework — one that prioritizes measurable financial criteria, structured evaluation, and repeatable decision processes over speculation or emotion. Rather than reacting to headlines or short-term price swings, investors focus on earnings strength, cash-flow durability, and dividend consistency. The result is a system designed to build wealth methodically rather than chase it impulsively.

1. Defining the Core Concept: What is Dividend Growth?

At its simplest, Dividend Growth Investing (DGI) is an investment strategy focused on buying shares in companies that have a proven track record of increasing their dividend distributions over time.

While a “Dividend Yield” strategy might chase the highest current payout (often a trap for struggling companies), the Dividend Growth strategy focuses on the yield on cost and the underlying health of the business. The goal is to build a portfolio where the income stream grows faster than inflation, regardless of what the stock market’s “ticker tape” says on any given day.

The Three Pillars of DGI

- Profitability: The company must generate real, growing earnings.

- Cash Flow: Dividends are paid in cash, not accounting profits. High free cash flow is the financial “fuel” that sustains dividend growth over time.

- Capital Discipline: Management must prioritize returning value to shareholders over reckless expansion or vanity projects.

2. Why Dividend Growth? The Mathematical Advantage

The power of this strategy is best understood through the lens of Total Return. Total return is the combination of share price appreciation plus dividends received. Historically, dividends have accounted for a significant portion of total market return over multi-decade periods, reinforcing the importance of income reinvestment and disciplined long-term ownership.

The Shield and the Sword

During bull markets, dividend growth stocks often keep pace with the broader market because their earnings are rising. During bear markets, however, they act as a “shield.” Because these companies are profitable and paying out cash, their floor is often higher than speculative growth stocks that rely entirely on sentiment.

Yield on Cost (YOC)

This is perhaps the most motivating metric for a DGI investor. Yield on Cost is calculated by dividing your current dividend per share by your original purchase price per share.

$$Yield\ on\ Cost = \frac{Current\ Annual\ Dividend}{Original\ Purchase\ Price}$$

Imagine you buy a stock for $100 that pays a $3 dividend (3% yield). If that company grows its dividend by 10% every year, in 10 years, the dividend will be approximately $7.78. Your yield on cost is now 7.78%, even if the market yield for new buyers is still only 3% because the stock price rose to $260.

3. Key Metrics for Evaluating Dividend Growth Stocks

Not all dividend payers are created equal. To filter for the “best of the best,” investors use a specific toolkit of financial ratios.

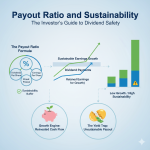

The Payout Ratio

The Payout Ratio tells you what percentage of earnings a company is paying out as dividends.

- 0% – 35%: Very safe; plenty of room for future raises.

- 35% – 60%: The “sweet spot” for many mature dividend growers.

- 80% +: A potential “danger zone” where a minor earnings dip could force a dividend cut.

Note: Real Estate Investment Trusts (REITs) and Utilities often have higher payout ratios by design due to tax structures and stable business models. Always compare a company’s ratio to its industry peers.

Dividend Growth Rate (DGR)

Investors typically look at the 3-year, 5-year, and 10-year compounded annual growth rate (CAGR) of the dividend. A consistent 7-10% DGR is often considered the gold standard for balancing current income with future growth.

Free Cash Flow (FCF) Coverage

Since dividends are paid from cash, checking if FCF exceeds the total dividend payout is a more rigorous safety check than just looking at net income.

4. The Hierarchy of Dividend Quality

In the world of DGI, there are specific “titles” awarded to companies based on their consistency.

| Title | Requirement | Characteristics |

| Dividend Challengers | 5–9 years of increases | Often younger, high-growth companies starting their dividend journey. |

| Dividend Contenders | 10–24 years of increases | Proven through at least one full economic cycle (recession). |

| Dividend Aristocrats | 25+ years of increases | Members of the S&P 500 with a quarter-century of raises. |

| Dividend Kings | 50+ years of increases | The “royalty” of the market; have survived stagflation, wars, and bubbles. |

5. The Psychology of the “Income Factory”

One of the greatest hurdles for investors is emotional volatility—the urge to sell when the market crashes. The Dividend Growth Strategy flips the script.

When you view your portfolio as an “Income Factory,” the daily price of the “building” (the stock price) matters less than the “output” of the machines (the dividends). In fact, for a long-term investor in the accumulation phase, a market crash is a “sale” that allows them to buy more “income-producing machines” at a lower price, effectively boosting their future wealth.

6. Risks and Common Pitfalls

No strategy is without risk. To succeed with dividend growth, you must avoid the following:

- The Yield Trap: A company with a 12% yield often has that yield because the stock price has plummeted in anticipation of a dividend cut.

- Sector Over-Concentration: Don’t build a portfolio of 20 stocks that are all in the Utilities or Energy sectors. True DGI requires [Internal Link: Diversification Strategies].

- Earnings Decay: If a company’s earnings are shrinking, it cannot grow its dividend forever. The dividend is a derivative of the business’s success, not a replacement for it

7. Implementation: Starting Your Journey

Building a dividend growth portfolio can be done in two primary ways:

- The “Basket” Approach (ETFs)

For those who prefer a “set it and forget it” style, there are Exchange Traded Funds (ETFs) that track indices of dividend growers. Look for funds with low expense ratios and strict inclusion criteria (e.g., must have 10+ years of increases).

- Individual Stock Selection

This requires more work but allows for higher precision. You can hand-pick companies that you understand and that meet your specific yield and growth requirements.

Dividend growth portfolios are typically reviewed quarterly or semi-annually rather than daily, reinforcing a long-term discipline rather than short-term reaction to market fluctuations.

Dividend growth strategies often complement ETF allocation and broader investment frameworks. Investors frequently combine income-producing holdings with diversified ETFs or structured stock-trading approaches to balance stability with opportunity.

Summary and Next Steps

The Dividend Growth Strategy is a marathon, not a sprint. By focusing on quality businesses that share their success with owners, you harness the power of compounding in its purest form. Over time, the goal isn’t just to “beat the market”—it’s to create a self-sustaining stream of income that provides true financial freedom.