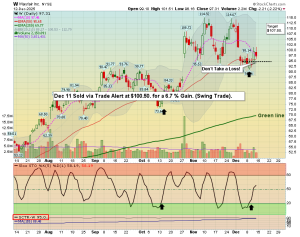

This week’s Top Pick of the Week (TPOW) strategy continued to demonstrate the edge of a rules-based, momentum-driven process. Wayfair (W) was our selection for the week ending December 12, 2025, meeting the criteria of relative strength, trend confirmation, and volume support at the entry. The trade was opened Monday, December 8, at an opening price of $96.36. Throughout the week, W maintained positive technical structure and respected key support levels, closing the position on Thursday, December 11, at $100.22 for a 4.01% gain on the trade.

On the broader market front, the S&P 500 (via SPY) experienced a modest pullback over the same period. SPY traded lower through Friday, ending the week with a downweek of approximately –0.6%, pressured by weakness in technology and AI-related names late in the week. A sharp sell-off on Friday drove the S&P 500 lower, despite the index having reached a fresh record high earlier in the week as investor optimism followed the Federal Reserve’s final rate cut of 2025. AP News+1

That market backdrop reinforced the value of focusing on individual strength rather than broad index performance. While SPY lagged modestly, leadership in specific stocks — such as W — allowed the TPOW strategy to capture positive returns amid rotation and sector divergence. This highlights that even in weeks without strong index gains, a process grounded in trend and relative strength can isolate outperformers and manage risk effectively.

Looking ahead into the coming holiday-tail end of the year trading environment, volatility and rotation may persist. Investors appear more discerning, particularly in tech sectors where stretched valuations have triggered profit-taking pressure late in the week. This makes following objective technical rules — like those embedded in TPOW — all the more important.

We’ll return next week with a fresh Top Pick, applying the same discipline and focus on strength that guides our strategy each week. Stay disciplined, keep your focus on price action, and always trade Above the Green Line.

To understand why this weekly approach compounds differently than buy-and-hold investing, see Why Weekly Trading Outperforms Buy & Hold Investing.