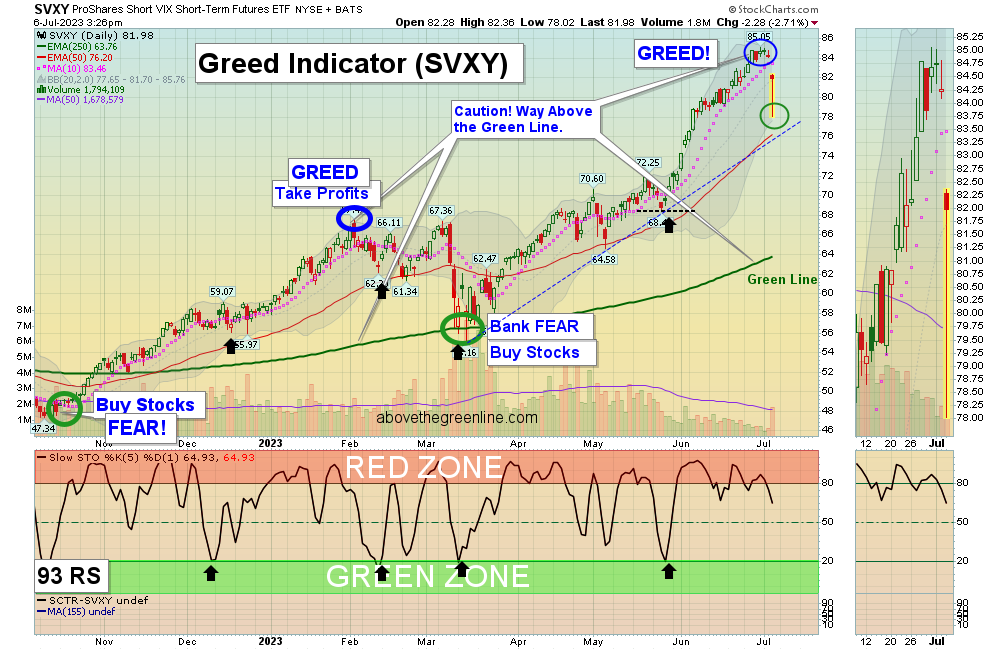

Markets were lower today as the S&P 500 & NASDAQ 100 Funds could not make higher highs to avoid the dreaded “M” or Double Top pattern. Some real Selling came in early to move the FEAR Index (VIX) up 16%, and then Buying came in. The S&P 500 & NASDAQ 100 Indices were was able to hold above the 10-day averages to avoid short term Sell Signals.

Most of the Leaders were up in the Red Zones (probably too late to Buy for the short term). Please be patient and wait for more Buy Signals in the Green Zones. CHARTS The best moves happen when the S&P 500 Index is also coming up out of the Green Zone.

__________________________________________________________________________

BUYS TODAY 7/6/2023 NONE TODAY

BUYS TOMORROW

OSCR OSCAR HEALTH INC. Wait for Money Wave Close > 20 with High Volume.

Shop for a better price earlier in the day with Triple Buy Signal, on the same day that a Daily Money Wave Buy Signal will occur.

BUYS SOON

PBR PETROBRAS ENERGY Money Wave must Close in the Green Zone.

UBER UBER TECH. Money Wave must Close in the Green Zone.

Please be patient and Wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

SELLS TODAY

APLD APPLIED DIGITAL Slipped below the Buy Price yesterday and was Stopped Out even, The Target was Hit at $10 for a 7 % Gain.

DKNG DRAFTKINGS INC. EXIT if it is going to Close below the Pink Line around $25.77. The Target was already Hit at $26 for a 4.2 % Gain.

ITB HOME BUILDING FUND EXIT if it is going to Close below the Pink Line around $83.68. The Target was already Hit for a 3.1 % Gain.

MVIS MICROVISION INC. Slipped below the Buy Price and was Stopped Out even.

SOFI SOFI TECH. Lower Sell Stop Loss below $7.71 until it bottoms.

YEXT YEXT INC. EXIT if it is going to Close below Support of $10.47. This trade was not logged.

_________________________________________________________________________

DAY TRADING SETUPS. Day Trading Alerts are now being sent out on our new Discord Site with Live Chatting. Please install Discord app on your pc or cell for mobile notifications. Also follow our YouTube Live Stream for quick trades. Or look for Triple Buy Pops (3 Green Circles). Movers today: VIXY (+12%) LABD (+7%) & SOXS (+6%). Try out the Side by Side layout.

DAY TRADING FOR INDICES & LARGE CAPS CHARTS.

Bonds were down today and are Below the Green Line.

Crude Oil was up $0.09 today at $71.88.

MY TRADING DASHBOARD

SWING TRADING CURRENT POSITIONS

DAY TRADING SETUPS

TRADE ALERTS

GREEN LINE CHARTS AT STOCKCHARTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

GREEN LINE RULES

ETF SECTOR ROTATION SYSTEM

New TOP 100 LIST Updated Ju1 1, 2023

Many like to Buy the Swing Trades just before the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and up out of the Green Zone). Don’t Buy if the Security has already popped up too much. Money Wave Buy Signals are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

Related Post

– PBR