Reviewing the Strong Rebound in 2025 and Setting the Stage for the Year Ahead

The Dogs of the Dow investment strategy delivered a notable rebound in 2025, following a challenging and uneven performance in 2024. The strategy, which selects the ten highest-yielding stocks from the Dow Jones Industrial Average (DJIA) at the start of the year, benefited from a combination of mean reversion, strong company-specific recoveries, and renewed investor interest in dividend-paying blue-chip stocks.

After declining nearly 4% in 2024, the Dogs of the Dow portfolio reasserted its value-oriented thesis in 2025. Using an equal-weighted approach and holding positions for the full calendar year, the Dogs of the Dow generated a 13.91% gain, turning a $142,082 portfolio into $162,572 by year-end. This performance highlights how periods of underperformance can often set the stage for meaningful recoveries in dividend-focused strategies.

The 2025 Dogs of the Dow Lineup

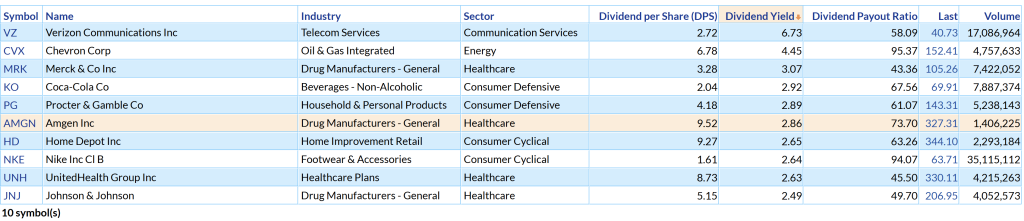

At the start of 2025, the Dogs of the Dow consisted of the following ten stocks, selected based on dividend yield as of the prior year-end:

- Verizon Communications (VZ)

- Chevron (CVX)

- Amgen (AMGN)

- Johnson & Johnson (JNJ)

- Merck (MRK)

- Coca-Cola (KO)

- IBM

- Cisco Systems (CSCO)

- Procter & Gamble (PG)

- McDonald’s (MCD)

Each position was funded equally at inception and held throughout the year without rebalancing, allowing individual stock performance to drive portfolio outcomes.

What Drove Performance in 2025

The portfolio’s strong results were not evenly distributed across all holdings. Several stocks delivered outsized gains and were responsible for the bulk of the portfolio’s advance.

Johnson & Johnson was the standout performer, benefiting from renewed confidence in its pharmaceutical pipeline and operational stability following prior legal and restructuring concerns. IBM and Cisco Systems also delivered strong gains as enterprise technology spending stabilized and investor sentiment improved toward legacy technology firms with strong cash flows.

Amgen added further support to the portfolio as healthcare stocks regained favor, while Coca-Cola and Merck provided steady contributions consistent with their defensive and income-oriented profiles.

Not every holding contributed positively. Procter & Gamble was the lone material detractor, declining over the year as consumer staples lagged and margin pressures weighed on the stock. Despite this drag, the strength of the portfolio’s top performers more than offset the weakness.

Small Dogs of the Dow: Concentration Matters

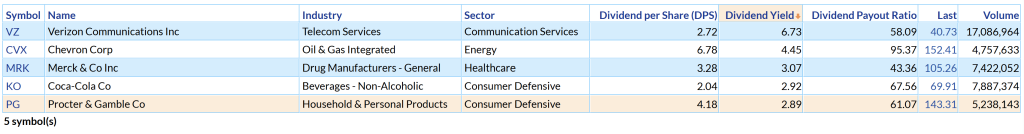

In addition to the traditional Dogs of the Dow, 2025 once again highlighted the power—and risk—of the Small Dogs of the Dow approach. This variation narrows the portfolio to the five lowest-priced stocks among the Dogs at the start of the year:

- Verizon Communications (VZ)

- Cisco Systems (CSCO)

- Coca-Cola (KO)

- Merck (MRK)

- Johnson & Johnson (JNJ)

Using equal initial allocations and allowing winners to compound without rebalancing, the Small Dogs portfolio produced an 18.20% return, turning $56,204 into $66,434 by year-end.

The outperformance of the Small Dogs strategy was driven primarily by concentration in the strongest performers, particularly Cisco Systems and Johnson & Johnson. Because the portfolio was not rebalanced during the year, capital naturally flowed toward stocks that appreciated the most, amplifying gains. This dynamic illustrates why Small Dogs strategies often outperform in years when leadership is narrow and momentum persists in a handful of names.

Lessons from 2025

The 2025 experience reinforces several important principles of dividend-based investing:

- Mean reversion matters. Stocks that struggled in prior years often rebound once pessimism fades.

- Concentration cuts both ways. Small Dogs can outperform significantly, but results depend heavily on a few key stocks.

- Dividends are not the whole story. While yield determines selection, price appreciation ultimately drives performance.

- Patience is essential. Holding positions through volatility allowed the strategy to capture full-year recoveries.

Looking Ahead to 2026

As we enter 2026, the Dogs of the Dow strategy resets once again. New high-yield candidates emerge as prices and dividends change, while some 2025 constituents rotate out of the lineup. The coming year will reflect how companies adapt to evolving economic conditions, including interest rate policy, inflation trends, and shifting consumer and business demand.

After a strong rebound year, expectations should remain grounded. The Dogs of the Dow is not a momentum strategy—it is a disciplined, rules-based approach that rewards investors willing to embrace periods of underperformance in exchange for long-term value and income potential.

Whether 2026 proves to be another strong year or a consolidation phase, the lessons from 2025 underscore why the Dogs of the Dow remains a compelling framework for investors seeking exposure to high-quality, dividend-paying companies within the Dow Jones Industrial Average.

Based on dividend yields and closing prices as of December 31, 2025, the following lists identify the Dogs of the Dow and Small Dogs of the Dow entering 2026. See the portfolio here.