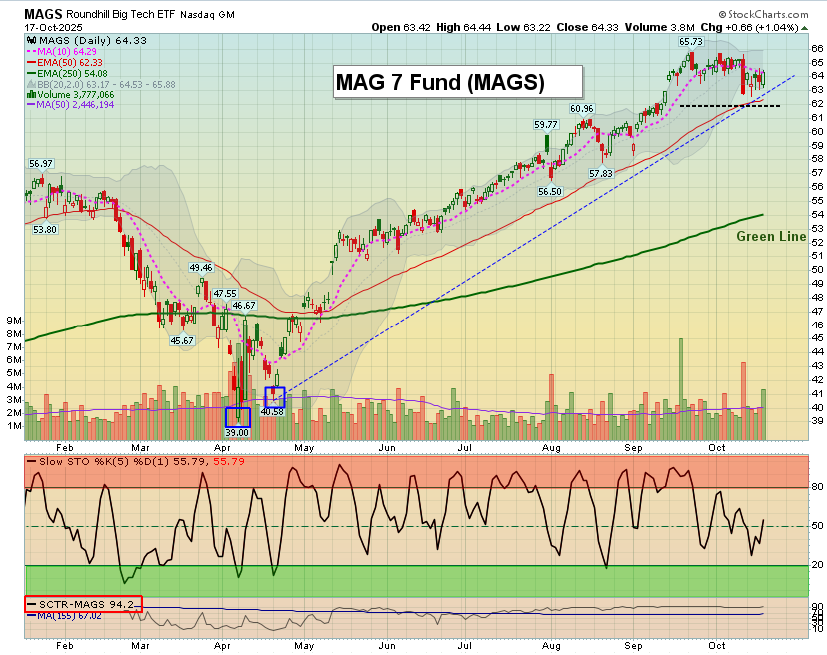

This week’s TPOW selection, MAGS, delivered a steady performance amid a market environment marked by cautious optimism. Entering the week with strong technical momentum, MAGS maintained its uptrend and closed slightly higher by week’s end. After opening on Monday, October 13 at $63.81, MAGS held its strength and finished on Friday, October 17 at $64.33, producing a modest +0.81% gain for the week. While not a breakout move, the stock showed resilience and continued to trade above key support levels—an encouraging sign for trend followers and swing traders alike.

From a broader perspective, the overall market continued to digest recent economic data and corporate earnings. Investor sentiment leaned cautiously bullish, with buyers stepping in on dips but remaining sensitive to interest rate expectations and forward guidance.

SPY (S&P 500 ETF) traded within a tight range throughout the week, reflecting consolidation after recent gains. Despite midweek volatility, SPY managed to hold above its 50-day moving average—an important technical line in the sand. The index showed signs of basing, which often precedes either a renewed rally or a deeper pullback. Traders are watching closely to see if SPY can reclaim recent highs or if overhead resistance will trigger profit-taking.

Overall, while this week lacked explosive moves, it reinforced an important message: in uncertain markets, disciplined stock selection and adherence to rules-based strategies can continue to produce consistent results. MAGS exemplified that approach with a controlled, positive return, maintaining its position above the Green Line and confirming institutional support.

As we move into the upcoming week, we’ll continue to look for high relative strength names breaking out of well-defined setups—always focusing on leaders, not laggards. Stay tuned for the next Top Pick of the Week.

To understand why this weekly approach compounds differently than buy-and-hold investing, see How Weekly Reinvestment Accelerates Long-Term Compounding